Margin

What's Margin?

Profits or losses from futures and options trading are determined by the future prices of the underlying assets.

Adverse fluctuations of such prices may cause significant losses in the future. Margin is deposited to ensure that the payments are made even when such losses are incurred.

Who should make margin deposits?

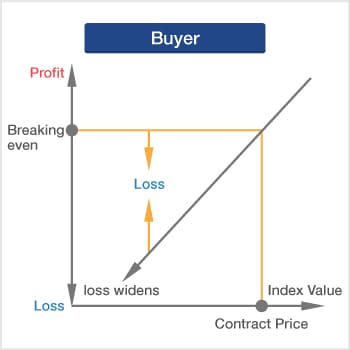

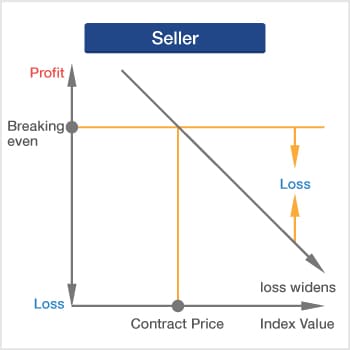

In futures trading

In futures trading, if the market moves against the forecasts of a buyer and seller, significant losses could be incurred. In this case, both the buyer and seller are required to make margin deposits.

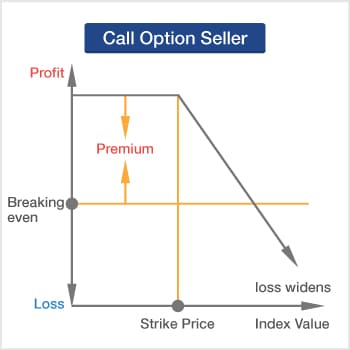

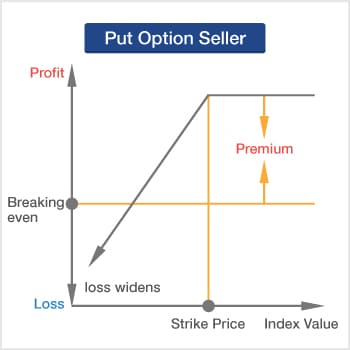

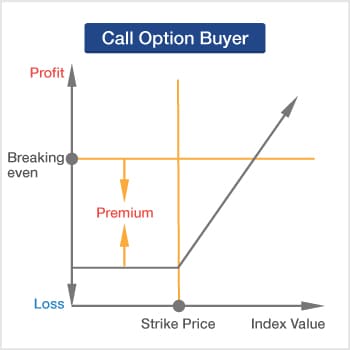

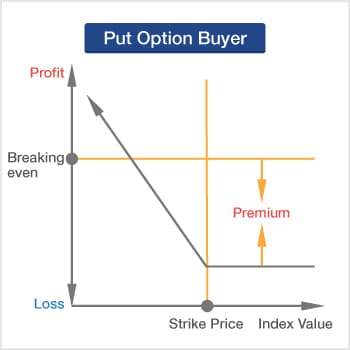

In options trading

If the market moves against the forecasts of an options sellers, significant losses could be incurred. In this case, a margin deposit is required.

However, in cases where the market moves against the forecasts of an options buyer, potential losses would be limited to only the premium. As such, a margin deposit would not be required.

How much is required as margin?

Margin requirements for futures and options are calculated based on VaR method.

Please refer to the JSCC website for details of VaR method such as parameter files, simulation environment and other related issues.