Compression Trade

[Important Notice] OSE is suspending Compression Trade after the June 2024 Compression run.

Compression Trade

Compression Trades are the J-NET trades which allows market participants to reduce their OSE listed Index Futures and Options positions by executing trades multilaterally between multiple market participants.

Compression needs have been increasing among market participants, especially between Market Makers with multiple issues backed by leverage ratio regulations where the reduction of management costs for open interests is important.

- ・Compression is available for Nikkei 225 Options for the time being.

Compression Trade Flow

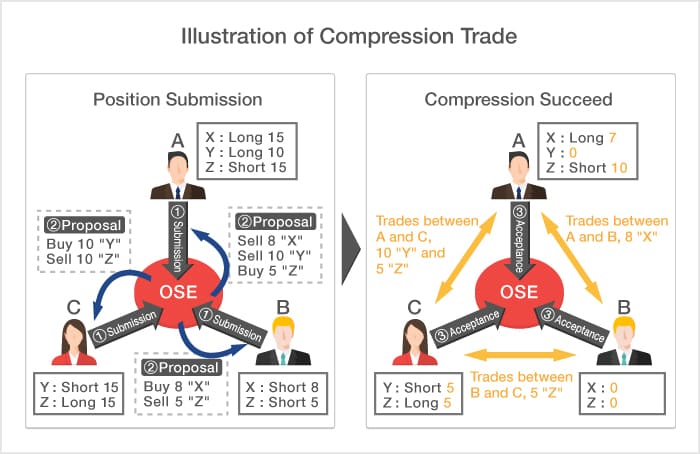

Compression participants A, B, and C will submit positions that they wish to compress along with their risk tolerances to OSE. OSE will then create a trade proposal using an algorithm that will try to reduce the gross position as much as possible. Proposed trades will be executed when all the compression participants accept OSE’s proposal and OSE accepts the proposal acceptance. Compression will complete by unwinding existing positions and opposite positions from Compression Trades.

Outline of Compression Trade Rules

For more details of Compression Trade Rules, please refer to the following page.