CME Group Petroleum Index Futures

Overview

CME Group Petroleum Index Futures is the index futures contract tracking CME Group Petroleum Index, which reflects a weighted basket of 3 exchange traded energy futures contracts namely WTI futures (crude oil), RBOB futures (gasoline) and ULSD futures (heating oil) traded on New York Mercantile Exchange, the core market of CME Group.

Characteristics of the product

Highly correlated with WTI futures prices

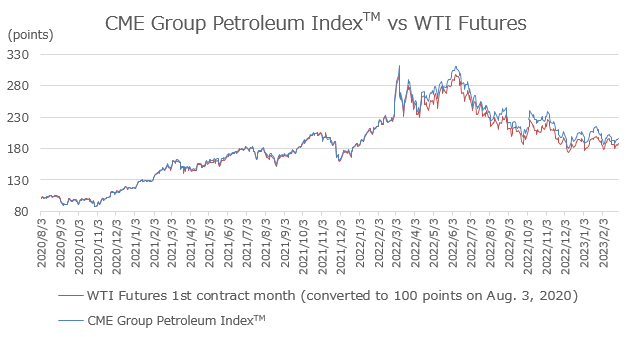

WTI futures prices, a leading indicator of global crude oil prices, are the major component of CME Group Petroleum Index. The index moves close to the futures. From the beginning of August 2020 to the end of March 2022, the correlation coefficient between WTI futures prices and CME Group Petroleum Index is more than 0.99.

Yen-denominated Transaction

CME Group Petroleum Index Futures is traded in Japanese yen.

No physical delivery risk

Due to its cash settlement characteristics, there is no physical delivery risk.

CME Group Petroleum Index

Components

Components of CME Group Petroleum Index are as follows:

NYMEX RBOB Gasoline Futures (External Site)

NYMEX NY Harbor ULSD Heating Oil Futures (External Site)

The percentage weight of each futures contract composing the Index is based on the respective average open interest volumes for the last quarter of calendar year, i.e. from October 1st to December 31st.

Changes to the weights will be advised to stakeholders in advance and applied on the first business day of the following year after April 1.

CME Group released the change in the weightings of each futures contract within CME Group Petroleum Index. The change is to be effective on April 1, 2024, and the weightings of each futures contract of the index will be set as follows.

| Futures Contract | Before March 31, 2024 |

After April 1, 2024 |

| NYMEX WTI crude oil | 75% | 72% |

| NYMEX RBOB gasoline | 11% | 14% |

| NYMEX NY Harbor ULSD heating oil | 14% | 14% |

Methodology

CME Group Petroleum Index is calculated based on the settlement price of the nearest contract month, except for the roll period.

The index value is calculated by the following formula:

- ・ Weighted Average Price=Σ(Settlement Prices for each futures in USD/bbl×weighting for each futures)

- ・ During the roll period, taking into account the trend in liquidity over several days prior to the last trading day, the settlement prices used to calculate the index are smoothed out for the first and second contracts. CME Group released the change in roll period for CME Group Petroleum Index. The change is to be effective on June 5, 2023 as follows:

| Roll Period weights (before June 4, 2023) | The 1st contract month | The 2nd contract month |

| ED (Expiry Day of each component futures contract)-6 | 100% | 0% |

| ED-5 | 80% | 20% |

| ED-4 | 60% | 40% |

| ED-3 | 40% | 60% |

| ED-2 | 20% | 80% |

| ED-1 | 0% | 100% |

| Roll Period weights (after June 5, 2023) | The 1st contract month | The 2nd contract month |

| ED (Expiry Day of each component futures contract)-7 | 100% | 0% |

| ED-6 | 80% | 20% |

| ED-5 | 60% | 40% |

| ED-4 | 40% | 60% |

| ED-3 | 20% | 80% |

| ED-2 | 0% | 100% |

| ED-1 | 0% | 100% |

Therefore, on the day before the last trading day of the first contract month, only the second contract month is used to calculate the index.

Please refer to CME website (external site) for the detail.

Trends in index values

It is highly correlated with WTI futures contract, the world's leading futures commodity for crude oil.

Please refer to CME website (external site) for the current value of the index.

* Please use other browsers such as Microsoft Edge or Google Chrome to check the index value, as it may not be displayed in Internet Explorer (IE).

DISCLAIMER

CME GROUP MARKET DATA IS USED UNDER LICENSE AS A SOURCE OF INFORMATION FOR CERTAIN OSAKA EXCHANGE, INC, AND ITS AFFILIATES PRODUCTS. CME GROUP HAS NO OTHER CONNECTION TO OSAKA EXCHANGE, INC, AND ITS AFFILIATES PRODUCTS AND SERVICES AND DOES NOT SPONSOR, ENDORSE, RECOMMEND OR PROMOTE ANY OSAKA EXCHANGE, INC, AND ITS AFFILIATES PRODUCTS OR SERVICES. CME GROUP HAS NO OBLIGATION OR LIABILITY IN CONNECTION WITH THE OSAKA EXCHANGE, INC, AND ITS AFFILIATES PRODUCTS AND SERVICES. CME GROUP DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF ANY MARKET DATA LICENSED TO OSAKA EXCHANGE, INC, AND ITS AFFILIATES AND SHALL NOT HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN CME GROUP AND OSAKA EXCHANGE, INC, AND ITS AFFILIATES.