Revisions of TOPIX

Rules of Next-Generation TOPIX

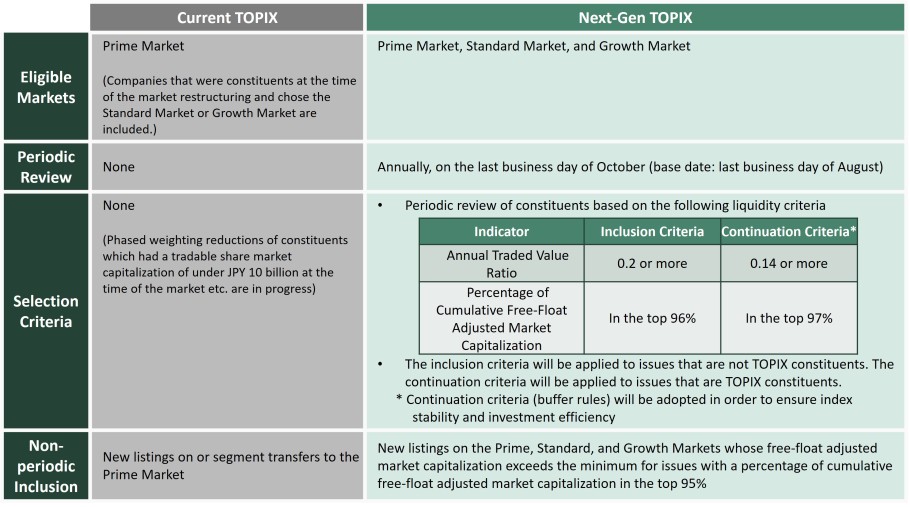

The differences between the current TOPIX and the Next-Generation TOPIX are shown in the table below. In the Next-Generation TOPIX, all market segments will become the index universe, and periodic reviews will be carried out based on liquidity criteria. For detail, please refer to the calculation method.

*There are no changes to non-periodic removals (Delistings, Securities to be Delisted, Securities on Special Alert) or the weight cap (10%).

*For the annual traded value ratio, the sum of the monthly traded value ratios for the previous 12 months preceding the month containing the base date for the periodic review will be used. The monthly traded value ratio is defined as "(the median daily traded value in TSE's trading sessions for the month x the number of business days in the month) / free-float adjusted market capitalization on the last business day of the month."

*Percentage of cumulative free-float adjusted market capitalization is defined as "the cumulative free-float adjusted market capitalization of the issues starting with the largest free-float adjusted market capitalization in the group of issues that meet the criteria for the annual traded value ratio and that are not Securities to be Delisted or Securities on Special Alert / the total free-float adjusted market capitalization of said group of issues."

Transitional Measures to Next-Generation TOPIX

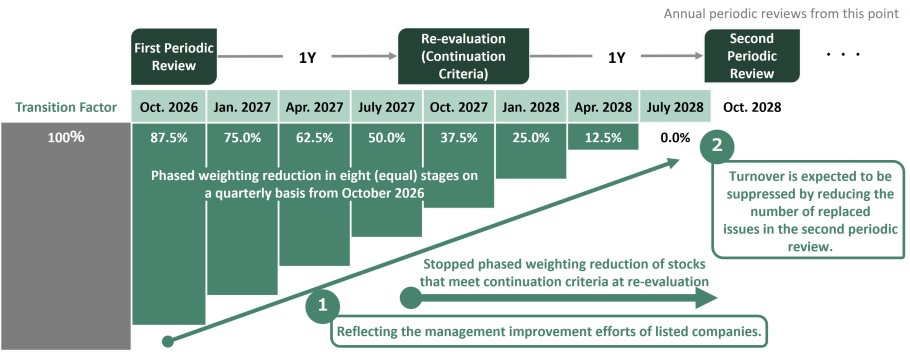

To ensure a smooth transition to the next-generation TOPIX and to mitigate the impact on the market , JPXI will provide sufficient time for public awareness and transitioning, and perform the transition in phases.

Similar to the first stage revisions, a re-evaluation for the issues subject to transitional measures will be conducted during the transition period.

- The first periodic review will be in October 2026 and the second will be in October 2028.

- Issues that are no longer selected as constituents after the first periodic review (issues subject to transitional measures) will have their weightings reduced in eight stages on a quarterly basis.

- Re-evaluation will be carried out in October 2027, and phased weighting reduction of stocks that meet the continuation criteria* will be stopped.

- Annual Traded Value Ratio ; 0.14 or more, Percentage of Cumulative Free-Float Adjusted Market Capitalization ; In the top 97%

Please see the link below for calculation method after revisions.