Revisions of TOPIX

Background

Since its launch on July 1, 1969, the Tokyo Stock Price Index (TOPIX) has been widely used as a market benchmark with functionality as an investable index, covering a wide range of stocks listed on the Japanese market.

TOPIX is being used in a variety of ways: in line with the recent boom in passive investment, assets under management of passively managed assets such as ETFs and pension trusts linked to TOPIX is about JPY 110 trillion (as of end of March 2024), with TOPIX Futures being traded at Osaka Exchange (OSE) and Chicago Mercantile Exchange (CME).

Using the opportunity provided by the market restructuring, these series of revisions of TOPIX aim to ensuring continuity and further enhance its functionality as an investable index as well as how accurately it represents the market.

Outline

TOPIX is widely used both in Japan and overseas as a market average benchmark for the overall Japanese market.

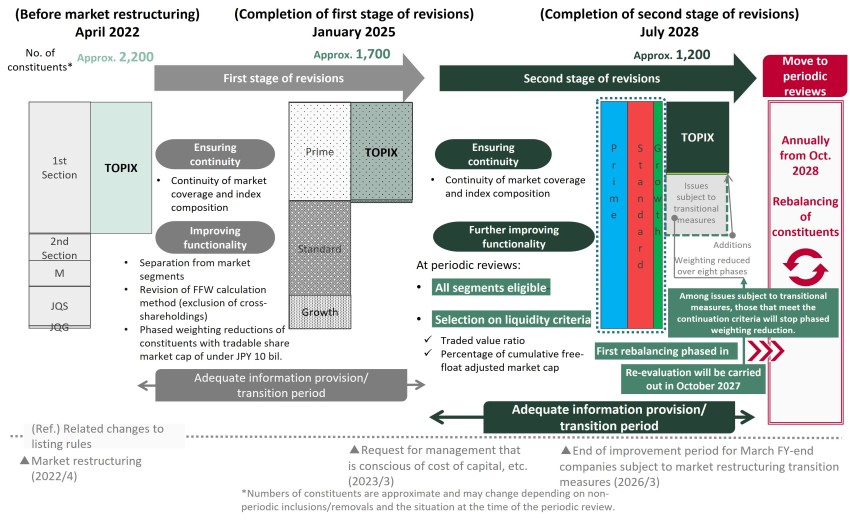

The revisions currently in progress, using the opportunity provided by TSE's market restructuring in April 2022 to enhance TOPIX's functionality as an investable index (the first stage of revisions), are set to be completed in January 2025.

Following this, a second stage of revisions will commence to further enhance TOPIX‘s broad coverage and its functionality as an investable index. While ensuring the index’s continuity, the second stage of revisions will take into account the large amount of assets that are linked to TOPIX and its wide usage. Periodic reviews of issues in all market segments (Prime Market, Standard Market, and Growth Market) will be conducted with a greater emphasis on liquidity.

As in the first stage of revisions, the transition will be conducted in phases and sufficient time will be ensured for public awareness and transitioning in order to smoothly transition to the next-generation TOPIX and mitigate the impact on the market.