FTSE JPX Net Zero Japan Index Series

FTSE JPX Net Zero Japan Index Series

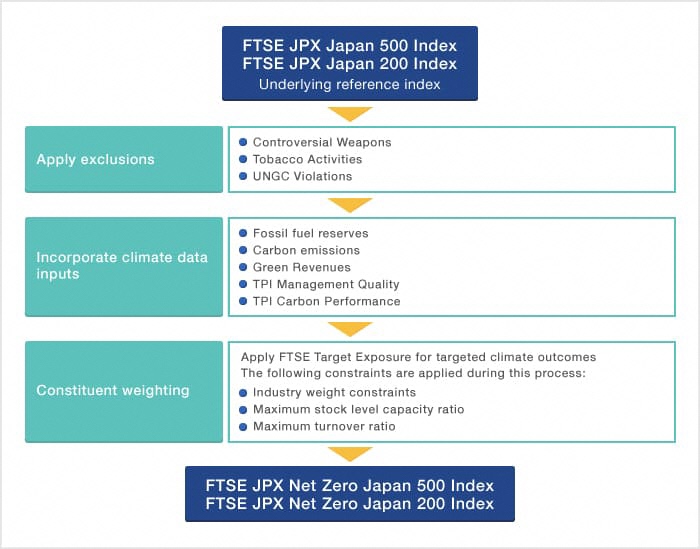

FTSE JPX Net Zero Japan 500 and FTSE JPX Net Zero Japan 200 indexes are jointly manged by LSEG / FTSE Russell and JPX/ JPX Research Institute. These indexes allow investors and other Japanese market participants to integrate and implement climate related risks and opportunities, such as greenhouse gas emissions, companies’ management quality and carbon performance for a climate transition to net zero via the Transition Pathway Initiative (TPI) data.

Why and What is Net Zero?

In response to the rapidly advancing global warming at the global level, the Paris Agreement was adopted at the 21st Conference of the Parties to the United Nations Framework Convention on Climate Change (COP21) in 2015. This aims to significantly reduce global greenhouse gas emissions by pursuing measures to limit global temperature rises to plus 2 degrees Celsius above pre-industrial levels this century, while limiting them to an additional 1.5 degrees Celsius. In October 2020, Japan declared that it would follow the world and aim to reduce greenhouse gas emissions by 46% by 2030 (compared to 2013) and achieve carbon neutrality by 2050. There are huge investment demand for climate transition. This index series provides investors with a passive benchmark to Net Zero by monitoring climate transition pathway with quantitative targets.

Five climate assessments within the index

| 1. Fossil Fuel Reserves | The estimated CO2 equivalent greenhouse gas (GHG) emissions through the use and combustion of the recoverable coal, oil and gas reserves |

| 2. Operational carbon emission | CO2 equivalent GHG emissions |

| 3. Green Revenue | Percentage of Green Revenues as defined by the FTSE Green Revenues Classification System aligned with EU Taxonomy for Sustainable Activities |

| 4. TPI Management Quality | The quality of companies’ management of their greenhouse gas emissions and of risks and opportunities related to the low-carbon transition |

| 5. TPI Carbon Performance | How companies’ carbon performance now and in the future might compare to the international targets and national pledges made as part of the Paris Agreement |

The Transition Pathway Initiative (TPI) is a global initiative led by asset owners and supported by asset managers. It assesses companies’ preparedness for the transition to a low-carbon economy, supporting efforts to address climate change.

Climate-related factor goals

Target parameters aligned with the European Union’s Climate Transition Benchmark (CTB) with FTSE Russell’s Target Exposure methodology. An 'EU Climate Transition Benchmark' means a benchmark that is labelled as aligned with the EU’s CTB, where the underlying assets are selected, weighted or excluded in such a manner that the resulting benchmark portfolio is on a decarbonization trajectory and is also constructed in accordance with the minimum standards laid down in the delegated acts.

| Index Parameters | FTSE JPX Net Zero Japan 500 | FTSE JPX Net Zero Japan 200 |

| Universe | TOPIX 500 Constituents | Top 200 TOPIX 500 constituents by market capitalization |

| Baseline Emission/ Fossil Fuel Reserves Intensity Ruduction | >=30% relative to benchmark at each review | >=30% relative to benchmark at each review |

| Operational Emission Intensity Reduction Trajectory | >=7% annually on average | >=7% annually on average |

| Green Revenue Ratio Uplift | >=70% relative to benchmark | >=100% relative to benchmark |

| TPI Management Quality | >=0.3σ* relative to benchmark | >=0.5σ* relative to benchmark |

| TPI Carbon Performance | Overweight / Underweight depending on the score | Overweight / Underweight depending on the score |

- σ is the market capitalization weighted standard deviation of the score in the underlying universe.

Constituent Selection and Weighting

For more information, please visit the FTSE Russell website.

©FTSE International Limited (“FTSE”) JPX Market Innovation & Research, Inc. (“JPXI”) 2022.

FTSE® is a trade mark of London Stock Exchange Group Plc and its group undertakings and is used by FTSE under licence. JPX© is a trade mark of Japan Exchange Group, Inc (“JPX”). All rights in and to the FTSE JPX Net Zero Japan Index Series (“Index”) vest in FTSE and JPXI. Every effort is made to ensure that all information given in this publication is accurate, but FTSE, JPX and JPXI or of their licensors assume no responsibility or liability for any errors or loss from use of this publication. FTSE, JPX and JPXI, or any of their licensors makes no claim, prediction, warranty or representation whatsoever, expressly or impliedly, as to the results to be obtained from the use of the Index or the fitness or suitability of the Index for any particular purpose to which it might be put. No part of this publication may be copied, reproduced, made available to third parties or public, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of FTSE. Use or distribution of any FTSE index values (including those of the Index) in any manner and/or FTSE mark requires a licence with FTSE and/or its licensors.