Global International Default Simulation Conducted

2025/11/12

Japan Securities Clearing Corporation (hereinafter referred to as “JSCC“)conducted the 2nd global international default simulation, assuming the default of a large-sized financial institution, aligning with major CCPs*1 in other countries*2 during the period from November 4, 2025 (Tue.) to November 12, 2025 (Wed.), with participation of the Financial Services Agency and the Bank of Japan, in addition to 53 financial institutions, such as banks and securities companies.

Each of the participating CCPs established or reinforced their default management functions to prevent contagion from the default of a member financial institution impacting other market participants, which could potentially develop into a future financial crisis. This default simulation was the coordinated simulation where key global CCPs conducted simultaneous default simulations, which assumed the default of a hypothetical global financial institution, with the scale expanded from the first conducted in 2023.

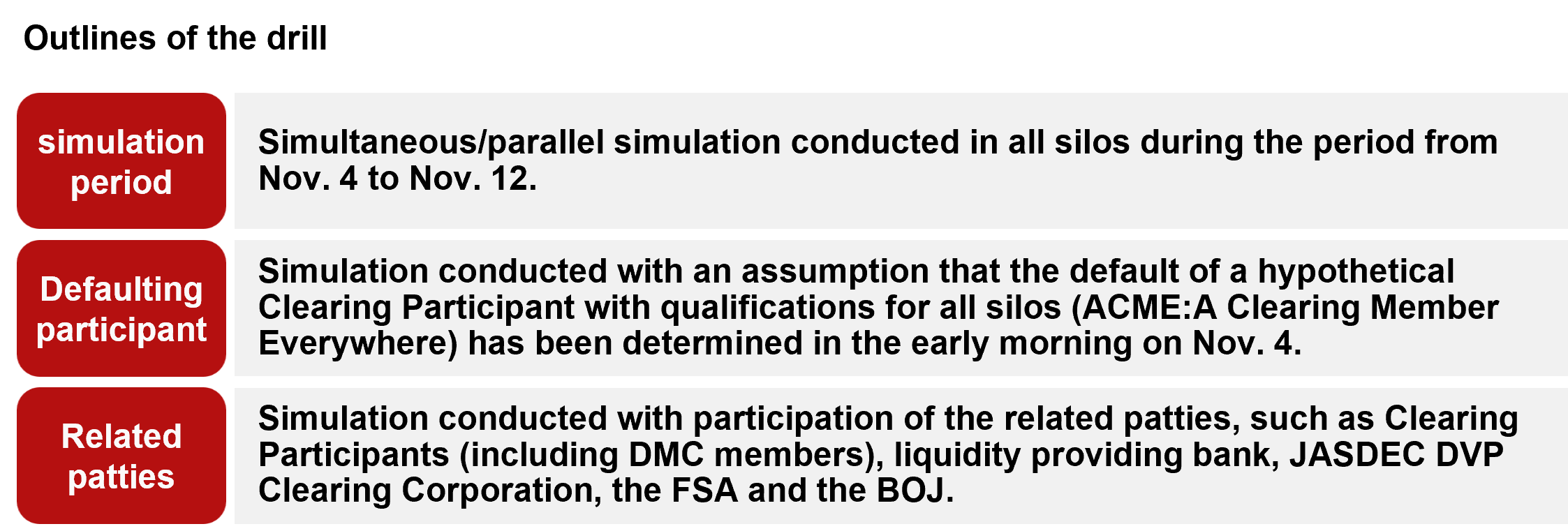

JSCC had previously established a robust default settlement framework to manage the default of a financial institution participating in clearing of listed or OTC transactions (Clearing Participant). This framework is designed to manage the disposal of collateral posted by a defaulted Clearing Participant, as well as liquidating its unsettled positions to prevent any impact on other market participants. These measures are one of the critical functions of a CCP, and JSCC continuously strives to maintain and enhance its default settlement framework, taking into account any findings and insights gained from regular default simulations, including this global international default simulation (see the chart below, for an outline of the simulation).

*1 Institutions that clear obligations of trades executed on exchanges or the like and guarantee their settlement performance.

*2 The first simulation initiated by “CCP Global”, the international association of CCPs globally. 38 CCPs participated, including Chicago Mercantile Exchange Group in the U.S. and LCH Ltd in the U.K.

| Global International Default Simulation Conducted |

|

Contact Points related to this Press Release

Japan Securities Clearing Corporation

Risk Management Division

TEL: +81-3-3665-1234 (Main Phone No.)