Overview of IPO

About JDRs

Foreign companies have the option of listing their shares on Tokyo Stock Exchange (TSE) via the JDR scheme.

A JDR (Japanese Depositary Receipt) is a beneficiary certificate, for entrusted foreign securities, issued in Japan by a beneficiary certificate-issuing trust pursuant to the Trust Act. This mechanism, like an ADR (American Depositary Receipt) in the U.S. or GDR (Global Depositary Receipt) in Europe, allows for the smooth transaction of foreign stocks, bonds, and ETFs within Japan.

European and American depositary receipts (DRs), such as ADRs and GDRs, have experienced growth and are actively traded. Potential issuers around the world who wish to conduct fund raising in non-domestic securities markets have taken advantage of DRs in cases where they are not able to directly list on such markets due to a variety of reasons, including restrictions in their home country and trading/settlement concerns.

In November 2007, TSE developed listing rules for JDRs of foreign stocks and ETFs coinciding with revisions to the Financial Instruments and Exchange Act in September 2007. In enabling the utilization of JDRs in a manner similar to U.S./European DRs, these rules aim to a) allow foreign companies to conduct fund raising through the Japanese capital market and b) offer a wider range of investment options to Japanese investors.

In contrast to ADRs and GDRs, which are issued according to a deposit agreement, JDRs are issued pursuant to the Trust Act. As such, JDR beneficiaries are subject to protections under the Trust Act and trustees (i.e., trust banks) are subject to relevant rules, such as trustee's responsibility under the Trust Act. However, given that the same risks exist as when directly acquiring securities issued by a foreign company, the trustee (i.e., trust bank) does not act to supplement credit. Additionally, due to the fact that JDR owners indirectly own the issuer's securities through trusts, said JDR owners may not exercise the same rights as if they directly held such securities.

Benefits of the JDR scheme

- A foreign corporation that is organized in a jurisdiction where direct listing on foreign exchanges is impractical or prohibited can still raise funds by listing JDRs. Some examples include cases where nationals of countries outside the jurisdiction are not allowed to hold stock of companies in said jurisdiction or where local laws do not allow companies to list on foreign stock markets.

- There is a greater possibility that issuers can attract Japanese investors, because said investors do not need to open a foreign securities trading account to trade JDRs.

JDR Issuance Mechanism

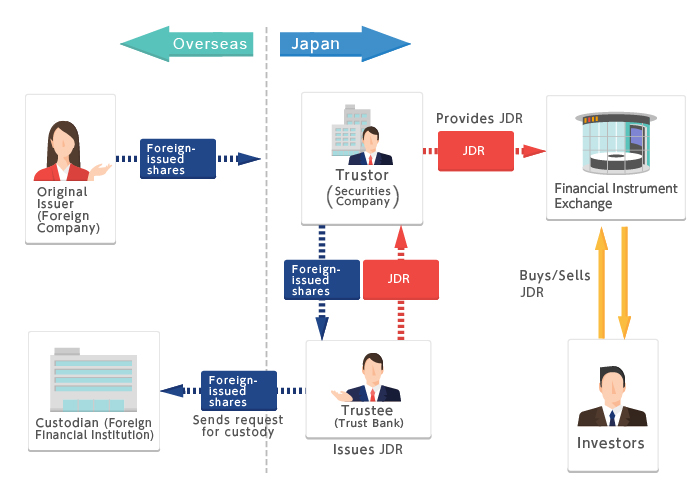

Below is the flow from issuance to trading of JDRs.

- A foreign company (the original issuer) allocates its shares to a securities company (the trustor).

- The trustor entrusts said shares to a trust bank (the trustee).

- The trustee entrusts custody of said shares to a foreign financial institution (the custodian).

- The trustee issues the JDRs to the trustor.

- The trustor conducts an IPO of the JDRs and investors make payment to the trustor.

- After listing, investors trade the JDRs in the TSE market.

Number of Shares and JDRs

The number of shares and JDRs can differ because only a portion of the shares issued by a foreign company are entrusted to a trust bank and the trust bank then issues them in the form of JDRs.

If all of the issued shares are entrusted to the trust bank, then the number of issued shares and JDRs should be the same.

One JDR unit is assumed to represent the right to one share of common stock.

Calculation of Market Capitalization

Under the JDR scheme, shares issued by a foreign company are entrusted to a trust bank, which then issues JDRs in place of said shares. Thus, there are two methods for calculating market capitalization as shown in the table below.

| Based on issued shares | Based on JDRs |

| No. of shares issued multiplied by the JDR price (note) | No. of JDRs multiplied by the JDR price |

- ・The price of JDR is used in calculations, because no price is attached to the shares.

- ・One JDR unit is assumed to represent the right to one share of common stock.

JDR Price

Under the JDR scheme, the price of JDR is calculated instead of that for the shares, because it is the JDR that is being traded on TSE.

| Category | Price |

| Shares | N/A |

| JDRs | Calculated |