3-Month TONA Futures

Overview

Since the listing, the market size has been expanding.

About 3-Month TONA Futures

3-Month TONA Futures based on Tokyo Over-Night Average rate (TONA; published by the Bank of Japan).

What is TONA?

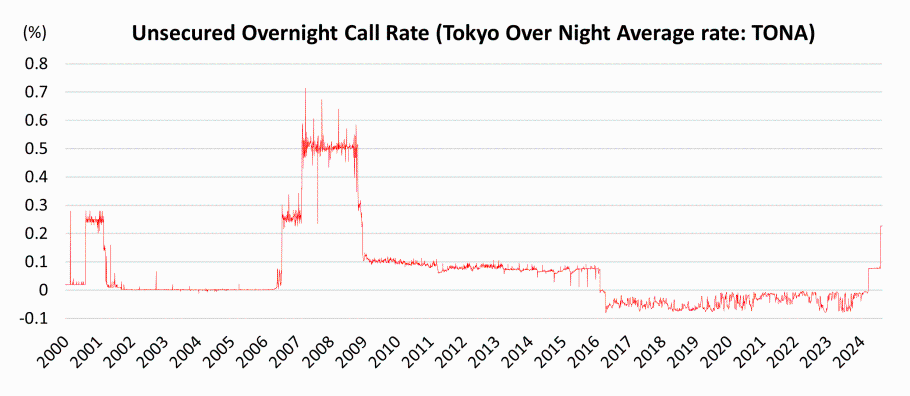

TONA is the overnight interest rate for unsecured money lending and borrowing in the call market. In Japan, TONA has been identified as an alternative RFR to the JPY LIBOR in the reform of interest rate benchmark in response to LIBOR Scandal. The greatest strength of TONA is that it is "based on actual transactions" and in the call market, unsecured call O/Ns are traded daily in excess of several trillion yen.

TONA is specifically calculated by weighting and averaging the rates of transactions subject to the calculation by the volume per rate (the volume per rate is the amount of transactions that have been executed). Provisional results are published at around 5:15 p.m. on the same day, and Final results at around 10:00 a.m. on the following business day.

(Source: Bloomberg)

| Quick | Bloomberg | Refinitiv (Thomson Reuters japan) |

| MMC.ON%T/ACLJ | MUTKCLAM Index | JPONMUF=RR |

Why 3-month compounded TONA?

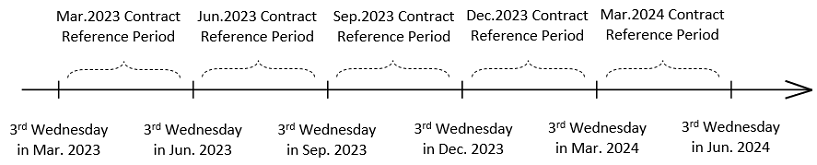

3-Month TONA Futures are not based on the value of TONA itself, but on a financial indicator obtained by subtracting 3-month compouded TONA from 100.

Although TONA is an overnight (one business day) rate, in practice, term rates such as LIBOR have been preferred and used. Therefore, in practice, when TONA is used as an alternative term rate to LIBOR, the rate that would be obtained if TONA were compounded for a certain period of time (so-called TONA post-determined compound interest) is used.

OSE has adopted the 3-month term because 3-month term contracts are the most actively traded on overseas exchanges, in addition to the fact that the need for 3-month term is the greatest in practical terms.

IMM Index

The IMM Index (100 minus rate) is the pricing method and adopted as the standard in interest rate futures. In the case of the IMM index method, the direction of interest rate movements coincides with the direction of price movements.

Key Advantages of OSE's 3-Month TONA Futures

Trading hours are until 6:00 a.m. the following morning

Available to trade responding to the European, U.S. and other overseas markets since the night session covers their business hours.

One-stop trading available for interest rate products from short to long term

One-stop trading available for interest rate products from short to long term on the same derivatives trading system (J-GATE) with existing JGB futures and options.

Margin Offset with JGB Futures

Margin is discounted by offsetting risks between JGB Futures, allowing you to trade more efficiently with your funds.

Hedging Tool for OIS or Alternative to OIS to Reduce Trading Cost

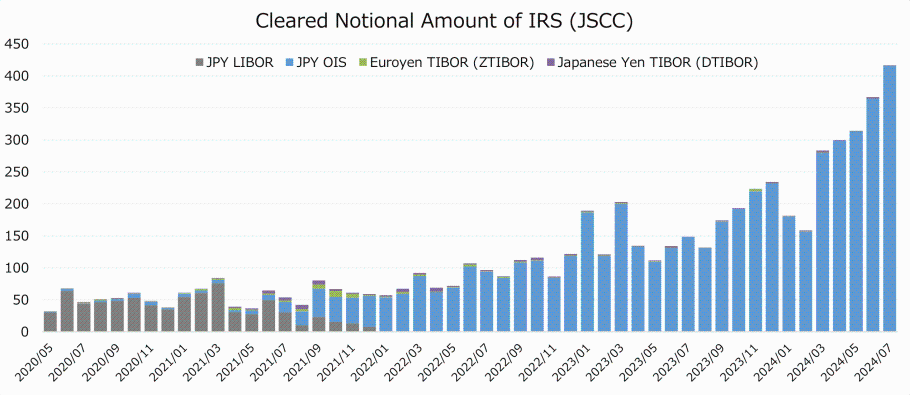

Overnight Index Swap (OIS) is a type of swap in which a fixed rate of interest is exchanged for a floating rate of interest. With the permanent suspension of the JPY LIBOR publication at the end of December 2021, the majority of IRS hace shifted to TONA as the base rate.JSCC clears IRS; and notional amount of IRS is increasing. Since the calculation of the daily cumulative compound TONA is similar to the one of the floating rate of OIS, 3-Month TONA Futures have the same economic value as OIS. Therefore, it is expected to be used as a hedging tool for OIS or as an alternative to OIS to reduce trading costs.

Trading and Clearing Fee Half-Off Campaign

OSE has decided to extend the Trading and Clearing Fee Half-Off Campaign for 3-Month TONA Futures until March 31, 2026, in order to encourage a wide range of investors to participate in the market and to enhance liquidity.

Cross Margining with IRS

Cross Margining, a system to reduce the collateral burden of clearing participants and others by offsetting the risk of the trading of interest rate swaps (IRS), Japanese Government Bond (JGB) Futures and 3-Month TONA, contribute to improving the convenience and efficiency of yen interest rate derivatives trading.

Off-auction trading support

Ueda Tradition Securities Ltd. and Osaka Exchange are collaborating to stimulate off-auction trading of 3-month TONA Futures.

Ueda Tradition Securities Ltd. - Introduction of Osaka Exchange 3-Month TONA Futures Off-Market Trading

Vendor Code List

| Quick | Bloomberg | Refinitiv (Thomson Reuters Japan) |

CQG |

| 030.n /O | JOAA <Comdty> | JTOAcn | F.US.TOA3M |

Related Reports & Videos

Related Reports

This report provides a comprehensive look at the Japanese interest rate market, explaining how OSE 3-Month TONA futures can be utilized by both hedgers and speculators. It also includes practical examples to demonstrate how to calculate the probability of interest rate hikes.

(Author: Dr. Alexis Stenfors, Reader in the Economics and Finance, University of Portsmouth)

Contents

- Abstract

- 1. Introduction

- 2. The end of LIBOR and the transition to alternatives

- 3. Differences between LIBOR and RFRs

- 4. The case of Japan: TONA and OSE 3-month TONA futures

- 5. Three hypothetical case studies

- 5.1. Hedging against an imminent BOJ rate hike

- 5.2. Positioning ahead of (hawkish) BOJ communication

- 5.3. Speculating on the precise timing of a BOJ rate hike

- 6. Summary and conclusions

- References

Two Summary Videos:

Related Videos

[JPX-Eurex Joint Webinar] The Euro and Yen Ibor transition - New trading opportunities in derivatives(May 25 2023)

Eurex and Osaka Exchange and experts from across the market discussed exploring how the transition to new risk-free rates will create opportunities for trading firms ahead of the launch of 3-Month TONA Futures on Osaka Exchange on May 29, 2023 and following the launch of ESTR futures on Eurex in January.

- What is the strategy for the introduction of ESTR and TONA derivatives?

- How will divergence in fiscal policies across Europe and Japan create opportunities?

- How are RFRs trading in the US market and creating opportunities for trading firms, and what can we expect in the Euro and Yen market?

- How will liquidity and participation evolve in the new Risk-Free Rates in Europe and Japan?

Speakers & Agenda:

[Moderator]

- Will Mitting, Founder, Acuiti

[Discussion Speakers]

- Shun Yanagisawa, Director, Japan Head, Futures, Clearing and FX Prime Brokerage, Citigroup Global Markets Japan

- Elad Hertshten, Managing Director, Futures First

- Iris Hui, Senior Representative of North Asia FIC Derivatives and Repo Sales, Eurex

- Kensuke Yazu, General Manager, Osaka Exchange

[Interview Session]

- Alexis Stenfors, Reader in the Economics and Finance, University of Portsmouth