News Release

Apr. 27, 2023 JPXI Study Panel on the Use of Digital Bonds in ESG Investing concludes discussions, publishes report

April 27, 2023 --- JPX Market Innovation & Research, Inc. (“JPXI”) partnered with Nomura Securities Co., Ltd. (“Nomura”) to form the Study Panel on the Use of Digital Bonds in ESG Investing on September 28, 2022 (organizer: JPXI; administration: Nomura), bringing together issuers and investors with green bond experience, as well as securities firms, banks and trust banks, ESG rating agencies, system vendors, and public-sector organizations*1. The panel has met seven times, and a report on the findings of its discussions has been published.

The report indicates that, in light of the global push towards net zero emissions and carbon neutrality, as well as the investing community’s stance on responsible investment, growing adoption of new green bonds—such as the digitally tracked green bonds (GDTB) issued by Japan Exchange Group (“JPX”) in June 2022—by both issuers and investors will help improve green investment data transparency and enhance the user experience for issuers, investors, and other stakeholders.

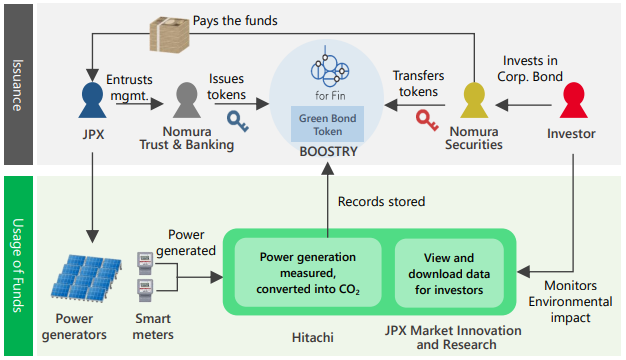

One focus of the discussions was GDTB, whose advantages include a mechanism for automatically collecting and recording data on the amount of green power generated and avoided CO2 emissions, substantially reducing the effort and cost that go into collecting data and ensuring the green status of the bond’s proceeds. The panel participants noted the further potential for this technology, pointing out that it could be used to track data for a variety of other green projects and may have applications that extend beyond green bonds to other types of financial instruments.

Schematic of the Digitally Tracked Green Bond mechanism

However, the panel also identified some challenges that must be addressed for digital bonds to achieve further growth as an ESG investment option. These include tax amendments, introduction of DVP settlement, broadening of the market participant base, better secondary-market functionalities, and the inclusion of digital bonds in domestic bond benchmark indexes*2.

Of these challenges, the ones considered particularly high priority are the tax amendments (specifically, changes to provisions in the Act on Special Measures Concerning Taxation that govern withholding tax exemptions*3, and to provisions in the Income Tax Act that govern tax exemptions for public institutions, etc.*4) and the broadening of the market participant base, which includes securities firms and custodians.

JPXI and Nomura will continue to engage with market stakeholders in order to address these challenges and pursue the possibilities that digital bonds offer in ESG investing. The two companies hope that the GDTB mechanism will prove useful for a wide range of issuers and investors, and that this report will assist in the development of sustainable financing in Japan.

*1 Participating organizations (in alphabetical order)

| ANA HOLDINGS INC. | Anderson Mori & Tomotsune |

| BOOSTRY Co., Ltd. | Custody Bank of Japan, Ltd. |

| The Dai-ichi Life Insurance Company, Limited | Daiwa Asset Management Co. Ltd. |

| Daiwa Institute of Research Ltd. | Daiwa Securities Co. Ltd. |

| Daiwa Securities Group Inc. | Development Bank of Japan Inc. |

| DNV Business Assurance Japan K.K. | Fujitsu Ltd. |

| Goldman Sachs Japan Co., Ltd. | Hitachi, Ltd. |

| Japan Airlines Co., Ltd | Japan Bond Trading Co., Ltd. |

| Japan Credit Rating Agency, Ltd. | Japan Information Processing Service Co., Ltd. |

| Japan Securities Dealers Association | Japan Security Token Offering Association |

| JPX Market Innovation & Research, Inc. | Manulife Investment Management (Japan) Limited |

| The Master Trust Bank of Japan, Ltd. | Meiji Yasuda Life Insurance Company |

| Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. | Mitsubishi UFJ Trust and Banking Corporation |

| Mitsui O.S.K. Lines, Ltd. | Mizuho Bank, Ltd. |

| Mizuho Securities Co., Ltd. | Mizuho Trust & Banking Co., Ltd. |

| Mori Hamada & Matsumoto | Nippon Life Insurance Company |

| Nissay Asset Management Corporation | Nomura Asset Management Co., Ltd. |

| Nomura Institute of Capital Markets Research | Nomura Research Institute, Ltd. |

| Nomura Securities Co., Ltd. | The Nomura Trust and Banking Co., Ltd. |

| The Norinchukin Bank | NTT DATA Corporation |

| Rating and Investment Information, Inc. | SBI SECURITIES Co., Ltd |

| SHIMIZU CORPORATION | SMBC Nikko Securities Inc. |

| SoftBank Corp. | Sony Life Insurance Co., Ltd. |

| Sumitomo Life Insurance Company | Sumitomo Mitsui Banking Corporation |

| Sumitomo Mitsui DS Asset Management Company, Limited | Sumitomo Mitsui Trust Bank, Limited |

| Sustainalytics Japan Inc. | Tokai Tokyo Financial Holdings, Inc. |

| Tokai Tokyo Securities Co., Ltd. | Tokyo Realty Investment Management, Inc. |

| XNET Corporation |

64 organizations in total (including some that are not listed here)

*2 This report was prepared by JPXI and Nomura based on discussions that took place at study panel meetings, and does not necessarily reflect the participants’ opinions and positions.

*3 Article 8 of the Act on Special Measures Concerning Taxation exempts financial institutions, etc. from withholding tax on interest income received. However, according to prevailing interpretations of the current version of this statute, this exemption does not apply to digital bonds.

*4 Article 11 of the Income Tax Act sets forth tax exemptions on interest and similar income that public corporations, etc. receive. However, according to prevailing interpretations of the current version of this statute, this exemption does not apply to digital bonds.

Contact

JPX Market Innovation & Research, Inc. Frontier Development

E-mail:j-quants@jpx.co.jp