JPX Prime 150 Index

Purpose of JPX Prime 150 Index Development

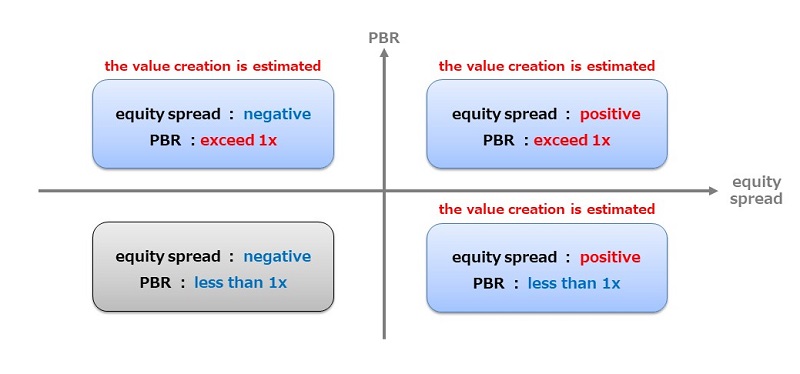

Recently, there has been increasing attention paid to the status of value creation by Japanese companies. For example, only about half of the listed companies in TSE Prime Market have a PBR (price book value ratio) exceeding 1x, which represents expectations of future value creation. Therefore, listed companies are required to be conscious of the cost of equity capital and the stock price as they manage their company.

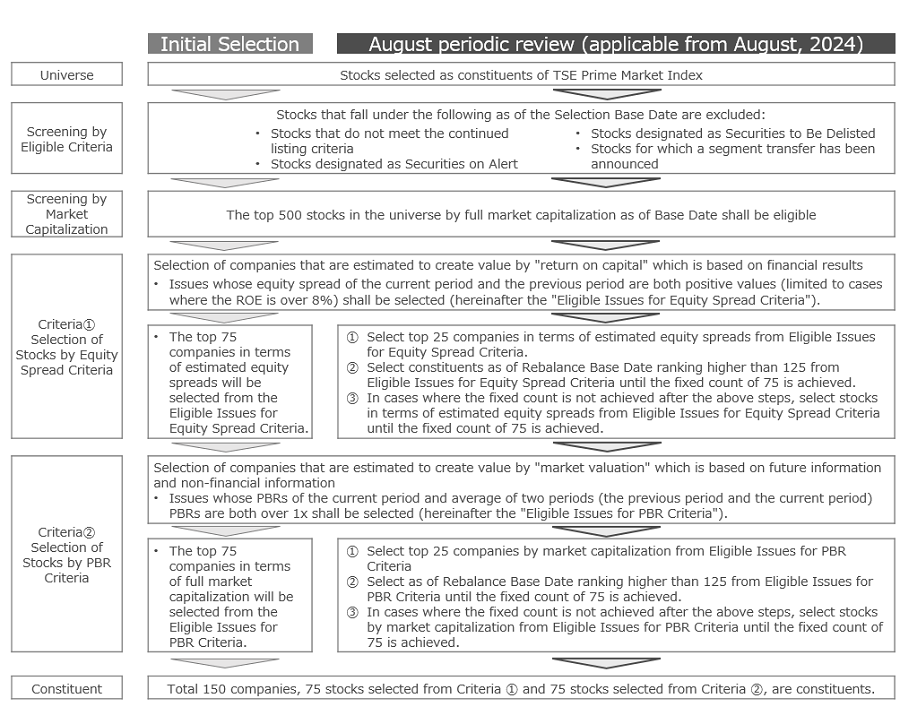

In light of these circumstances, we have developed a new stock price index which will be composed of stocks selected to represent "Japanese companies that are estimated to create value" from among the top-ranked stocks listed on TSE Prime Market by market capitalization based on two measures of value creation: 1) "return on capital" which is based on financial results, and 2) "market valuation" which is based on future information and non-financial information.

In addition, "return on capital" above refers to the equity spread1, which is the difference between ROE (return on equity) and cost of equity, as an indicator, whereas "market valuation" above refers to the PBR2, which is the stock price divided by BPS (Book Value per Share), as an indicator.

The JPX Prime 150 Index is designed to make visible the leading Japanese companies that are estimated to create value, and to make the index and its constituent stocks the target of medium- to long-term investment by institutional and individual investors in Japan and abroad, thereby contributing to the penetration of value-creating management and the enhancement of the appeal of the Japanese stock market.

- When ROE exceeds the cost of equity, which is the return expected by investors, the equity spread becomes positive and the value creation is estimated.

- When the stock price exceeds the BPS, the PBR exceeds 1x, and the value creation is estimated.

Outline of the JPX Prime 150 Index

| Name | JPX Prime 150 Index |

| Concept | Index composed of leading Japanese companies that are estimated to create value |

| Number of Constituent Stocks | 150 |

| Calculation Method | Free-float adjusted market capitalization-weighted |

| Base Date/Base Value | May 26, 2023/1,000pts |

| Calculation/Distribution of Index Values | To be calculated and distributed in real time (every second) starting July 3, 2023 |

| Total Return Index | Available |

| Dissemination of Index Data | Index data is provided via Index Data Service (paid service). |

Stock Selection Method

JPX Prime 150 Index Chart

Constituents List with Weight

Other Referential Data

Calculation Method

Use of Index

A license agreement with JPXI is required when using the index for structuring or offering financial products or providing them to third parties.

Please contact Client Services Dept. JPXI about a license agreement.

Inquiries

Index Business Dept. JPX Market Innovation & Research, Inc.(For the outline of this index)

E-mail:index@jpx.co.jp

Client Services Dept. JPX Market Innovation & Research, Inc.(For the license of this index)

E-mail:index-license@jpx.co.jp

News

Status of JPX Prime 150 Index components in light of Action Program 2024

Purpose of this list

This list is based on the following measures announced in the “Action Program for Accelerating Corporate Governance Reform: From Form to Substance” (hereafter, “Action Program”)1 published on April 26, 2023 and the “Action Program for Corporate Governance Reform 2024: Principles into Practice” (hereafter, “Action Program 2024”)2 published on June 7, 2024 by “The Council of Experts Concerning the Follow-up of Japan's Stewardship Code and Japan's Corporate Governance Code”, which is jointly administered by the Financial Services Agency and the Tokyo Stock Exchange, Inc.

- Action Program

Promote dialogues between companies and investors by "visualizing" companies that willingly and actively respond to the expectations of global investors

(such as the ratio of independent directors, diversity, and disclosure in English).

https://www.fsa.go.jp/en/news/2023/20230426.html - Action Program 2024

A specific list that shows indicators regarding profitability, market valuation, growth, and the status of corporate governance, such as the appointment of independent directors, the attributes of chairs of boards and those of nomination and remuneration committees, and the ratio of female executives, should be published in order to "visualize" the group of companies that willingly and actively respond to the expectations of global investors, which is the initiative presented in the Action Program.

https://www.fsa.go.jp/en/news/2024/20240607-2.html

JPX Market Innovation & Research, Inc. retains all rights related to this document and it may not be copied, reproduced, or reprinted, in whole or in part, in any form, without the permission of JPXI. This material is prepared for the purpose of enhancing understanding of stock price indices and is not intended as a solicitation for securities trading, etc. JPXI shall not be liable for any costs or damages arising from the use of the information contained herein.