Overview of IPO

Listing on Tokyo Stock Exchange

Initial Listing

This refers to a company's first listing on the TSE market. When an unlisted company lists on the market, it is referred to as an "IPO (Initial Public Offering)."

Additionally, the listing of companies already listed on another exchange is referred to as "New Listing on Tokyo Stock Exchange by Listed Companies on other stock exchanges." They are subject to examination based on the same criteria used for IPOs.

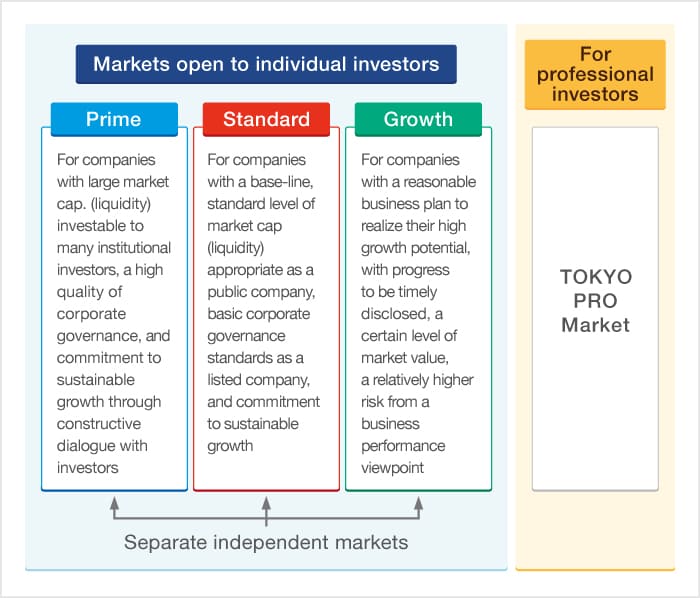

TSE operates four markets: the Prime, Standard, and Growth Markets and the TOKYO PRO Market.

Prime

For companies which have appropriate levels of market capitalization (liquidity) to be investment instruments for many institutional investors, keep a higher quality of corporate governance, and commit to sustainable growth and improvement of medium- to long-term corporate value, putting constructive dialogue with investors at the center.

Standard

For companies which have appropriate levels of market capitalization (liquidity) to be investment instruments in the open market, keep the basic level of corporate governance expected of listed companies, and commit to sustainable growth and improvement of medium- to long-term corporate value.

Growth

For companies which have a certain level of market value by disclosing business plans for realizing high growth potential and their progress towards these appropriately and in a timely manner, but at the same time pose a relatively high investment risk from the perspective of business track record.

TOKYO PRO Market

TOKYO PRO Market was established based on the "Professional-oriented market system" introduced in an amendment to the Financial Instruments and Exchange Act in 2008. In TOKYO PRO Market, exchange-approved J-Advisers conduct listing examination of prospective companies and offer post-listing support in place of the exchange.

Please click here for more details regarding this market.

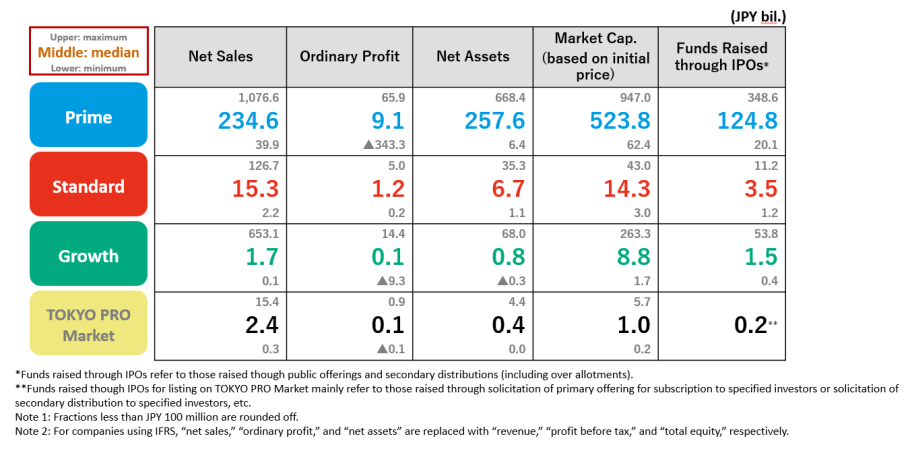

Comparison of Financial and Other Data From IPO Companies in 2025