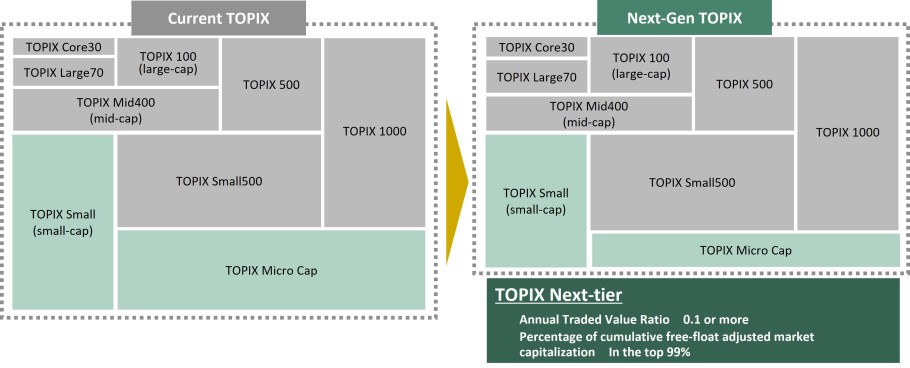

Revisions of TOPIX

Launch of "TOPIX Next-tier"

Coinciding with the first TOPIX periodic review (October 2026), JPXI will launch a new "TOPIX Next-tier“ composed of issues not selected for TOPIX (including those subject to transitional measures) which have a certain level of liquidity.

Please see the link below for calculation method.

Revision of Tokyo Stock Exchange Growth Market 250 Index

The revision will allow Tokyo Stock Exchange Growth Market 250 Index constituents to overlap with TOPIX constituents.

Please see the link below for calculation method after revisions.