Capital Adequacy Ratio of General Trading Participants

What is the Capital Adequacy Ratio?

The "capital adequacy ratio" is an important indicator to measure the financial soundness of securities firms.

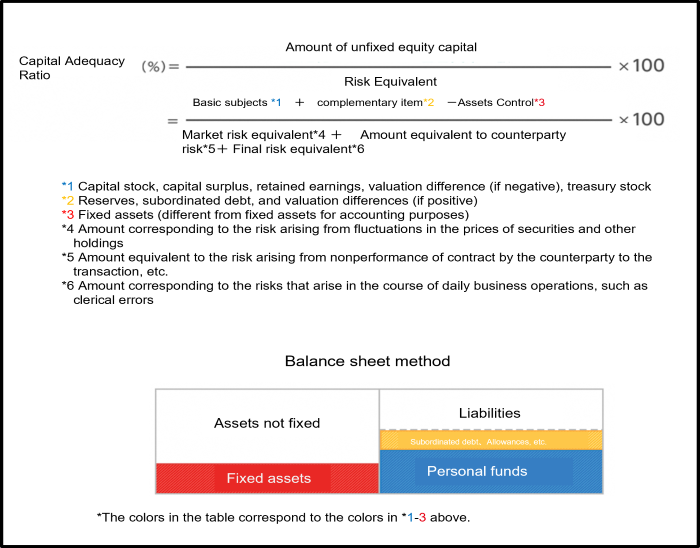

In the balance sheet, which is one of the financial statements, "liabilities" are called "others' capital" because they need to be repaid to others, while the total capital minus liabilities is the capital you own, or “owned capital.” The "capital adequacy ratio" is an index calculated by dividing the "amount of unfixed equity capital" (i.e., equity capital minus fixed assets) by the "amount equivalent to risk" corresponding to risks that may occur due to various circumstances.

The Financial Instruments and Exchange Act stipulates that securities companies must prepare a document stating their capital adequacy ratios as of the end of March, June, September, and December of each year, and must keep such documents at all of their offices for three months from the end of the following month and make them available for public inspection.

Capital Adequacy Ratio Calculation Method

The calculation of the capital adequacy ratio outlined below is stipulated in the Financial Instruments and Exchange Law and the Cabinet Office Ordinance on Financial Instruments Business.

Securities firms are required by the Financial Instruments and Exchange Act to maintain a capital adequacy ratio above a certain level due to the nature of their business, which involves frequent and large volume trading of securities and other assets.

However, there is often a trade-off between increasing the capital adequacy ratio and effectively utilizing capital. Since companies have different ideas on the level of capital adequacy ratio to be maintained, it is not necessarily appropriate to measure the financial soundness of a securities company solely by referring to the levels of their ratios.

In addition to a securities company's capital adequacy ratio, investors should gauge the financial soundness of a securities company comprehensively by referring to the "business and financial conditions" indicated in the company's financial statements.

Criteria stipulated by laws and regulations regarding capital adequacy ratios

The Financial Instruments and Exchange Act stipulates the obligation to maintain a capital adequacy ratio of 120%, and if the ratio falls below that level, the Financial Services Agency may issue a supervisory order to the securities company.

Tokyo Stock Exchange ("TSE") and Osaka Securities Exchange ("OSE") also regularly monitor the capital adequacy ratios and other financial conditions of trading participants, and restrict or suspend trading depending on the level of such ratios and company conditions, in an effort to ensure the stability of the securities market. TSE and OSE are committed to ensuring the stability of the securities market.

| Own Capital Regulation Ratio* |

Financial Instruments and Exchange Act, etc. |

Trading participant regulations, etc.

|

| Below 140% |

Requires notification to the Financial Services Agency |

Report to TSE and OSE in the prescribed reports |

| Below 120% |

The Financial Services Agency may order changes in business methods, order the deposit of assets and other matters necessary for supervision. |

TSE and OSE may suspend or restrict trading of securities on the TSE and the OSE market. |

| Below 100% |

The Financial Services Agency may order the suspension of all or part of the business for a period of not more than three months. |

TSE and OSE may suspend or restrict trading of securities on the TSE and OSE market. |

- For trading participants that are special financial instruments business operators, similar measures will be adopted according to their capital adequacy ratios on a consolidated basis.

List of Capital Adequacy Ratios of General Trading Participants

The following file is a list of capital adequacy ratios and other figures based on documents prepared by each General Trading Participant.

Capital Adequacy Ratios of General Trading Participants (as of Dec 31, 2023)

|

|

![]() Close

Close![]() Close

Close