Proof of Concept Testing for Utilization of Blockchain / DLT in Capital Market Infrastructure

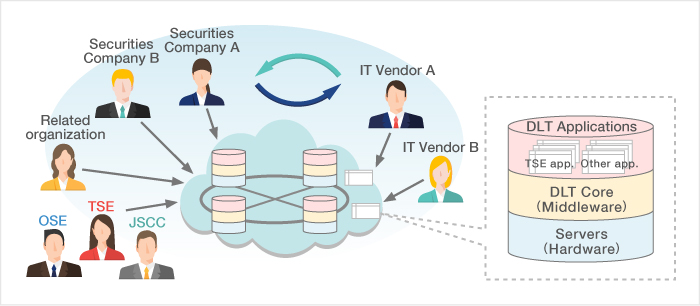

In cooperation with a wide range of stakeholders, such as financial institutions and IT vendors, the consortium of Japanese financial institutions conducts proof of concept (PoC) testing and research to discuss the possibility of applying blockchain or distributed ledger technology (DLT) 1 to capital market infrastructure.

The consortium consists of 33 Japanese financial institutions 2 and other related organizations, which deploy DLT applications for financial infrastructure developed by financial institutions, IT vendors, and other related entities, as well as issue proposals on PoC testing and assess the need for such applications.

We will gather broad expertise from a wide range of participants and conduct PoC testing, research, and studies on various use cases for financial infrastructure. We hope these will contribute to not only solving technical issues, but also generate numerous benefits, such as creating new businesses, streamlining business operations, and reducing costs.

- DLT enables network participants to validate the transfer of rights between each other and share those records in an immutable manner by utilizing cryptographic technology. DLT is gaining attention worldwide as one of the most promising aspects of Fintech that could be applied to constructing shared infrastructure to provide high availability and reliability at low cost.

- Figure is current as of the end of August 2017. Domestic financial institutions refer to trading participants of TSE, OSE, and/or JSCC.