Market News

Data & Statistics

Listed Companies

Equities, Debt, Funds

Derivatives

Rules & Trading Participants

Systems

Self-Regulation

Clearing & Settlement

![]() Close

Close

Market News

Data & Statistics

Listed Companies

- Company Announcement Service

- Listed Company Search

- Corporate Governance Information Search

- Number of Listed Companies/Shares

- New Listings/ Transfers/ Delistings

- Market Alerts

- Measures against Listed Companies

- Other Information

- Earnings Announcements/ Annual General Shareholders Meetings

- Introduction of Listed Companies

Equities, Debt, Funds

Derivatives

Rules & Trading Participants

Systems

Self-Regulation

Clearing & Settlement

- For Individual Investors

- For Listed Companies

- For Prospective Issuers

- For Trading Participants

- For Institutional Investors

- For Media

Recommended Contents

- TSE Daily Report

- Daily Report

- Equities Market Summary

- Stock Price Index - Real Time Values

- Daily Publication, etc., Concerning Margin Trading

- Regulatory Measures, etc., Concerning Margin Trading

- Short Selling Value

- Special Quotations

- JPX Monthly Headlines

Our Markets

Featured Products

- Stocks (Domestic)

- ETFs

- REITs

- TOKYO PRO Market

- TOKYO PRO-BOND Market

- Nikkei 225 Futures (Large Contracts)

- TOPIX Futures (Large Contracts)

- 3-Month TONA Futures

- Nikkei 225 mini Options

- Gold Standard Futures

- Platts Dubai Crude Oil Futures

External Links

Derivatives

Products

Japanese Indices

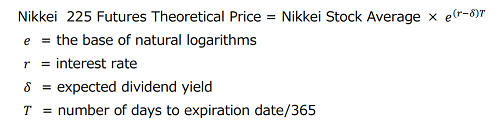

Nikkei 225 Futures

Nikkei 225 mini

Nikkei 225 micro Futures

Nikkei 225 Options

Nikkei 225 mini Options

Nikkei 225 Total Return Index Futures

TOPIX Futures

mini-TOPIX Futures

TOPIX Options

JPX-Nikkei Index 400 Futures

JPX-Nikkei Index 400 Options

JPX Prime 150 Index Futures

TSE Growth Market 250 Index Futures (previously known as TSE Mothers Index Futures)

TOPIX Core30 Futures

RN Prime Index Futures

TOPIX Banks Index Futures

TOPIX Banks Index Options

S&P/JPX 500 ESG Score Tilted Index Futures

FTSE JPX Net Zero Japan 500 Index Futures

Nikkei 225 Climate Change 1.5℃ Target Index Futures

![]() Close

Close