Market News

Jan. 13, 2026 OSEJSCC JGB and JPY Interest Rate Derivatives Reach Annual Record Highs in 2025

In 2025, the JPX government bond and interest rate derivatives markets saw both 20-year JGB Futures and 3-Month TONA Futures at Osaka Exchange, Inc. (OSE) set new annual trading volume records since their respective market launches. Furthermore, the annual clearing value for JPY interest rate swaps at Japan Securities Clearing Corporation (JSCC) also reached a new high. Against the backdrop of the return to a “positive-interest economy”, this year clearly demonstrated market expansion and revitalization.

JGB and JPY Interest Rate Derivatives Markets at OSE

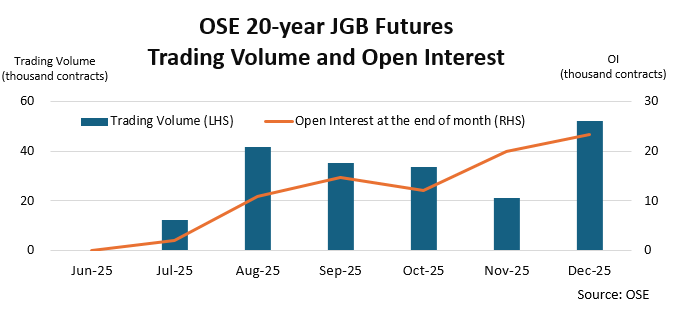

20-year JGB Futures

Amid fluctuations in ultra-long term JPY interest rates since April, investors reaffirmed the necessity of ultra-long JGB Futures. Consequently, 20-year JGB Futures were executed in July 2025 for the first time in approximately three years.

Furthermore, the annual trading volume in 2025 reached 196,682 contracts (JPY 1,966.82 billion in face value), representing the highest annual figure by far since the market launched in 1988. The year-end open interest also remained at a high level of approximately 23,000 contracts.

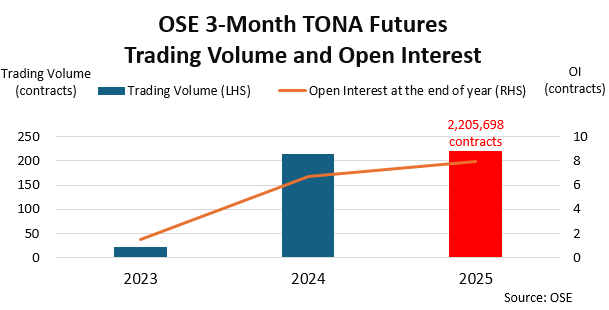

3-Month TONA Futures

In 2025, the annual trading volume for 3-Month TONA Futures reached approximately 2,205,698 contracts, marking the highest level since the market launched in May 2023 at OSE. The year-end open interest also remained high at approximately 80,000 contracts.

In addition to existing overseas investors, trading by domestic financial institutions became more active in 2025, leading to this record-breaking performance.

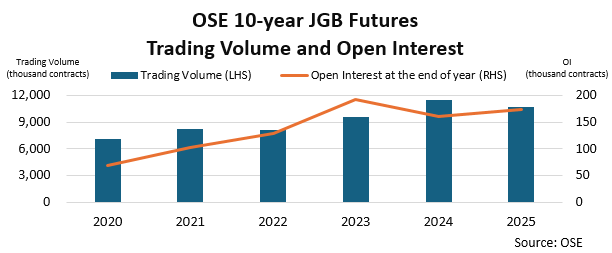

10-year JGB Futures

10-year JGB Futures, the flagship product of JGB Derivatives Market at OSE, marked its 40th anniversary on October 19, 2025. The annual trading volume in 2025 reached 10,750,902 contracts (JPY 1,075 trillion in face value). While this was slightly lower than the previous year, it marked the second consecutive year exceeding 10 million contracts. Furthermore, the year-end open interest remained at a high level of approximately 170,000 contracts, indicating the market's continued vitality.

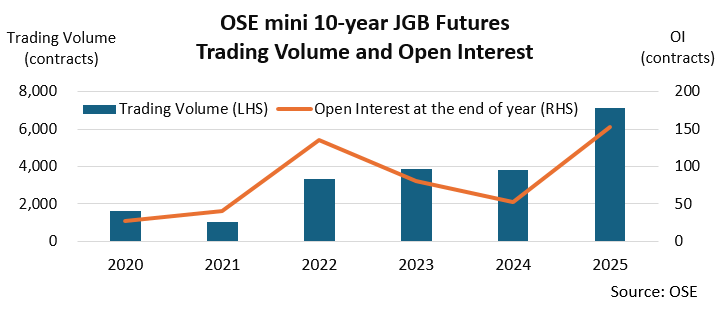

mini 10-year JGB Futures

Mini 10-year JGB Futures, which are traded at one-tenth the size of 10-year JGB Futures and are settled in cash, are a government bond derivative product that meets the trading needs of individual investors. The annual trading volume of 7,101 contracts in 2025 roughly doubled the previous year's figure, driving market activity alongside 10-year JGB Futures.

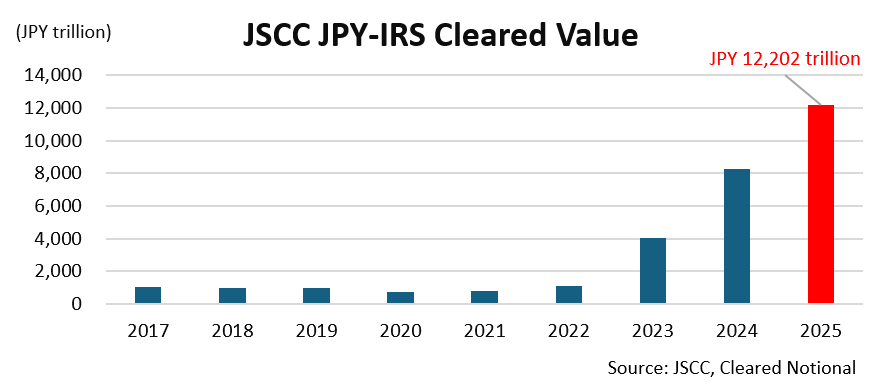

JPY Interest Rate Swaps Clearing at JSCC

In 2025, the annual clearing value of JPY interest rate swaps at JSCC reached approximately JPY 12,202 trillion, setting a new record high. This significant expansion is driven by the increase in yen interest rate swap transactions, reflecting heightened short-term interest rate fluctuations. Furthermore, in September 2025, JSCC received approval from the U.S. Commodity Futures Trading Commission (CFTC), enabling U.S. customers to access JSCC’s interest rate swap clearing services.

JPX has set out the objective of "expanding interest rate-related products and services" in its Medium-Term Management Plan 2027. With the arrival of a "positive-interest economy", JPX, OSE and JSCC will continue to strive to enhance risk management while working to further improve the efficiency and convenience of the JPY interest rate market in line with the demand of market participants.

Related Links

20-year JGB Futures

20 year-JGB Futures (Contract Specifications)

3-Month TONA Futures

3-Month TONA Futures Open Interest Surpasses 100,000 Contracts, Setting a New Record (March 13, 2025)

3-Month TONA Futures (Overview)

Articles on JPX Interest Rate Derivatives

10-year JGB Futures

Mini 10-year JGB Futures

Clearing and Settlement Services at JSCC

Contact

Osaka Exchange, Inc.

TEL:+81-6-4706-0800 (Operator)

Japan Securities Clearing Corporation

TEL:+81-3-3665-1234 (Operator)