Interest Rate SwapMargin

Initial Margin for IRS

In order to cover exposures for IRS, JSCC requires the deposit of variation margin and initial margin from all Clearing Participants.

Initial Margin for IRS consists of ①Initial Margin and ②Liquidity Charge.

(※)The total required IRS Initial Margin amount contributed by all Clearing Participants was JPY 2644.9B (as of 30, Dec, 2025)

- Initial Margin

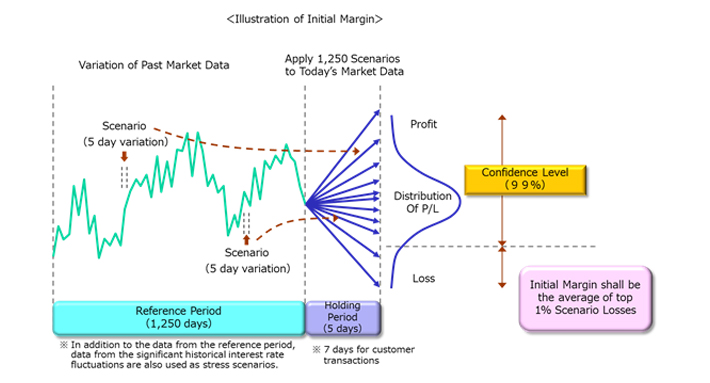

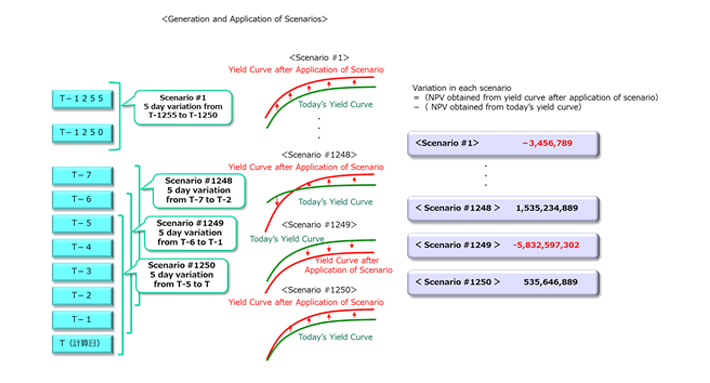

The required amount of initial margin is calculated using historical simulation (expected shortfall) methodology to cover risks from interest rate fluctuations. Specifically, it is set to cover a certain amount of an NPV fluctuation calculated using a daily yield curve fluctuation scenario for a given historical period.

Parameters used in the calculation include a reference period of 1,250 days, a confidence level of the average of the worst 1%, and a holding period of 5 days (7 days for customer transactions). In addition to the data from the reference period, data from the significant historical interest rate fluctuations are also used as stress scenarios. This is to prevent sudden changes in required initial margin when stress events are applied to or removed from the reference period data.

Additionally, JSCC has methodologies in place (Volatility Scaling methodology based in Exponentially Weighted Moving Average method) to revise the historical interest rate fluctuation scenarios, based on current interest rate trends.

- Liquidity Charge

Liquidity Charge is calculated to cover market liquidity risk arising from the liquidation of a defaulting Clearing Participant’s positions. This charge is calculated based on by multiplying the PV01 by an ask/bid spread derived from a market survey of Clearing Participants.

LC_img1_.jpg)

After above calculation related to each tenor, Liquidity Charge for participant’s portfolio is calculated

based on correlation of past interest rate fluctuations between the tenors.

LC_img2.jpg)

Market Data to be Used for Calculation

Quotes as of 15:02 will be obtained from Clearing Participants and inter-dealer brokers with respect to grid points prescribed by JSCC, average of such quotes after discarding the highest and the lowest of such value (in principle) will be calculated and the yield curves are to be generated based on such averages. For settlement rates as of 15:02, please see following:

Structure of Increasing Initial Margin

- Increase according to Credit Standing

If JSCC considers necessary in light of the credit standing of the IRS Clearing Participant, JSCC may increase the Required Initial Margin Amount. For detail, please refer to the “Interest Rate Swap Clearing Business Rules” Article 32, the “Handling Procedures of Interest Rate Swap Business Rules” Article 24, and the “Guidelines concerning Credit Standing of Clearing Participants, etc. in IRS Clearing Business.

Customer Buffer

At JSCC, the "Customer Buffer" framework is available, under which an allocation of collaterals posted by a Clearing Broker for such purpose is allowed at a time of Customer's collateral shortfall (Affiliate and Client). Please see here for details.

Client Additional Margin

For diversification of Clearing Brokers' customer risk management options, the "Client Additional Margin" framework is available at JSCC, under which customer's Initial Margin requirement will be increased pursuant to a prior agreement between a Clearing Broker and a Client. For outlines of this framework and handling of Clearing Fund when this framework is used, please see here .

Margin Simulation Tool

OpenGamma provides a margin simulation tool for yen interest rate swap at JSCC along with JGB futures and TONA interest rate futures cross-margining. For new users who want to learn how to register and login, please see the following signup guide.

| Signup Guide |

|

- The simulator is also available on the Bloomberg Swap Manager screen.

Please access it from CCP > Japan Securities Clearing Corporation (OpenGamma) within the following screens:

- “SWPM -OIS JPY”

- “SWPM -DTIBOR 1MONTH JPY”

- “SWPM -DTIBOR 3MONTH JPY”

- “SWPM -DTIBOR 6MONTH JPY”

Please kindly be informed that this is a simulation tool for margin for the relevant clearing services at JSCC for reference purpose only, and is not intended to provide the actual required margin in clearing of the relevant products at JSCC. While this tool is provided by OpenGamma using data and methodologies of JSCC, JSCC does not guarantee or verify the accuracy of the margin simulation output, and JSCC will have no liability over any and all damages on the side of users arising from any use of this tool for any reason whatsoever. The enhanced tool for IRS is available only to existing and potential clearing members and clients of JSCC, and is not open to individuals.