Risk ManagementMargin

Margin

(As of December 18, 2024)

- JSCC requires Clearing Participant to deposit margin, which is collateral to cover loss arising from that Clearing Participant default.

- For listed derivatives, CDS, IRS, and OTC JGB, open positions are marked-to-market using the most recent price at least once a day, following which variation margin is exchanged with Clearing Participants. This process ensures that current exposure is covered in a timely manner. For cash products, current exposure is covered by initial margin.

- Besides, initial margin is calculated for each Clearing Business using a method appropriate for that business, with a confidence level of at least 99% of potential future exposures for all products.

- Calculation of initial margin for each Clearing Business are as follows:

Calculation of Margin

|

|

Model Type |

Calculation Method |

Reference Period |

Holding Period |

Confidence Level |

Update |

|---|---|---|---|---|---|---|

|

VaR |

Historical Simulation |

250 business days |

1 business day |

99% |

Daily |

|

|

Expected Shortfall(*1) |

Historical Simulation |

1,250 business days + Stress Period (*2) |

2 business days (*3) |

99% |

Daily(*5) |

|

|

Expected Shortfall |

Historical Simulation |

750 business days + Stress Period |

5 business days |

99.5% |

Daily |

|

|

Expected Shortfall |

Historical Simulation |

1,250 business days + Stress Period |

5 business days (*4) |

99.5% |

Daily |

|

|

POMA |

Delta Method |

1250 business days + Stress Period |

3 business days |

99% |

Daily |

(*1) VaR for Nikkei 225 Dividend Index Futures of Listed Financial Derivatives and Listed Commodity Derivatives (excluding Platts Dubai Crude Oil Futures, CME Group Petroleum Index Futures, Electricity Futures and LNG Futures)

(*2) For Precious Metal Futures Contracts and Dojima Precious Metal Futures Contracts, 1250 business days with no Stress Period. For Listed Commodity Derivatives other than the above, 250 business days with no Stress Period (excluding Platts Dubai Crude Oil Futures, CME Group Petroleum Index Futures, Electricity Futures, and LNG Futures).

(*3) 1 business day for Listed Commodity Derivatives (2 business days for Electricity Futures and LNG Futures).

(*4) 7 business days for Clients.

(*5) Weekly for Nikkei 225 Dividend Index Futures of Listed Financial Derivatives and Listed Commodity Derivatives (excluding Electricity Futures and LNG Futures).

- JSCC performs daily backtesting of each account for each Clearing Business using required margin amounts and losses based on actual price fluctuations, in order to confirm that the target confidence level is achieved. JSCC reports backtesting results to the Risk Oversight Committee on a monthly basis, to the Board of Directors and the Risk Committee on a quarterly basis, and to Clearing participants via the advisory committees of each Clearing Business on an annual basis.

<Initial Margin Transparency and Measures to Control Procyclicality>

JSCC maintains a strict margin framework, which is risk-sensitive as well as stable, to mitigate a procyclical surge of margin during a stress period, by implementing Anti-Procyclical Measures (APC Measures*).* APC Measures include, but are not limited to, additional stress scenarios, a volatility floor and the minimum required margin.

|

|

Website Links to IM Outlines and APC Measures

|

|

Cash Products

|

(IM Outlines)

|

|

Listed Derivatives

|

(IM Outlines)

(Anti Procyclicality Measures)

|

|

CDS

|

(IM Outlines)

|

|

IRS

|

(IM Outlines)

(Anti Procyclicality Measures)

- Stress Event Scenarios for Calculating Required Initial Margin

- Margin Simulation Tool (Scroll Down to Margin Simulation Tool)

|

|

OTC-JGB

|

(IM Outlines)

(Anti Procyclicality Measures)

|

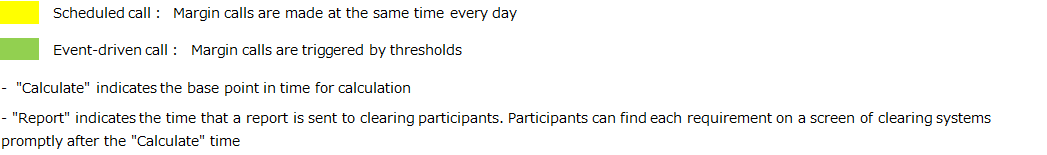

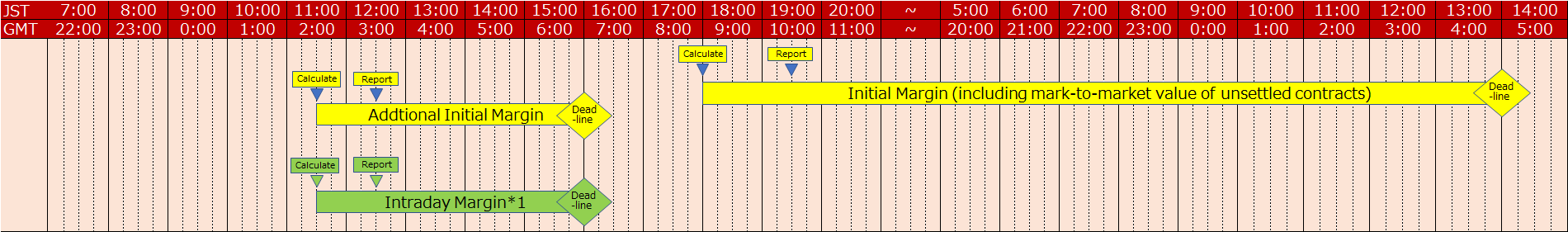

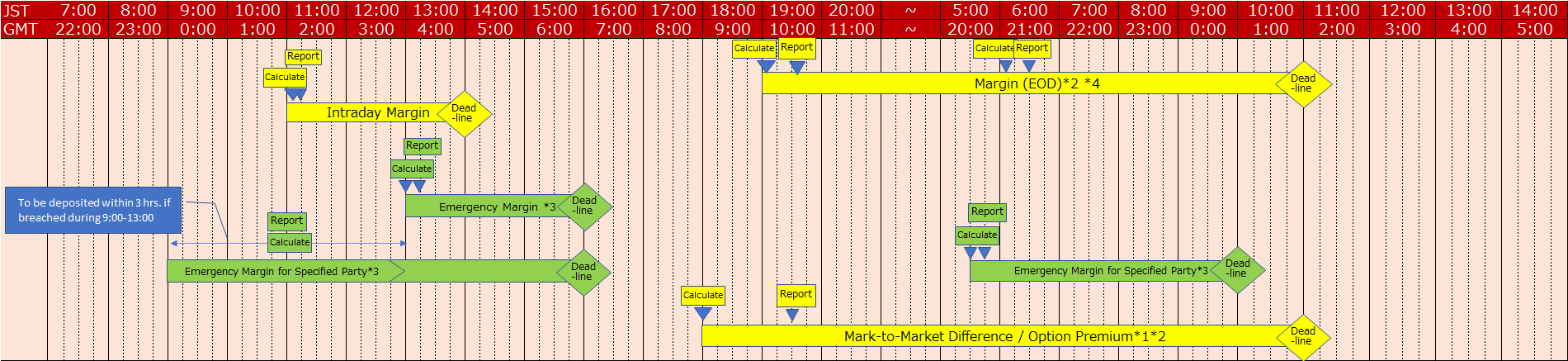

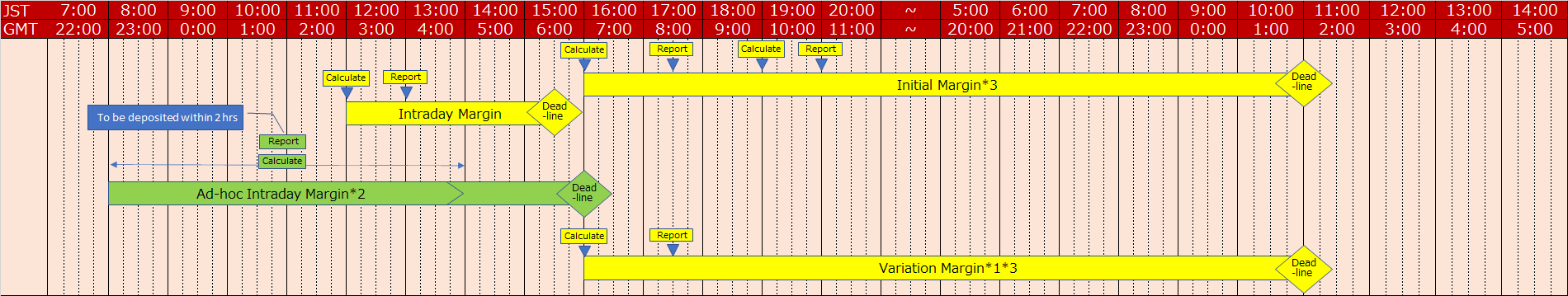

<Margin calculation schedules for each clearing service>

Equities and Bonds

*1 Reported only when a trigger threshold is breached. The threshold can be found here.

Futures and Options

*1 Mark-to-market difference and option premium are required to be deposited in Japanese yen cash. Other margins may be deposited in either cash or eligible securities.

*2 May be netted with cash collateral deposited in excess of margin requirement.

*3 Reported only when a trigger threshold is breached. The threshold can be found here.

*4 Participants can obtain their latest risk amount on a clearing system screen, after around 16:00 when Margin Calculation Parameter Files are distributed. "Calculate" shown on the tables, indicates the time of the report calculation and generation, taking into account each participants' collateral and various notifications, such as close-out or position reports.

Credit Default Swap

*1 Variation margin is required to be deposited in Japanese yen cash. Other margins may be deposited in either cash or eligible securities.

*2 Reported only when a trigger threshold is breached. The threshold can be found here.

*3 May be netted with cash collateral deposited in excess of margin requirement.

Interest Rate Swap

*1 Variation margin is required to be deposited in Japanese yen cash. Other margins may be deposited in either cash or eligible securities.

*2 Event-driven intraday margin is called only when markets fluctuate significantly and JSCC deems the scheduled margins would be insufficient to cover the market risk.

*3 May be netted with cash collateral deposited in excess of margin requirement.

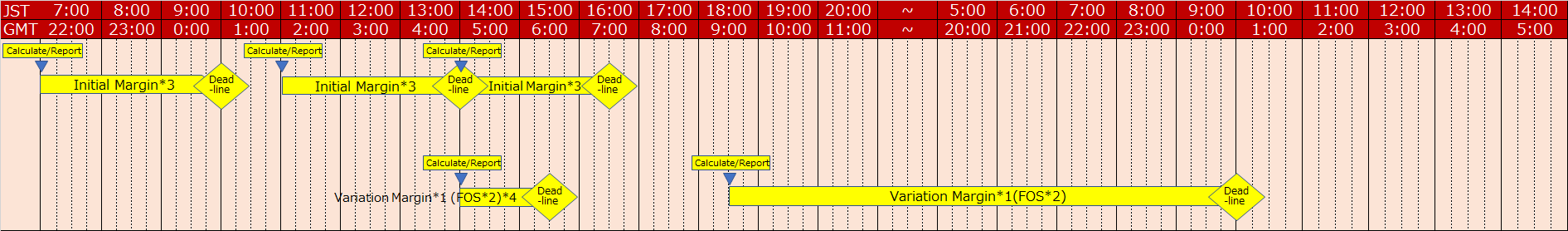

OTC Japanese Government Bonds

*1 Variation margin is required to be deposited in Japanese yen cash. Other margins may be deposited in either cash or eligible securities.

*2 Components of Funds Only Settlement (FOS) can be found in "Japanese Government Bond Over-the-Counter Transaction Clearing Business Rules", here.

*3 Triggering criteria and the increased rates for intraday initial margin can be found here.

*4 FOS for subsequent collateral allocation repos.