Custody and Book-Entry Transfer System for Foreign Stocks, etc.

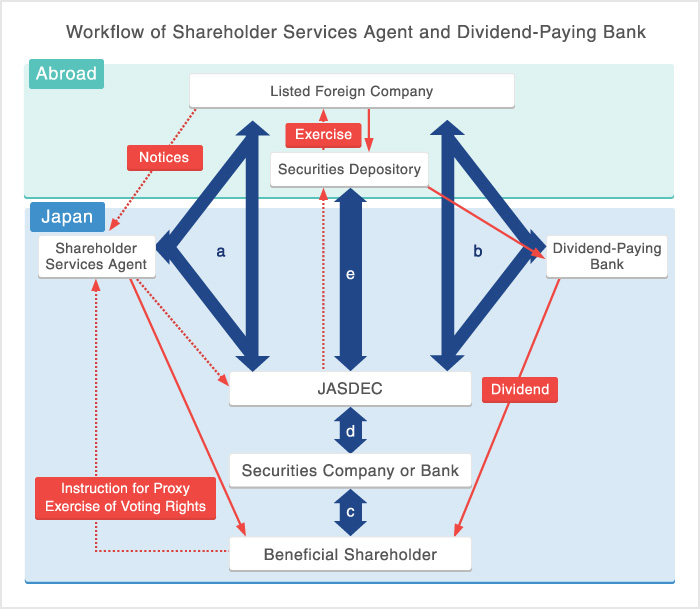

Foreign stocks are settled under the business regulations relating to the depository and book-entry transfers for foreign stocks, etc. of Japan Securities Depository Center, Inc. (JASDEC). In this system, securities companies and banks, etc. establish participant accounts in JASDEC and general investors establish customer accounts in securities companies or banks, etc. in accordance with the rules of JASDEC and Tokyo Stock Exchange, Inc. (TSE). Regular transactions of foreign stocks listed on the TSE market are settled, in the same way as domestic stocks, via book-entry transfer on the third business day counting from the trade day (T+2) based on the system for custody and book-entry transfer for foreign stocks, etc. of JASDEC.

The physical certificates of foreign stocks are not brought into Japan but are held in custody in the foreign depository designated by JASDEC. The shareholdings of beneficial shareholders (customers who actually own the foreign stocks, etc.) are recorded in the relevant customer accounts.

Dividend Payment

The foreign depository receives dividends from listed foreign company on behalf of JASDEC and transfers the corresponding amount to the dividend-paying bank in Japan (trust bank or major retail bank). When dividend-paying bank receives dividends, it distributes the dividend to the beneficial shareholders on the list of beneficial shareholders according to the instructions from the shareholder services agent (trust bank). These distributions of dividends are made by crediting the accounts designated by beneficial shareholders or by sending the form of postal money orders.

Dividend payment is made in Japanese yen. As a general rule, conversion into Japanese yen is calculated using the Telegraphic Transfer Buying (TTB) rate on the day when the dividend-paying bank receives dividends.

Record Date of Shareholders Eligible for Dividend

In the case of registered stocks, the record date shall, as a general rule, be the same as that in the home market. For the most of bearer stocks, the record date on the TSE market shall be one business day prior to the dividend payment date in the home market. Dividends will be paid to the beneficial stockholders as of record date.

Other Rights such as Subscription rights

In cases where subscription rights (shinkabu yoyakuken) are granted, if a beneficial shareholder wishes to subscribe for new shares and pays for them through a participant, JASDEC exercises the subscription rights and receives the new shares which are then credited to the customer account of the beneficial shareholder. Such payment is generally made in Japanese yen.

On the other hand, if a beneficial shareholder does not wish to subscribe for the new shares or JASDEC determines that it is unable to exercise the rights taking into account factors such as the payment schedule in the home country, JASDEC collectively sells all such subscription rights in the home market of the listed foreign company and pays sales proceeds to the beneficial shareholders via shareholder services agents. In addition, in the case of a stock listed only on the TSE market, if a corresponding subscription rights market is opened at TSE, JASDEC will not collectively sell all subscription warrants and the beneficial shareholder may sell the subscription rights in such market.

New shares, which are allotted due to a stock split or gratis allotment, etc., shall be received by JASDEC and credited to the costumer account of the corresponding beneficial shareholder. However, JASDEC will sell fractional shares in the home market of the listed foreign company and pay sales proceeds to the relevant beneficial shareholders via shareholder services agents.

(Note) If there is no market to sell the relevant rights, there may be no choice other than to abandon such rights.

Exercise of Voting Rights at General Shareholders Meetings

Voting rights at general shareholders meetings are exercised by JASDEC in accordance with instructions issued by beneficial shareholders (submission of instruction for the proxy exercise of voting rights). If no instruction is issued by a beneficial shareholder, JASDEC will not exercise the corresponding voting right.

In addition, in cases where the record date for a general shareholders meeting is set in the home country, the same date is set as record date in Japan. Documents such as notice of convening a general shareholders meeting and form for instruction for the proxy exercise of voting rights are sent to the beneficial shareholders as of the record date. Beneficial shareholders are able to exercise their voting rights referring to such documents.

However, even though a record date is set, in cases where procedures, such as sending of notice of convening a general shareholders meeting to the beneficial shareholder, are deemed difficult due to the limited schedule, such beneficial shareholder will be required to perform procedures to exercise the voting right through the shareholder services agent within the period published by the company in the newspapers.

In the case of a company which does not set a record date for the general shareholders meeting, a beneficial shareholder intending to exercise his/her voting right should perform the procedures within the period published by the company in the newspapers.

Book-Entry Transfers from JASDEC to Securities Companies

Foreign stocks bought on the TSE market can be sold in the other market where the foreign company is listed. In this case, a shareholder will be able to sell his/her shares after book-entry transfer from the custody of JASDEC to that of a securities company, etc. is completed. In addition, in the case where TSE decides to delist a foreign stock, such stock will also be transferred from a foreign custodian of the JASDEC to that of a securities company, etc.

- Agreement related to entrustment of shareholder services

- Agreement related to entrustment of dividend payment work

- Brokerage Agreement Standards (Agreement for Establishment of Foreign Securities Trading Accounts, etc.) or contracts

- JASDEC rules

- Custody agreement

![]() Close

Close![]() Close

Close