News Release

Feb. 12, 2026 JPXI JPXI Launches Study for Industry-wide Common Data Platform to Enhance Securities Operations

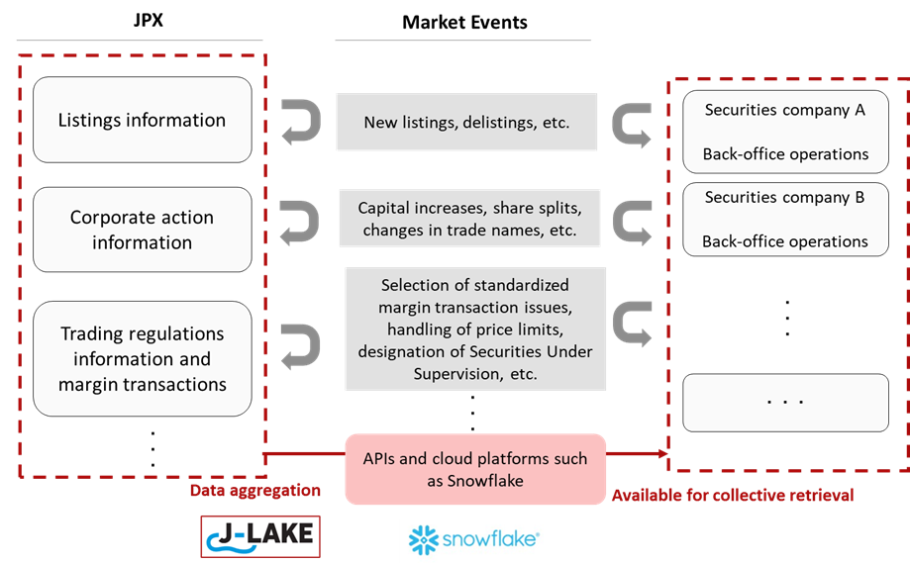

JPX Market Innovation & Research, Inc. (JPXI) has begun considering the establishment of an industry-wide common data platform. This platform will aggregate a range of corporate and transaction information and distribute it in a format conducive to automated processing, in order to support securities companies in enhancing the accuracy and efficiency of their back-office operations.

We aim to launch this service around spring 2027.

Issues in Verifying and Inputting Corporate and Transaction-related Information in the Securities Industry

Currently, back-office departments at securities companies collect information mainly from notifications (such as JPX Notices in PDF format) issued by exchanges and from the websites of securities-related institutions. This information is manually entered and verified by each company. The main types of information include:

- Information related to listings, such as new listings and delistings

- Day-to-day notifications regarding corporate actions, such as capital increases, share splits, and changes in trade names

- Information on trading regulations and margin transactions, such as handling of price limits, designation of Securities Under Supervision, and selection of standardized margin transaction issues

These operations have been identified as common industry issues, and include manual data entry workload and risk of error, as well as difficulties in training successors due to the reliance on individual expertise.

Promoting Business Process Reform Through the Integrated Provision of Market Information

To address these issues, JPXI is considering the development of a common data platform that aggregates wide-ranging data held by securities-related institutions and provides it in a format suitable for automated processing. We are exploring a variety of options for how to provide this data, including distribution via APIs and cloud platforms such as Snowflake.

By providing market information in a standardized format that can be automatically integrated into the business systems of securities companies, we aim to review the current back-office operations developed by each company and promote business process reengineering across the entire securities industry. Through these efforts, we expect to reduce manual workload, improve the speed and accuracy of processing, and enhance overall industry productivity.

Implementing Innovation Through Collaboration with Market Stakeholders

In this initiative, we are placing great emphasis on collaboration with market stakeholders in order to expand the standardized data platform throughout the industry, and are in the process of defining and verifying requirements.

So far, we have been working with multiple market stakeholders, including Mizuho Securities Co., Ltd., Daiwa Securities Co. Ltd., and Daiwa Institute of Research Ltd. to gather feedback on data distribution requirements and other matters.

Going forward, we will continue to explore collaboration with a wide range of market participants and securities-related institutions, with the aim of further improving productivity across the securities industry.

Beta Environment Scheduled for Launch in Early 2027

Prior to the full-fledged launch of the service, we plan to provide a beta environment in early 2027. This is intended to enable market stakeholders to verify whether the platform can contribute to improving the efficiency and sophistication of their operations, as well as to test its integration into actual business processes. Further details will be announced in due course.

Contact

JPX Market Innovation & Research, Inc. Frontier Development Department

E-mail:inf_dev@jpx.co.jp