Market Restructuring

Background

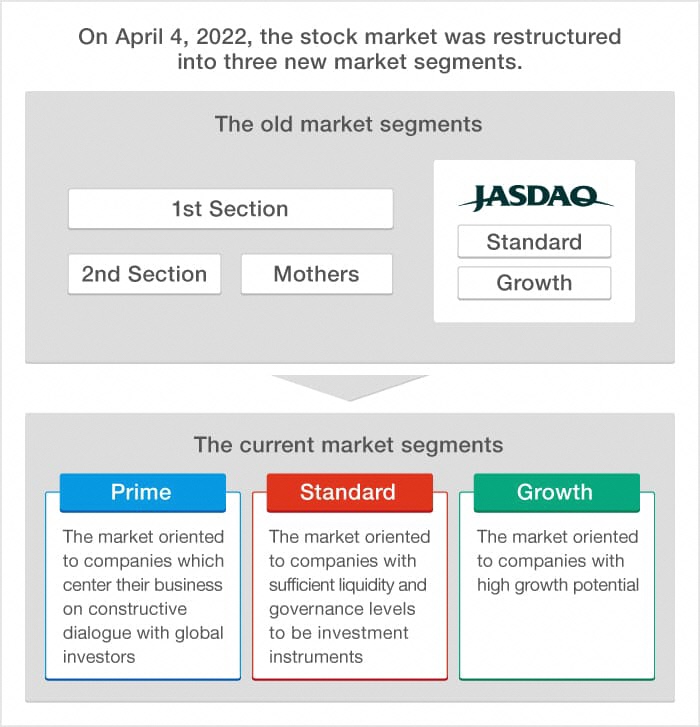

Tokyo Stock Exchange (TSE) had four market divisions: 1st Section, 2nd Section, Mothers, and JASDAQ (Standard and Growth).

The reason for this was that when TSE and Osaka Securities Exchange integrated their cash equity markets in 2013, TSE maintained the existing market divisions of each one in order to avoid impact on listed companies and investors.

However, there were two issues regarding these market divisions as indicated below.

- The concept of each market division was ambiguous, which reduces convenience for many investors:

Specifically, as well as there being overlap between the intended uses of the 2nd Section, Mothers, and JASDAQ markets, the concept of the 1st Section was also unclear. - The market divisions were not providing sufficient incentives for listed companies to sustainably increase corporate value:

For example, since delisting criteria were significantly less strict than initial listing criteria, the delisting criteria do not incentivize listed companies to continue to satisfy after listing the level of quality required at the time of initial listing.

Furthermore, since the criteria for transfers to the 1st Section from other market divisions were lighter than the direct initial listing criteria for the 1st Section, the system was not working to encourage transferee companies to proactively increase corporate value after listing.

Based on these issues, TSE carried out research into a possible market restructuring, and started three market segments, the "Prime Market", "Standard Market", and "Growth Market", on April 4, 2022.

For details of the current market divisions, please see the following page.

For details of the review and research process regarding the market divisions up until now, please see the following page.

The New Market Segments’ dedicated site was closed on July 29, 2022. Some contents have been transferred to the TSE Manebu site.

Concepts and listing criteria of the new market segments

Concepts

The concepts of the new market segments from April 4, 2022 onwards are as indicated below.

| Prime Market | For companies which have appropriate levels of market capitalization (liquidity) to be investment instruments for many institutional investors, keep a higher quality of corporate governance, and commit to sustainable growth and improvement of medium- to long-term corporate value, putting constructive dialogue with investors at the center. |

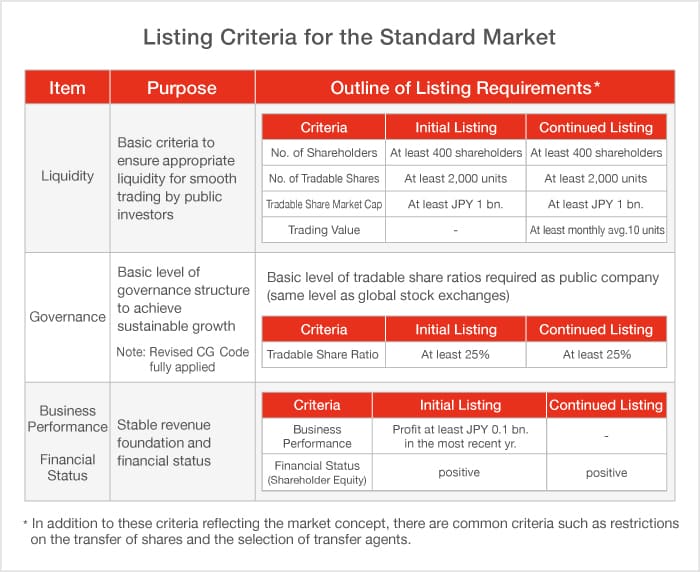

| Standard Market | For companies which have appropriate levels of market capitalization (liquidity) to be investment instruments in the open market, keep the basic level of corporate governance expected of listed companies, and commit to sustainable growth and improvement of medium- to long-term corporate value. |

| Growth Market | For companies which have a certain level of market value by disclosing business plans for realizing high growth potential and their progress towards these appropriately and in a timely manner, but at the same time pose a relatively high investment risk from the perspective of business track record. |

Listing criteria

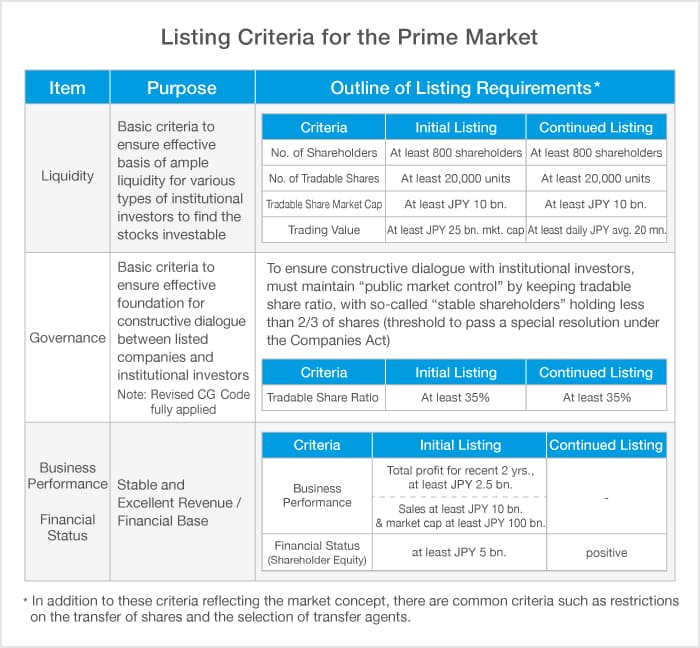

In accordance with the concept of each market segment, quantitative and qualitative listing criteria are established for liquidity (*1), corporate governance (*2), and other elements.

In principle, the initial listing criteria and continued listing criteria for the current market segments are integrated, meaning that listed companies will be required to meet the initial listing criteria for each current markets segment on an ongoing basis after listing.

Each market segment is independent. Thus, if a listed company intends to transfer to another market segment, said company will be subject to examination based on criteria equivalent to the initial listing criteria for that market segment and be required to meet said criteria.

- "Liquidity" is a scale that indicates the number and monetary value of shares traded on the market. It can be said that the higher the liquidity of a share is, the more smoothly investors can trade it.

- "Corporate governance" is the framework which enables companies to make decisions in a transparent, fair, timely, and decisive manner, taking into consideration the standpoints of shareholders and other varied stakeholders.

Revision to Japan's Corporate Governance Code

TSE implements Japan's Corporate Governance Code, which compiles the fundamental principles that contribute to effective corporate governance. TSE has revised the Code to encourage listed companies to enhance governance for their sustainable growth and medium- to long-term corporate value improvement in accordance with the features of each new market segment.

In particular, as the Prime Market is a venue for companies focusing on constructive dialogue with global investors, principles requiring a higher level of governance are applied to Prime-listed companies.

For details of Japan's Corporate Governance Code, please see the following page.

Process of transition to the new market segments

Market segment selection by listed companies

Before the transition to the new market segments in April 2022, each listed company selected the market segment to which it intends to transition, taking into account the concept and listing criteria of each market segment.

The market selection period and the subsequent schedule were as indicated below.

| Dates | Action |

| From Sep. 1 to Dec. 30, 2021 | Listed companies to select a new market segment |

| Jan. 11, 2022 | Results of new market segment selections by listed companies to be published |

| Apr. 4, 2022 | Transition to the new market segments |

As of April 3, the list of Market Segment Selection Results is as below.

Application of transitional measure (relaxed continued listing criteria)

If a listed company does not meet the continued listing criteria for its selected market segment, relaxed continued listing criteria are applied as a transitional measure, as long as the company makes efforts to improve with the submission of a plan to meet the continued listing criteria and reports on its progress towards said plan.