Insider Trading

Insider Trading

Insider trading is an attempt by someone who has access to unpublished corporate information that could significantly affect investment decisions through his or her duties or position, such as a company insider, to gain profit for themselves by buying or selling a company's shares or other related issues using said information. Since ordinary investors who are not informed of such information are then trading at a disadvantage, and the credibility of the securities market may be damaged, such trading is prohibited under the Financial Instruments and Exchange Act, and violators are subject to criminal prosecution or recommendation for an administrative monetary penalty payment order by the Securities and Exchange Surveillance Commission.

Monitoring of Insider Trading

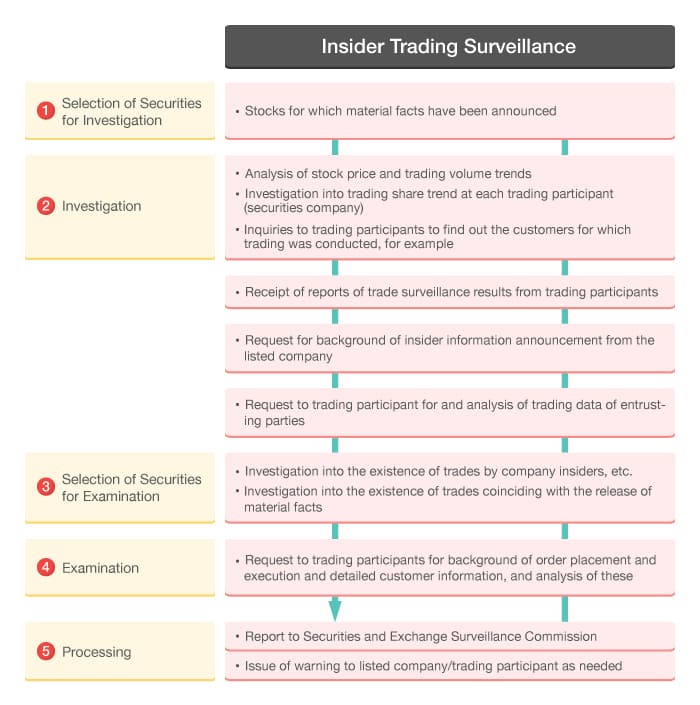

In order to check for insider trading on the cash market (Tokyo Stock Exchange) and derivatives market (Osaka Exchange), Japan Exchange Regulation (JPX-R) conducts daily analysis of all issues for which corporate information (material facts) that could significantly affect investment decisions, such as information on stock issuances, bankruptcies, mergers, and financial results, has been disclosed. All transactions suspected of being insider trading are reported to the Securities and Exchange Surveillance Commission.

This approach is referred to as "market surveillance." JPX-R selects a wide range of securities for which material facts have been disclosed and then conducts detailed analysis of investor attributes, trading conditions, and other aspects to narrow down transactions that are suspected of being insider trading.

Prevention of Insider Trading

In order to prevent insider trading, listed companies must fully ensure that they:

- Proactively carry out timely disclosure of corporate information that has a significant impact on investment decisions

- Establish an internal system to ensure that unpublished corporate information is not leaked to others or used improperly

- Ensure that officers and employees are fully aware of the significance and content of insider trading regulations

Insider trading by officers or employees undermines confidence in the company's shares in the market and seriously damages the company's image, so companies must have adequate awareness of the importance of the above three points also from a listed company compliance perspective.

Listed companies are requested not only to have sufficient knowledge of laws and regulations in connection with various activities related to the securities market, such as trading of shares by their own officers and employees and acquisition of own shares as a corporate act, but also to ensure a higher level of information management to prevent insider trading, based on recent circumstances.

For more information on recent insider trading cases, please see the below page.

JPX-R has published the results of a survey on the formulation of internal rules and establishment of internal systems for trading of company stock by officers and employees at listed companies. JPX-R is also available for individual consultation on this matter (in Japanese only).

JPX-R holds regular seminars on insider trading regulations and dispatches in-house training instructors upon request (in Japanese only). We also provide a booklet explaining the regulations and educational posters to help prevent insider trading.

Insider Trading FAQs

We have compiled a list of questions received by JPX-R and our answers to each. Please note that these FAQs are a general discussion of the key points regarding insider trading regulations, and that different conclusions may be reached depending on the facts of the actual case. Please also note that even if a transaction is not subject to insider trading regulations, it does not mean that there are no problems from the perspective of other laws and regulations or moral standards.

In addition, the Financial Services Agency and the Securities and Exchange Surveillance Commission have published Q&As on the basic contents of insider trading regulations and guidelines for interpretation of laws and regulations with regards to practical implementation issues.

Q&As on market manipulation can be fonud on the below page.

Reference

Most of the FAQs in the above PDF can be found in English below.

Persons Subject to Insider Trading Regulations

-

Q1.

Trading by officers (employees) of a listed company

I am an officer (employee) of a listed company. What should I be careful about when buying or selling the company's shares? -

A1.

Needless to say, investing in stocks is a legitimate economic activity, and it is of course possible for officers and employees of a listed company to buy and sell the company's shares. In order to ensure that trading in the company's shares is conducted properly and to avoid any suspicion of insider trading, it is useful to keep the following points in mind.

-

Confirm whether you know any unpublished material facts.

(If so, conduct the transaction after the material fact has been made public.) - If it is difficult to determine whether the information you know is an unpublished material fact, check with, for example, the department that manages the trading of your company's shares.

- If there are internal rules regarding the trading of the company's shares, be sure to follow the internal rules and, if necessary, take the prescribed procedures before trading.

-

Confirm whether you know any unpublished material facts.

-

Q2.

Relatives who are officers (employees) of a listed company

I have a relative who is an officer (employee) of a listed company. Would it be a violation of insider trading regulations if I buy or sell shares of said company? -

A2.

Officers and employees of a listed company are considered to be "company insiders," and therefore, that relative would be considered the same. If a company insider learns of a material fact in the course of their duties, a person who obtains this unpublished material fact from the company insider is a primary recipient of that information. However, if you simply have a relative who is an officer or employee of a listed company and have not received any unpublished material facts from that relative, it is not a violation of insider trading regulations because the requirements to constitute insider trading are not met.

-

Q3.

Trading after resignation as an officer of a listed company

I was an officer of a listed company until four months ago, and now I would like to sell the shares of said company that I have held since my resignation due to a financial need. Is it correct to think that this would not violate insider trading regulations since I have retired from my position? -

A3.

Persons who used to be company insiders are subject to insider trading regulations in the same manner for a year after they cease to be so. Therefore, if material facts that you became aware of while in office have not yet been made public at the time of the transaction, this may constitute a violation of the insider trading regulations. Even if you learn of an unpublished material fact after leaving your position, you may be in violation of the insider trading regulations as a recipient of information if you are informed of this fact by a company insider. Please note that in all cases, the motive for buying or selling, such as "financial need," has nothing to do with whether a trade constitutes insider trading.

-

Q4.

Meaning of "officer"

In relation to the insider trading regulations, there is an obligation for "officers" to submit trading reports (Article 163 of the Financial Instruments and Exchange Act) and a rule that companies can request "officers" to return short-term trading profits (Article 164). Who counts as an "officer"? -

A4.

In Article 21, Paragraph 1, Item 1 of the Financial Instruments and Exchange Act, the definition of "officer" reads: "a director, accounting advisor, company auditor, executive officer, or a person equivalent thereto; the same applies hereinafter, except in Articles 163 to 167." This means the definition of "officer" in the insider trading regulations is left to interpretation.

However, the definition of "officer" under the insider trading regulations is generally considered to be the same as the definition in Article 21, meaning executive officers and advisors (sōdanyaku and komon) are not included in the definition of "officer." Regardless, executive officers and advisors are also considered to be subject to the insider trading regulations under "other employees."

-

Q5.

Scope of "subsidiary"

I heard that under the insider trading regulations, officers and employees of subsidiaries of a listed company are considered "company insiders" and that certain matters relating to subsidiaries of the listed company are considered material facts of the listed company. What counts as a "subsidiary"? -

A5.

A subsidiary is a company that is listed in the most recent annual securities report or similar as belonging to the corporate group that belongs to the listed company. (Reference: on December 25, 2008, the Financial Services Agency, in its response to an inquiry under the written inquiry procedures for general legal interpretation, provided an example of its thinking on the status of a "subsidiary" as defined in Article 166, Paragraph 5 of the Financial Instruments and Exchange Act.)

Relevant page on the FSA website (Japanese only)

-

Q6.

Receipt of information through overhearing or at a social event

I am an employee of a listed company. Would it be a violation of insider trading regulations if I buy or sell the company's shares or other related products after I accidentally overhear unpublished material facts inside the company or at an after-hours social event? -

A6.

Facts that are accidentally overheard within the company could, depending on the circumstances, be considered learnt "in the course of duties" and therefore be considered insider trading by a company insider. As for information learned at social events, you may be subject to regulations as a recipient of information.

Transactions Subject to Insider Trading Regulations

-

Q1.

In the case of a small profit or a loss

If I bought shares of a listed company after learning an unpublished material fact about the company and sold them after the company announced the fact, is it still a violation of insider trading regulations if I only made a small profit of a few tens of thousands of yen, or if I incurred a loss? -

A1.

Whether a trade is insider trading has nothing to do with the amount of profit or loss incurred. If a company insider or other related person learns of an unpublished material fact of a listed company in the course of his/her duties, and buys or sells shares of the listed company before the fact is made public, this is a violation of insider trading regulations unless an exemption is applicable. There was an actual case in which a recommendation for an administrative monetary penalty order was issued when the profit was only JPY 40,000.

-

Q2.

In the case of a small trading volume such as 1 share (1 unit)

I have knowledge of an unpublished material fact of a listed company. If I buy or sell only a small amount of shares, such as 100 shares (1 unit), will I be caught in violation of insider trading regulations? -

A2.

Whether a trade is insider trading has nothing to do with the volume traded. Even if it is only one unit, if a company insider or other person learns of an unpublished material fact of a listed company in the course of his/her duties and buys or sells shares of the listed company before the fact is made public, this is a violation of insider trading regulations unless an exemption is applicable. There have been cases where a recommendation for an administrative monetary penalty order was issued where the number of shares purchased was as small as one unit.

-

Q3.

In the case of shares not sold for profit

I purchased shares of a listed company after learning an unpublished material fact about the company, but did not sell the shares after the material fact was announced. Is such a purchase a violation of insider trading regulations? -

A3.

As long as the other requirements are met, it becomes a violation of insider trading regulations at the time of the initial purchase with knowledge of unpublished material facts. Therefore, even if you subsequently sell or continue to hold the shares you purchased, it will not cease to be an insider trading violation.

-

Q4.

Trading other than for the purpose of gaining an unfair advantage

If the purpose of the trade is saving for a child's school fees, repaying a mortgage, holding shares after being appointed an officer of the company, or long-term investment, does it constitute insider trading to buy or sell the shares with knowledge of unpublished material facts? -

A4.

Insider trading is established when a company insider or recipient of information trades with knowledge of an unpublished material fact. The motive for the trade has no bearing on whether insider trading has been committed.

Therefore, please note that even if a company insider or recipient of information trades for the purposes described in the question, this will be considered insider trading. Since insider trading restrictions are lifted when unpublished material facts are made public, please confirm in advance whether or not material facts have been made public before buying or selling.

-

Q5.

Trading around the time of announcement of financial results

Is it prohibited for officers and employees of a listed company to trade in the company's shares immediately before or immediately after the company announces its earnings? -

A5.

Under the law, even if you are a company insider of a listed company such as an officer or employee, there is no rule that prohibits you from trading in the company's shares immediately before or after the company announces its financial results.

However, in order to prevent insider trading, some listed companies have internal rules that prohibit trading in shares of the company immediately before or immediately after the announcement of financial results. Please make sure you fully understand the company's internal rules.

-

Q6.

Officers' (employees') stock ownership associations

I am an officer (employee) of a listed company and have knowledge of an unpublished material fact. Would it be insider trading if I purchase the company's shares monthly through the officers' (employees') stock ownership association, or if I withdraw the shares from the association and sell them? -

A6.

Regular fixed amount purchases (of less than JPY 1 million per officer/employee per contribution) made monthly in accordance with a certain level of plan are exempt from the insider trading regulations. Therefore, such purchases of the company's shares can be made even with knowledge of unpublished material facts and will not be seen as violating insider trading regulations. However, an increase in the amount of contributions or a new subscription to a stock ownership association made with knowledge of unpublished material facts is subject to insider trading regulations.

On the other hand, sales of shares withdrawn from a stock ownership association are not exempt from insider trading regulations. In order to sell the company's shares appropriately and avoid suspicion of insider trading, it would be useful to follow the points mentioned in Q1 of "1. Persons Subject to Insider Trading Regulations."

-

Q7.

Cumulative stock investment plans ("Ruito")

Are purchases by cumulative stock investment plans subject to insider trading regulations? -

A7.

Similar to regular fixed amount purchases through an officers' (employees') stock ownership association in Q6 above, purchases through cumulative stock investment plans are also exempt from insider trading regulations. However, the sale of shares purchased is subject to insider trading regulations.

-

Q8.

Gifts and inheritance

Are transfers or acquisitions of shares of a listed company through a gift, or acquisitions of shares through inheritance, subject to insider trading regulations? -

A8.

The acts subject to insider trading regulations are "buying and selling, etc.," which means buying and selling as well as other paid transfers or acquisitions. Therefore, transfers or acquisitions of shares through a gift, i.e., without payment, are not subject to insider trading regulations. For the same reason, acquisition of shares by inheritance is not subject to insider trading regulations.

-

Q9.

Exercise of stock options

I work for a listed company and have been granted stock options by the company. Would acquisition of shares through exercise of these options be subject to the insider trading regulations? What about if I sell the shares I acquired through the exercise? -

A9.

The acquisition of shares through exercise of stock acquisition rights granted as stock options is exempt from the insider trading regulations and is possible even with knowledge of unpublished material facts.

In contrast, the sale of shares acquired through exercise of stock options is not exempt. Therefore, please note that there are cases where you cannot sell the acquired shares if you know unpublished material facts, even when you exercise your rights, acquire, or sell the shares in view of stock prices.

-

Q10.

Off-market OTC trading and trading through ToSTNeT

Are purchases and sales of a listed company's shares conducted through off-market OTC trading or ToSTNeT subject to insider trading regulations? -

A10.

Purchases and sales of listed companies' shares conducted through OTC trading or ToSTNeT can both be subject to the insider trading regulations. However, there may be cases in which off-market transactions are exempted from the regulations if both parties involved in the transaction have knowledge of the same unpublished material fact.

Securities Subject to Insider Trading Regulations

-

Q1.

Fractional shares

I hold shares of a listed company of under one unit. Is the sale or purchase of such fractional shares subject to insider trading regulations? -

A1.

Since there is no provision exempting the purchase and sale of fractional shares from insider trading regulations, they are considered to be subject in the same manner as shares constituting one unit or above. In contrast, if a listed company purchases fractional shares in response to a request for such a purchase (Article 192 and Article 193 of the Companies Act) or sells fractional shares in response to a request for such a sale (Article 194 of the Companies Act), these trades are exempted from the regulations.

-

Q2.

ETFs and equity investment trusts

Are the purchase and sale of ETFs and equity investment trusts subject to insider trading regulations? -

A2.

In principle, ETFs and equity investment trusts are not "specified securities, etc." subject to insider trading regulations. However, even ETFs and stock investment trusts may be subject to insider trading regulations as "specified securities, etc." if, for example, they are beneficiary certificates of an investment trust that stipulates in its trust agreement that the trust assets are to be invested only in specified securities of a specific listed company, or investment securities issued by an investment corporation that stipulates the same in its articles of incorporation.

-

Q3.

Shares issued by unlisted companies

Are shares issued by unlisted companies and "Phoenix Issues" subject to insider trading regulations? -

A3.

Since the insider trading regulations are limited to securities issued by listed companies, shares issued by unlisted companies are not, in principle, subject to the insider trading regulations. However, shares traded under the Phoenix Issues rules, which allow investors of stocks that have been delisted from an exchange to exit their positions, are subject to insider trading regulations despite being technically unlisted. The Phoenix Issues rules can be found on the below page.

JSDA Rules

-

Q4.

Meaning of "Subsidiary Linked Shares" and "Linked Subsidiary Companies"

When I was researching the criteria for specifying minor facts concerning decisions by subsidiaries, I came across the terms "Subsidiary Linked Shares" and "Linked Subsidiary Companies" (Article 52, Paragraph 2 of the Cabinet Office Ordinance on Restrictions on Securities Transactions, etc.). What are these? -

A4.

Simply put, when a listed company issues two types of shares, A and B, and the company's own profits are used as the source of the dividend of surplus for A shares (ordinary listed shares), but the dividend of surplus for B shares is determined based on the profits of a particular subsidiary, B shares are called "Subsidiary Linked Shares" (so-called tracking stock) and the subsidiary is called the "Linked Subsidiary Company."

The definitions of "Linked Subsidiary Companies" and "Subsidiary Linked Shares" are stipulated in Article 49 (xi) and Article 52 (1) (xii) of the Cabinet Office Ordinance on Restrictions on Securities Transactions, etc., respectively, and the specific details are stipulated in Article 29 (viii) of the Order for Enforcement of the Financial Instruments and Exchange Act.

Currently, there are no Subsidiary Linked Shares issued by listed companies.

Material Facts

-

Q1.

Quarterly financial results

In the quarterly financial results, there was a significant difference in net sales compared to the forecast announced in the financial report. Is this a material fact regarding financial results under insider trading regulations (Article 166, Paragraph 2 (iii) of the Financial Instruments and Exchange Act)? -

A1.

Although a material fact with regards to financial results information is thought to arise when there is a difference in in the annual forecasts or results in comparison to the last forecast for net sales, current profits, or net income, attention should also be paid to the quarterly financial results.

For example, if it is possible to read from the contents of the quarterly financial results that the forecast of sales for the full fiscal year will be revised, this could be considered as having effectively learned the revision of the forecast of sales for the full fiscal year and therefore financial results under the regulation, even if the actual figures are only for the quarterly sales forecast.

In addition, a revision of a quarterly sales forecast in itself may have an impact on the stock price, so these cases are not necessarily exempted from the basket clause.

-

Q2.

Granting stock options

We are considering granting stock options to our officers and employees. Is the decision to grant stock options a material fact under insider trading regulations? -

A2.

When stock acquisition rights are granted as stock options to officers or employees, it is common to set the subscription price at JPY 0 or at a significantly low price. In this case, if the total amount to be paid in for the offering is less than JPY 100 million, it does not constitute a material fact.

-

Q3.

Changes in representative directors, representative executive officers, and directors

Is a decision to change a representative director or representative executive officer or a director of a listed company a material fact under insider trading regulations? -

A3.

Decisions to change representative directors or representative executive officers are generally not considered to be material facts under insider trading regulations, even though they are matters for timely disclosure (Rule 402, Item (1)-aa of the Securities Listing Regulations). Decisions to change directors or executive officers without representative authority are also generally not considered to fall under material facts.

However, if, for example, the representative director is the founder of the company who has a strong influence, the resignation of the representative director may affect the stock price, and thus may fall under the basket clause as having a significant impact on investment decisions.

-

Q4.

Creation, modification or abolition of shareholder benefits

Are decisions by a listed company to create, amend, or abolish shareholder benefits material facts under insider trading regulations? -

A4.

Although it could be questioned as to whether a decision to create or change a shareholder benefit is a decision on dividends of surplus, which is a material fact, generally a decision to create, change, or abolish a shareholder benefit will not constitute dividends of surplus. However, if, for example, most shareholders hold their shares in anticipation of shareholder benefits, the decision to abolish such benefits may fall under the basket clause.

-

Q5.

Criteria for determining minor facts related to decisions by listed companies (non-consolidated or consolidated figures)

In relation to determining minor facts. for example, in the case of a decision by a listed company to carry out a share exchange, "in cases where the book value of the total assets of a company ... which is to become a Wholly Owned Subsidiary Company in Share Exchange ... as of the last day of the most recent business year is less than the amount equivalent to 30 percent of the Amount of Net Assets of said company as of the last day of the most recent business year, and the net sales of said company which is to become a Wholly Owned Subsidiary Company in Share Exchange as of the last day of the most recent business year are less than the amount equivalent to ten percent of the net sales of said company, a share exchange to be conducted with said company" would fall under the criteria for a minor fact and would not be considered a material fact (Article 166, Paragraph 2, Item 1 (h) of the Financial Instruments and Exchange Act and Article 49, (v) (a) of the Cabinet Office Ordinance on Restrictions on Securities Transactions, etc.). Do "amount of net assets" and "net sales" here mean consolidated or non-consolidated figures? -

A5.

They mean non-consolidated figures.

For criteria for minor facts related to decisions by subsidiaries, the law states that they refer to consolidated figures, for example "the amount of increase in the assets of the Corporate Group to which the relevant Listed Company, etc. belongs" (Article 52, Item (1)(i)(a) of the Cabinet Office Ordinance on Restrictions on Trading of Securities, etc.). In the case of the example in your question, there is no limitation such as "of the corporate group" like the one stated above, so this can be judged to be on a non-consolidated basis.

However, if the listed company is a "specified listed company, etc.," financial figures such as for assets and sales should refer to consolidated figures.

For a list of material facts and laws and regulations related to insider trading regulations, please see the below page.

Publication

-

Q1.

Trading immediately after publication of a material fact

Is it a violation of insider trading regulations if a listed company itself acquires its own shares or a person related to the company trades immediately after the company announces a material fact? -

A1.

After a material fact has been publicly announced, trading shares of said listed company does not violate the insider trading regulations. However, immediately after the public announcement, from a practical standpoint, there is an information gap between those involved in the company who knew about the material fact from beforehand and general investors, and therefore, there is a risk that equality with general investors will be significantly impaired if those involved in the company, especially directors, actively trade the company's shares.

For this reason, TSE has notified listed companies that it would like them to fully understand and give due consideration to the original purpose of the Company Announcements Service, which is to communicate corporate information to a wide range of investors in a fair and timely manner, when company insiders trade in the listed company's shares immediately after the announcement of material facts. (January 16, 2004 (Information Services No. 19), "Request for Enhancement of Proactive IR Activities in Accordance with Amendment to Article 30 of the Order for Enforcement of the Securities and Exchange Act").

Request for Enhancement of Proactive IR Activities in Accordance with Amendment to Article 30 of the Order for Enforcement of the Securities and Exchange Act (Japanese only)

-

Q2.

Scoop and speculation articles

If information regarding a material fact of a listed company becomes known to the public through a scoop article or speculation article, is it considered to have been made public in relation to the insider trading regulations? Also, would it be a violation of the insider trading regulations if one learns of the material fact through these articles and trades shares of the listed company? -

A2.

"Publication" of a material fact by listed companies must legally be done by a method prescribed by law, so even if a scoop or speculation article by a newspaper or other media is published and information that constitutes a material fact becomes known to the public, this does not constitute "publication" under the law, and the restrictions on company insiders or other related persons will not be lifted.

Ordinary readers who are not company insiders or other related persons will not be subject to the regulation, but company insiders and related persons will be restricted from trading in the listed company's stock until the listed company makes a public announcement.

-

Q3.

Large shareholding reports

A large shareholding report has been submitted which indicates that a change in a major shareholder (which constitutes a material fact) has occurred or that a controlling stake has been bought (a fact about a tender offer, etc.). If these become known to the public as a result of the submission of a large shareholding report, can we consider the fact to have been made public? -

A3.

Although "publication" is required through a method prescribed by law, by the listed company for a change in major shareholders and by the person buying the controlling stake in the case of a tender offer, the submission of a large shareholding report is not included in the methods of publication prescribed by law.

Please confirm, for the former, whether the information is posted on its Company Announcements Service, and for the latter, whether a public announcement has been made through a method prescribed by law, such as a public notice of tender offer.

Penalties

-

Q1.

Penalties for insider trading

What are the penalties for violating insider trading regulations? -

A1.

The penalty is imprisonment for up to 5 years or a fine of up to JPY 5 million, or a combination of both. In addition, if a representative, agent, or employee of a corporation violates the insider trading regulations using the corporation's funds, the corporation is subject to a fine of up to JPY 500 million.

Property obtained through violation of insider trading regulations shall, as a general rule, be confiscated or funds of the same worth collected. For example, if a company earns JPY 3 million by selling shares purchased for JPY 2 million through insider trading, JPY 3 million will be subject to confiscation or collection.

Furthermore, although not a criminal penalty, as an administrative measure to ensure the effectiveness of the regulations, the Financial Services Agency will issue an administrative monetary penalty payment order to anyone who violates the insider trading regulations by buying or selling securities on his or her own account. The amount of the penalty is calculated based on the amount of economic profit gained from the violation, using a specified method, and is to be paid to the national treasury.

-

Q2.

Statute of limitations for insider trading regulations

To when does the statute of limitations run for violations of insider trading regulations? -

A2.

The statute of limitations for prosecution is five years from the date of the trade (purchase or sale). The same applies to the period allowed for the decision to initiate trial proceedings prior to the administrative monetary penalty payment order.

-

Q3.

Relationship between administrative monetary penalties and criminal penalties

Can a single violation of insider trading regulations be subject to both administrative monetary penalties and criminal penalties? -

A3.

Under the law, a single violation can be subject to both an administrative monetary penalty and a criminal penalty. However, if the criminal penalty is confiscation of property obtained through insider trading or collection of equivalent funds, adjustments will be made such as the amount equivalent to the value of such property being deducted from the amount of the administrative monetary penalty (Article 185-7, Paragraph 15 and Article 185-8, Paragraph 1 of the Financial Instruments and Exchange Act).

Internal rules

-

Q1.

Templates and examples of insider trading prevention rules

We have recently decided to revise our insider trading prevention rules. Does the TSE provide a template for insider trading prevention rules that can be used as a reference? -

A1.

COMLEC does not provide a template for insider trading prevention rules, but has published a "Casebook of Insider Trading Prevention Rules" that introduces the contents of internal rules of listed companies. This can be found on the below page (in Japanese only).

Public Documents

-

Q2.

Internal rules that prohibit trading of the company's stock at certain times

Our company is a listed company. Should we have an internal rule that prohibits officers and employees from trading the company's stock or other securities immediately before or after the end of the fiscal year or the announcement of financial results? -

A2.

More than 50% of listed companies have internal rules that prohibit their officers and employees from trading shares of the company during specific periods or contain measures to avoid this happening. Among these, the majority of listed companies focus on the end of the fiscal year as a "specific period."

These restrictions on trading by officers and employees at specific times are not required by law, but are based on the internal rules of each listed company from the perspective of preventing insider trading. However, by establishing such regulations, officers' and employees' freedom to form assets is also restricted to a certain extent. Therefore, listed companies are requested to determine whether or not to establish such internal rules depending on whether the effectiveness of prevention can be ensured while avoiding overly strict restrictions.

-

Q3.

Whether or not family members should be subject to internal rules

Our company is a listed company. Should the trading of company stock by family members of officers (employees) be subject to the same internal rules as officers (employees), such as prior notification? -

A3.

It is not always necessary for a listed company to uniformly manage the trading of family members of officers (employees) through internal rules. Looking at the current rules at listed companies, some companies have made the trading of company shares by family members subject to internal rules, but we would like each company to make its own decision based on its own circumstances.

To prevent insider trading by family members of officers (employees), apart from making them subject to internal rules, it is also useful to ensure information management so that unpublished material facts are not communicated to family members and to register with J-IRISS (see Q6 below).

-

Q4.

Violation of internal rules

Our company is a listed company, and we have an internal rule that prohibits us from trading in the company's stock immediately before or after the end of the fiscal year. Would such trading be a violation of insider trading regulations? -

A4.

The company's internal rules are established from the viewpoint of preventing insider trading, but under the law, there is no rule that prohibits trading of a company's shares immediately before or immediately after the end of the fiscal year. Therefore, trading in the company's stock immediately before or immediately after the fiscal year end does not immediately constitute a violation of insider trading regulations, so even if you trade during this period, if you do not know any unpublished material facts about your company, you will not be in violation of insider trading regulations.

Please note, however, that even if there is no violation of laws and regulations, violations of company rules may generally be subject to disciplinary action as a violation of employment regulations.

-

Q5.

Reporting obligations for officers of subsidiaries

There is an obligation for "officers" to submit trading reports on "specified securities" (Article 163 of the Financial Instruments and Exchange Act) and a rule that companies can require "officers" to return short-term trading profits (Article 164). Are officers of subsidiaries also included in this? -

A5.

It is the officers and major shareholders* of the relevant listed company who are obliged to submit trading reports and are subject to the claim for return of short-term trading profits, and not the officers of its subsidiaries. However, those who concurrently serve as an officer of the listed company are required to file a trading report as an officer of the listed company.

*A "major shareholder" is a shareholder who holds 10% or more of the voting rights of all shareholders under their own name or in the name of another person (Article 163, Paragraph 1 of the Financial Instruments and Exchange Act).

-

Q6.

J-IRISS

What is J-IRISS? -

A6.

J-IRISS (Japan-Insider Registration & Identification Support System) is a system operated by the Japan Securities Dealers Association to prevent unintentional insider trading by officers and employees of listed companies and their cohabitants.

For details of J-IRISS, please refer to the "Other Activities" page or the website of the Japan Securities Dealers Association.

Other Activities

Japan Securities Dealers Association (Japanese only)

Unless otherwise noted, the contents of the above Q&As are based on the regulations on insider trading by company insiders and other related persons (Article 166 of the Financial Instruments and Exchange Act). Please note that separate consideration may be required when considering insider trading regulations for those making tender offers (Article 167 of the Financial Instruments and Exchange Act).

Please also note that the conclusions in the above Q&As are general discussions, and that different conclusions may be reached if the facts underlying the assumptions differ from those in the above.

Agreements and Plans Made Before Knowledge of Material Fact

On September 16, 2015, the Cabinet Office Ordinance on Restrictions on Securities Transactions, etc. was amended to expand the scope of exemptions from the insider trading regulations pertaining to agreements/plans made before the knowledge of a material fact.

Under the insider trading regulations, trading by company insiders who have knowledge of unpublished material facts is prohibited. However, if the trade meets the conditions for one made before the material fact was known, it is exempt.

For more information, please see the FAQs and links provided below.