Trading resumption through a system reboot

In response to the system failure that occurred within the arrowhead cash equity trading system on October 1, 2020, Tokyo Stock Exchange, Inc. (TSE) established the Council for Recurrence Prevention Measures and the Specialist Working Group (WG) to consider rules and procedures for trading resumptions which happen after a trading suspension resulting from a system failure. Discussion has been proceeding since then.

The Council has confirmed that a system reboot can be considered as an acceptable course of action in cases where it is required to resume trading.

If a failure has occurred after the start of trading and trading is resumed through a reboot, execution completion notices which have been processed normally in the trading system and sent to a trading participant will be treated as valid in principle. (Executions which were processed normally before trading was suspended will be considered valid.) Below are some other points to note related to trading after a resumption.

Please refer to the link below for details of the discussions at the Council and WG.

Handling of entrusted orders

Orders received by TSE from trading participants will be cancelled when the system is rebooted.

In these cases, trading participants will, in principle, need to resend entrusted orders received from customers to TSE. However, not resending orders to TSE will also be accepted if a separate agreement is made between the trading participant and the customer for reasons of the nature of the entrusted orders or operational needs.

Handling of partially executed orders

Resending the unexecuted parts of a partially executed order1 will involve a single order entrusted by a customer being split and sent to TSE in two installments. As such, trading participants need to consider the link between the customer and the orders.2

- Where the unexecuted parts of the order have been cancelled by TSE.

- Since, after the system reboot, information for in-house processing and the order entry sequence number (order acceptance number) will become available once again, a link could be established using these data.

If a trading participant does not resend an order for the unexecuted part of the original order, said trading participant will be required to invalidate the customer order and request the customer to send the order again.

Price continuity and application of regulations

After a reboot, the base price (i.e., the central price on the order book) and application of regulations will be reset to what they were at the start of morning trading. In consideration of system-based restrictions, etc., the handling will be as follows:

- Base price: The last execution price before the trading suspension will not be used, and trading will resume with the base price from that morning.

- Application of short selling restrictions: Some orders for issues that hit the trigger for short selling restrictions on the day may be returned as errors. However, we will resume trading without applying restrictions such as a trading halt. (For details on short selling restrictions after a resumption, refer to the "Limitation of short selling restrictions" section below.)

- Trading halt due to corporate information: For an issue for which there has been a media report regarding material information, etc., a trading halt will be implemented even after the trading resumption. (However, if disclosure is made regarding said media report via TDnet by 15 minutes before the trading resumption, a trading halt will not be implemented.)

Handling of market information after the trading resumption

Opening/high/low/closing prices, trading volumes, and trading values, etc. transmitted by FLEX after the resumption will be only those from after the resumption. Such information for the whole day (consolidated information before and after the resumption) will be published after the closing of the afternoon session.

If this information from before the system failure is different from that distributed via FLEX, details of the difference will be published on the JPX website, etc. However, this will not be a condition for trading resumption.

Limitation of short selling restrictions

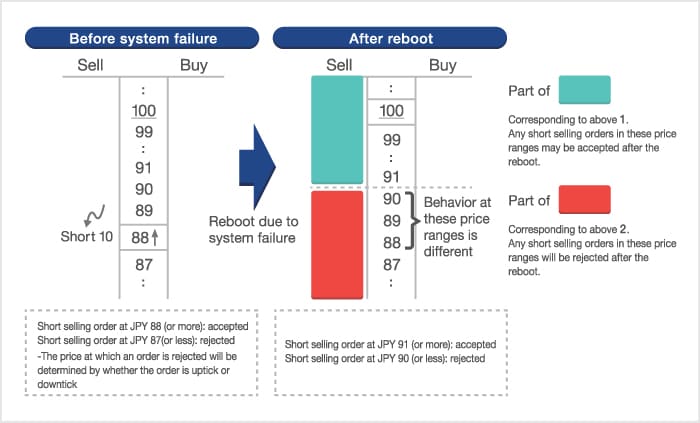

A limitation of the short selling restrictions is that if an issue has hit the trigger for short selling price restrictions during trading before a system failure, a reboot will mean that said issue returns to its pre-trigger status.

Below are points to be noted if an order for such an issue is resent during the order acceptance period after a reboot.

- Short selling in a price range above the trigger price: Short selling orders may be accepted regardless of whether they are uptick or downtick

- Short selling in a price range at or below the trigger price: Short selling orders will be returned as errors regardless of whether they are uptick or downtick

(Specific example) Where there is no continuous price restriction from the previous day, the base price is JPY 100 (trigger price: JPY 90) and the last price before failure is JPY 88 (uptick trend):