Listing Eligibility

Operations of the Listing Examination Department

A large number of unspecified investors will look to invest in companies once their stocks have been listed on the financial instruments exchange. As such, there must be systems in place to ensure that investors can have confidence in these newly listed companies. The Listing Examination Department of Japan Exchange Regulation (JPX-R) examines the eligibility of listing applicants based on certain quality standards (listing examination criteria) aiming to ensure confidence from investors.

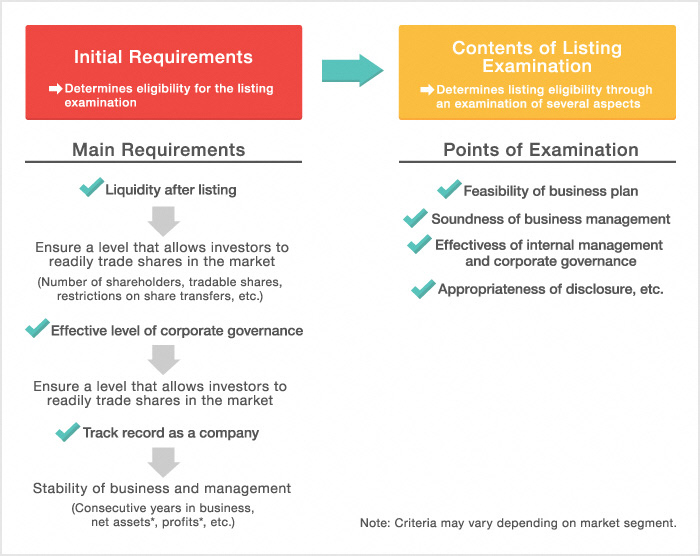

There are two types of listing examination criteria: initial requirements, and the contents of the listing examination.

In addition to new listings on the Prime, Standard, and Growth Markets, JPX-R conducts segment transfer examinations on stocks, etc. It also conducts listing examinations on other financial instruments, including REITs and ETFs.

For more information on the listing examination criteria for each market segment, please refer to the following pages.

Listing Examination Process

For more information on the listing examination process and the roles of related parties, including securities companies, please refer to the following pages.

For details of the listing examination process and more, please refer to the following guidebook.