Revisions by Invoice System

Revisions by Invoice System

Japanese Government will introduce the qualified invoice-based method (the invoice system) to the Japanese Consumption Tax from October 1, 2023. Osaka Exchange, Inc. (OSE) and Tokyo Commodity Exchange, Inc. (TOCOM) will partially revise the rules of settlement by delivery for commodity futures transactions as follows.

- Deliverers who conduct settlement by delivery in physically delivered futures transactions shall be limited to business issuers of qualified invoice in order for a receiver to receive tax credit for consumption tax on purchases.

- A qualified invoice for settlement by delivery of domestic physically delivered futures* transactions shall be prepared by the Exchange on behalf of the deliverer and provided to a receiver by electromagnetic record in accordance with the Special Provisions for Intermediary's Delivery.

Please see the following outline.

- In Commodity Futures trading, if the transaction is terminated by cash settlement (without physical delivery), it does not fall under the transfer of assets and is not subject to consumption tax. However, if the physical delivery is made in Japan, it falls under the category of transfer of assets, etc. and is subject to consumption tax.

Eligible Products

| OSE |

Precious Metal |

Gold Standard Futures, Gold Rolling-Spot Futures*, Silver Futures, Platinum Standard Futures, Platinum Rolling-Spot Futures* and Palladium Futures |

| Rubber |

Rubber (RSS3) Futures |

| Agriculture |

Soybean Futures and Azuki (red beans) Futures |

| TOCOM |

Energy |

Gasoline Futures, Kerosene Futures, Gas Oil Futures, Chukyo-Gasoline Futures and Chukyo-Kerosene Futures |

- Eligible only for "Delivery on Request"

Notes for Deliverers

For a settlement by delivery of eligible products, a deliverer must be a business issuer of qualified invoice, and the deliverer who has open interests must notify the Exchange of its registration number as a business issuer of qualified invoice through its Trading Participant.

Please note that if the notification is not received by a certain date designated by the Trading Participant, the open interest will be settled by the Trading Participant by repurchase.

Delivery of Invoices by the Exchange

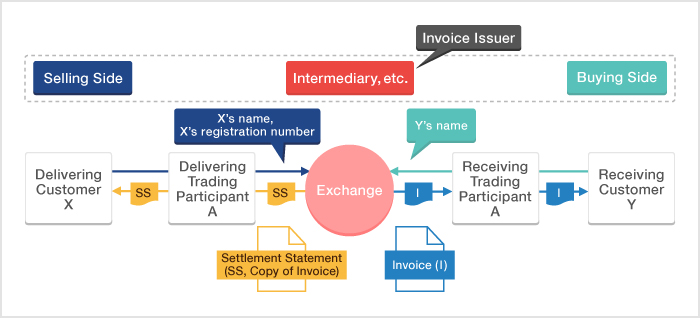

After the introduction of the invoice system, in the normal transaction, a seller issues an invoice and delivers it to a buyer. In a settlement by delivery on the Exchange, however, the Exchange issues an invoice on behalf of the deliverer (seller) and delivers it to the receiver (buyer). Also, the Exchange issues a "settlement statement" to the deliverer as a copy of the invoice.

The issuer of the invoice is the Exchange, and the registration number of the Exchange as a business issuer of qualified invoice will be written on the invoice. In order to ensure anonymity, the qualified invoice delivered by the Exchange will not contain any information regarding the deliverer.

The amount shown on the invoice is calculated based on the delivery price, not the traded price.

Implementation Date

In conjunction with the introduction of the invoice system in October 2023, the Exchange will start to issue invoices for settlement by delivery conducted after that date.

Please refer to the above outline for the start dates of the subject contract months for each eligible product.

Declaration and Calculation of Consumption Tax

After the introduction of the invoice system in October 2023, both a deliverer and a receiver of settlement by delivery will calculate the tax base of consumption tax and the amount of payment based on the "delivery price" shown on the invoice.

Notice to investors who are not business issuers of qualified invoice

After October 1st, 2023, only business issuers of qualified invoice will be able to conduct settlement by delivery as deliverers when they deliver contracts that involve the transfer of consumption tax. Investors who hold warehouse receipts will not be able to deliver them, if they are not registered as business issuers of qualified invoice. Therefore, investors who do not plan to become business issuers of qualified invoice should consider conducting settlement by delivery (or selling) of their warehouse receipts by the contract months as follows.

<Contract months in which investors can conduct settlement by delivery as a selling party without a status of business issuers of qualified invoice>

| Exchange |

Market |

Product |

Contract Month |

| OSE |

Precious Metal |

Gold Standard Futures |

By August 2023 |

| Silver Futures |

By August 2023 |

| Platinum Standard Futures |

By August 2023 |

| Palladium Futures |

By August 2023 |

| Rubber |

RSS3 Rubber Futures |

By September 2023 |

| Agriculture |

Soybean Futures |

By August 2023 |

| Azuki(redbean) Futures |

By September 2023 |

| TOCOM |

Energy |

Gasoline Futures |

By September 2023 |

| Kerosene Futures |

By September 2023 |

| Gas Oil Futures |

By September 2023 |

| Chukyo-Oil |

Chukyo-Gasoline Futures |

By September 2023 |

| Chukyo-Kerosene Futures |

By September 2023 |

(note)

- ・After October 2023, investors who are not business issuers of qualified invoice can still hold warehouse receipts, etc., but cannot be delivered by delivery settlement. Please note that when selling the warehouse receipts, etc., you need to sell the receipts to jewelry shop, etc. by yourself.

![]() Close

Close![]() Close

Close