Price Limits/ Circuit Breaker Rule

Index Futures

The Price limit range

- For Nikkei 225 Futures, Nikkei 225 mini, Nikkei 225 micro Futures, TOPIX Futures, mini-TOPIX Futures, JPX-Nikkei 400 Futures, JPX Prime 150 Index Futures, TSE Growth Market 250 Index Futures, TOPIX Core30 Futures, TOPIX Banks Index Futures, TSE REIT Index Futures, RN Prime Index Futures, S&P/JPX 500 ESG Score Tilted Index Futures, FTSE JPX Net Zero Japan 500 Index Futures, Nikkei 225 Climate Change 1.5℃ Target Index Futures, DJIA Futures, TAIEX Futures and FTSE China 50 Index Futures, the price limit range shall be calculated by multiplying the reference price for price limits by the following rates.

- The price limit range for Nikkei 225 VI Futures will be ±10 points (absolute value).

- The price limit range for Nikkei Stock Average Dividend Point Futures will be ±JPY 50 (absolute value).

Expansion of upper or lower price limits when a Circuit Breaker is triggered

- Only price limits in one direction, up or down, will be expanded.

- Normally, the expansion in each direction shall be conducted only twice. However, the upper or lower price limit range for Nikkei 225 VI Futures and Nikkei Stock Average Dividend Point Index will be expanded with no limitations.

| Products |

Normal |

1st Expansion |

2nd Expansion |

| Nikkei 225 Futures, Nikkei 225 mini, Nikkei 225 micro Futures |

±8% |

±12% |

±16% |

| TOPIX Futures, mini-TOPIX Futures |

| JPX-Nikkei 400 Futures |

| JPX Prime 150 Index Futures |

| TSE Growth Market 250 Index Futures |

| TOPIX Core30 Futures |

| TOPIX Banks Index Futures |

| TSE REIT Index Futures |

| RN Prime Index Futures |

| S&P/JPX 500 ESG Score Tilted Index Futures |

| FTSE JPX Net Zero Japan 500 Index Futures |

| Nikkei 225 Climate Change 1.5℃ Target Index Futures |

| FTSE China 50 Index Futures |

±10% |

±15% |

±20% |

| Nikkei 225 VI Futures |

±10 points |

Normally, expanded by 5 points (unlimited number of times) |

| DJIA Futures |

±7% |

±13% |

±20% |

| TAIEX Futures |

±10% |

No expansion of price limits |

| Nikkei Stock Average Dividend Point Index Futures |

±JPY 50 |

Normally, expanded by JPY 25 (unlimited number of times) |

(note)

- ・Where there is a fraction less than tick size in the amount of the price limit range calculated by multiplying the Reference Price by the rate, such a fraction shall be discarded. Suppose that the Reference Price for Nikkei 225 Futures is JPY 28,780. Since the price limit range is (JPY 28,780*8% = JPY 2,302.4, 2.4 shall be discarded) ± JPY 2,300, the upper limit is JPY 31,080 and the lower limit is JPY 26,480.

Index Options

The Price limit range

- For Nikkei 225 Options, Nikkei 225 mini Options, TOPIX Options and JPX-Nikkei 400 Options, the price limit range shall be calculated by multiplying the base price for calculating the price limit range by the following rates.

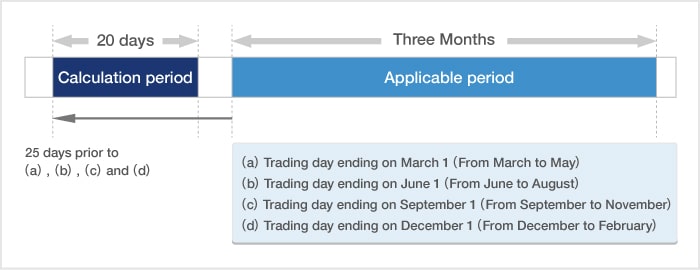

- Base price for calculating the price limit range is the average value of the reference price of the price limits for bids and offers (=previous day's settlement price) on each trading day with regards to the leading contract month (Futures) on each underlying index for 20 days from the trading day ending on the day that is 25 days prior to the trading day (or the following business day, if it falls on a non-business day) listed in the following (a) through (d).

(a) Trading day ending on March 1

(b) Trading day ending on June 1

(c) Trading day ending on September 1

(d) Trading day ending on December 1

- In the case where the ratio between (a) the price range as calculated by multiplying the "base price for calculating the price limit range" by 16% and (b) the reference price for price limits is beyond 20% or falls below 12% for two straight days (Nikkei 225 Options, TOPIX Options, JPX-Nikkei 400 Options) or in other cases where OSE deems it necessary, OSE will make an extraordinary revision of the price limit range.

Expansion of upper and lower price limits when a Circuit Breaker is triggered

- Both the upper and lower limits will be expanded. The expansion shall be conducted only twice.

| Products |

Normal |

1st Expansion |

2nd Expansion |

Nikkei 225 Options and Nikkei 225 mini Options

(Reference price)

less than JPY 50

JPY 50 or more to less than JPY 200

JPY 200 or more to less than JPY 500

JPY 500 or more |

±4%

±6%

±8%

±11% |

Add 3% to Normal Price Limits |

Add 3% to 1st Expansion Price Limits |

TOPIX Options

(Reference price)

less than 5 points

5 points or more to less than 20 points

20 points or more to less than 50 points

50 points or more |

±4%

±6%

±8%

±11% |

Add 3% to Normal Price Limits |

Add 3% to 1st Expansion Price Limits |

JPX-Nikkei 400 Options

(Reference price)

less than 50 points

50 points or more to less than 200 points

200 points or more to less than 500 points

500 points or more |

±4%

±6%

±8%

±11% |

Add 3% to Normal Price Limits |

Add 3% to 1st Expansion Price Limits |

Securities Options

With respect to price limits for Securities options Contracts, the price limit range will be calculated by multiplying the reference price for price limits of an underlying security on the designated market by 25%.

JGB Futures / Options on JGB Futures

The price limit range

- The price limit range of JGB Futures and Options will be set as in the table below.

Expansion of upper or (and) lower price limits when a Circuit Breaker is triggered

- For JGB Futures, only price limits in one direction, up or down, will be expanded.

- For Options on JGB Futures, both the upper and lower limits will be expanded.

- The expansion shall be conducted only once.

| Products |

Normal |

Expansion |

| 5-year JGB Futures |

±JPY 2.00 |

±JPY 3.00 |

| 10-year JGB Futures |

±JPY 2.00 |

±JPY 3.00 |

| mini 20-year JGB Futures |

±JPY 4.00 |

±JPY 6.00 |

| mini 10-year JGB Futures (Cash-Settled) |

±JPY 2.00 |

±JPY 3.00 |

| Options on JGB Futures |

±JPY 2.10 |

±JPY 3.00 |

Interest Rate Futures

The price limit range

- The price limit range of Interest Rate Futures will be set by adding or subtracting the limit range in the table below to the reference price.

Expansion of upper or (and) lower price limits when a Circuit Breaker is triggered

- For Interest Rate Futures, only price limits in one direction, up or down, will be expanded. The expansion shall be conducted only twice.

| Products |

Normal |

1st Expansion |

2nd Expansion |

| 3-Month TONA Futures |

±0.25 points |

±0.5 points |

±0.75 points |

Commodity Futures / Options on Commodity Futures (OSE)

The Price limit range

- The price limit range of Commodity Futures listed on OSE shall be calculated by multiplying the reference price for price limits by the following rates. And Commodity Options listed on OSE will be set as in the table below.

| Products |

Normal |

1st Expansion |

2nd Expansion |

| Commodity Futures |

Gold Standard Futures |

±5% |

±10% |

±15% |

| Gold Mini Futures |

| Gold Rolling-Spot Futures |

| Silver Futures |

±10% |

±20% |

±30% |

| Platinum Standard Futures |

±10% |

±20% |

±30% |

| Platinum Mini Futures |

| Platinum Rolling-Spot Futures |

| Palladium Futures |

±10% |

±15% |

±20% |

| CME Group Petroleum Index Futures |

±10% |

±20% |

±30% |

| RSS3 Rubber Futures |

±10% |

No expansion of price limits |

No expansion of price limits |

| TSR20 Rubber Futures |

| Soybean Futures |

±10% |

No expansion of price limits |

No expansion of price limits |

| Azuki (Red Bean) Futures |

±8% |

No expansion of price limits |

No expansion of price limits |

| Corn Futures |

±8% |

No expansion of price limits |

No expansion of price limits |

| Commodity Options |

Options on Gold Futures

(Reference price)

less than JPY 10

JPY 10 or more to less than JPY 40

JPY 40 or more to less than JPY 100

JPY 100 or more |

±JPY 200

±JPY 300

±JPY 400

±JPY 550 |

±JPY 350

±JPY 450

±JPY 550

±JPY 700 |

±JPY 500

±JPY 600

±JPY 700

±JPY 850 |

Expansion of upper or (and) lower price limits when a Circuit Breaker is triggered

- The price limits for Commodity Futures and Commodity Options (Precious Metals and CME Group Petroleum Index) will be expanded to the 1st expansion of price limits, and then to the 2nd expansion of price limits.

- In case of Commodity Futures (Precious Metals and CME Group Petroleum Index), price limits will be expanded in one direction, up or down. For Commodity options, both the upper and lower limits will be expanded.

- SCB is not applied to Commodity Futures (Rubber and Agricultural).

Commodity Futures (TOCOM)

The price limit range (SCB Level)

- The price limit range of Commodity Futures listed on TOCOM (except Electricity Futures) shall be calculated by multiplying the reference price for price limits by the rate in the table below

- The price limit range of Electricity Futures shall be set as in the table.

Expansion of upper or (and) lower price limits when a Circuit Breaker is triggered

- The price limits for TOCOM Commodity Futures (except for Electricity Futures) will be expanded to the 1st expansion of price limits, and then to the 2nd expansion of price limits. in one direction, up or down.

- In case of Electricity Futures, the price limit range will not be expanded.

| Products |

Normal |

1st Expansion |

2nd Expansion |

| Platts Dubai Crude Oil Futures |

±30% |

±45% |

±60% |

| Gasoline Futures |

| Kerosene Futures |

| Gas Oil Futures |

| Chukyo Gasoline Futures |

| Chukyo Kerosene Futures |

| East Area Baseload Electricity Futures |

±JPY 8.00 |

No expansion of price limits |

No expansion of price limits |

| West Area Baseload Electricity Futures |

| East Area Peakload Electricity Futures |

| West Area Peakload Electricity Futures |

| East Area Baseload Electricity Futures (Weekly) |

| West Area Baseload Electricity Futures (Weekly) |

| East Area Peakload Electricity Futures (Weekly) |

| West Area Peakload Electricity Futures (Weekly) |

| LNG(Platts JKM)Futures |

±40% |

±50% |

±60% |

Circuit Breaker Rule(SCB)

The circuit breaker rule is applied to temporarily halt trading in order to allow investors to calm down when the market is overly volatile.

| Conditions for

CB Trigger |

Below applies with respect to the leading contract month of future contracts.

In the case where a buy (sell) order is placed (or executed) at the upper (lower) price limit for the central contract month of a futures contract (excluding mini contracts and micro contracts), the trading of futures whose underlying is the same as this central contract month (including mini contracts, micro contracts and Rolling-Spot contracts) will be suspended and the upper (lower) daily price limit range will be expanded.

Price limits will be expanded in stages according to CB trigger situation.

Price limits will be expanded during the trading halt. |

| Contracts (Issues) Subject to Trading Halt |

In cases where the criteria for the CB trigger are met, trading of the issues below will be halted.

- All future contract months

- All option contracts which have the same underlying

- The strategy trades related to (1)

- J-NET trading of (1) and (2)

|

| Conditions for Exception of Application |

- In the case where the above criteria is met within 20 minutes before the end of the regular session of the day (afternoon) or night session.

- For futures (excluding Nikkei 225 VI futures and Nikkei Stock Average Dividend Point Index futures), in the case where the CB criteria is triggered again after the daily price limits has been expanded to the 2nd expansion range (for JGB Futures, after the daily price limits has been expanded to the 1st expansion range).

- In cases where the Exchange deems that a trading suspension would not be appropriate in consideration of the trading conditions, etc.

|

Beginning of

Trading Halt |

The time that OSE determines on each occasion immediately after the criteria for CB trigger are met

(note)

- ・Due to that halt operation is carried out immediately after CB criteria is met, there is a slight time difference between the time CB criteria is met and the actual initiation of halt.

|

| Duration for

Trading Halt |

More than 10 minutes |

| Method for Resumption |

After the duration for a trading halt, trading will be resumed by the Itayose method with the price limit expanded. |

| Reference Price |

Renewed on a trading day basis |

(note)

- ・In cases where the circuit breaker is triggered 10 minutes or less before the end of the morning session of JGB Futures and Interest Rate Futures, the trading in the morning session shall be halted, but the closing auction of the morning session would be conducted with the price limit expanded. (The duration of the trading halt shall be 10 minutes or less. The closing auction would be conducted by the Itayose method in the range of ±DCB price range applied to the closing auctions of the DCB reference price at the time of triggering the circuit breaker condition).

- ・CB is not applied to TAIEX Futures and Commodity Futures (Rubber and Agricultural).

- ・In cases where the Exchange deems that a trading suspension would not be appropriate in consideration of the trading conditions, etc., trading will not be halted.

- ・For the handling of duration of the temporary trading halt on derivatives holiday trading days, please refer to "Holiday Trading"

Image of Triggering Circuit Breaker

When a buy (sell) order is placed (or executed) at the upper (lower) price limit, Static Circuit Breaker will be triggered immediately.

Please see the following for the description of expanding price limits in stages.

![]() Close

Close![]() Close

Close