Reduction of Investment Unit / Mechanism and Effects of Share Split

Desirable Investment Unit Level (Less than JPY 500,000)

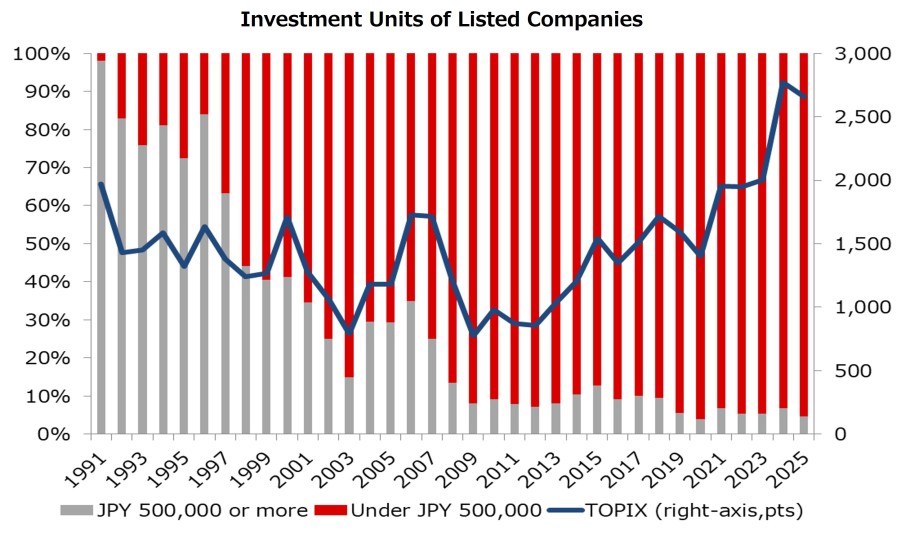

In order to create an environment in which individual investors can easily invest, TSE has indicated that the desirable investment unit level for listed companies should be less than JPY 500,000.

In addition, if a stock’s investment unit size is set at or above the desirable investment level (JPY 500,000 or more), TSE requires issuers of listed domestic stock certificates to disclose, within three months of the end of their fiscal years, the company's views, policies and other information concerning the reduction of the investment unit. This disclosure is required under TSE listing rules.

Corporate disclosures for individual companies can be found on the “Listed Company Search” page of the TSE website.

Reduction of Investment Units

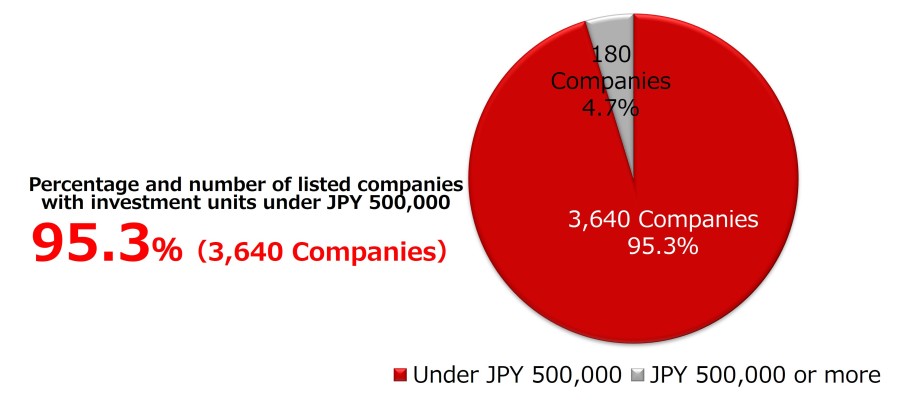

The percentage of “high investment unit companies” (companies with investment units of JPY 500,000 or more) has remained below 10% in recent years. As of September 30, 2025, 93.4% of TSE-listed companies had investment units less than JPY 500,000.

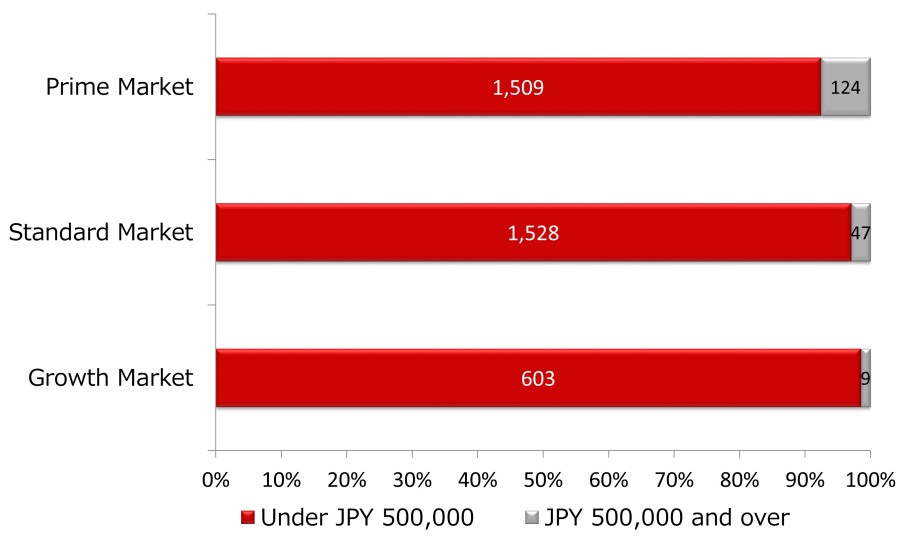

Status by Market Segment

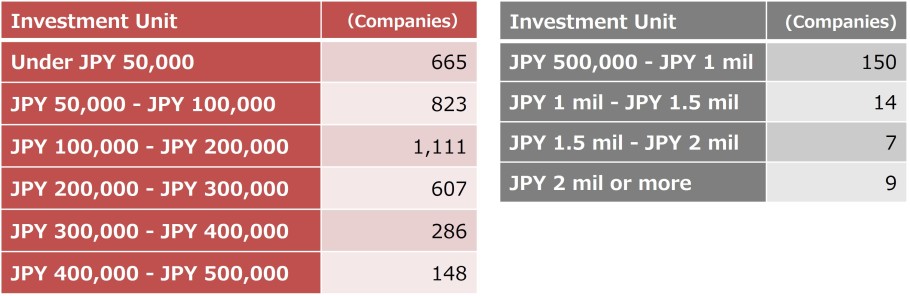

Investment Unit Distribution by Number of Companies

Request for Consideration of Reduction of Investment Unit

On October 27, 2022, TSE issued a request to companies with investment units of JPY 500,000 or more, asking them to consider reducing their investment units.

In addition, on April 24, 2025, TSE published the results of its “Study Group on Small-Size Investments,” to summarize the significance of reducing investment units, issues around procedures for and burdens on listed companies, and responses to such issues.

According to the questionnaire of retail investors conducted by TSE, it is believed that the investment unit level sought by retail investors is around JPY 100,000.

We would like to request that listed companies continue to consider share splits, taking into account these needs of retail investors.