Interest Rate SwapIRS Clearing

Example of Clearing

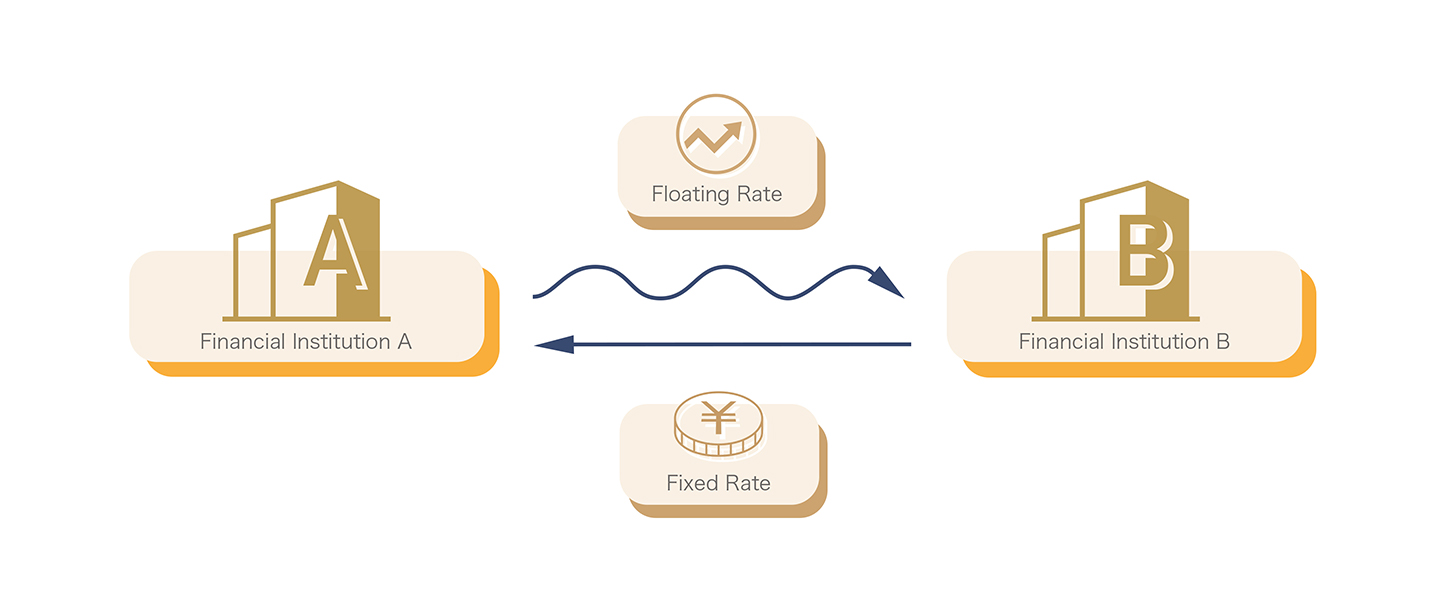

IRS is one of the derivative transactions traded over-the-counter (OTC Derivative Transaction). Once the trade is done, the obligation to pay coupon shall arise on the part of the interest rate payer and the claim to receive coupon shall arise on the part of the interest rate receiver.

(e.g.) Financial Institution A is paying Financial Institution B a floating rate and, at the same time, Financial Institution B is paying Financial Institution A a fixed rate.

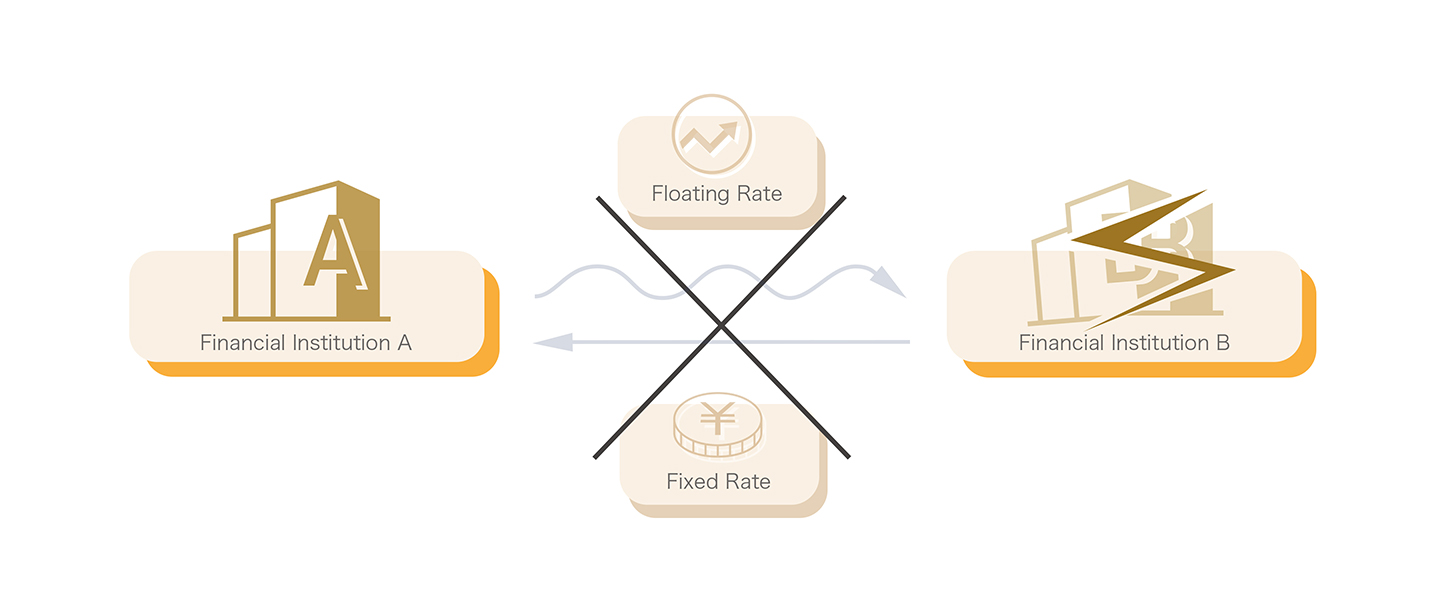

If, while Financial Institution A made payment of floating rate to Financial Institution B on the scheduled settlement date, Financial Institution B failed to make payment of fixed rate to Financial Institution A, Financial Institution A misses the receipt of the payment. Therefore, in case of settlements between individual parties, a party will bear a credit risk of each of its counterparties.

(e.g.) Due to default of Financial Institution B, Financial Institution A becomes unable to perform scheduled settlement.

As such, in case of OTC transactions, a party needs to bear as much credit risks as the number of counterparties to its transactions. Moreover, there will be separate operational procedure that needs to be processed for each of its counterparties which cause significant operational burden. Then, if one highly creditworthy organization bears obligations arising between the parties and acquires corresponding claims, and guarantees settlement by becoming a party to the claims and obligations, each party to transactions may trade without having concern about credit risks of the original counterparties.

(e.g.) When Financial Institution B defaults with respect to a cleared transaction.

Clearing Timing

New transactions are cleared during the periods from 9:00 a.m. to noon and from 1:00 p.m. to 4:00 p.m. and 5:30 p.m. to 7:00 p.m., respectively on every business day.

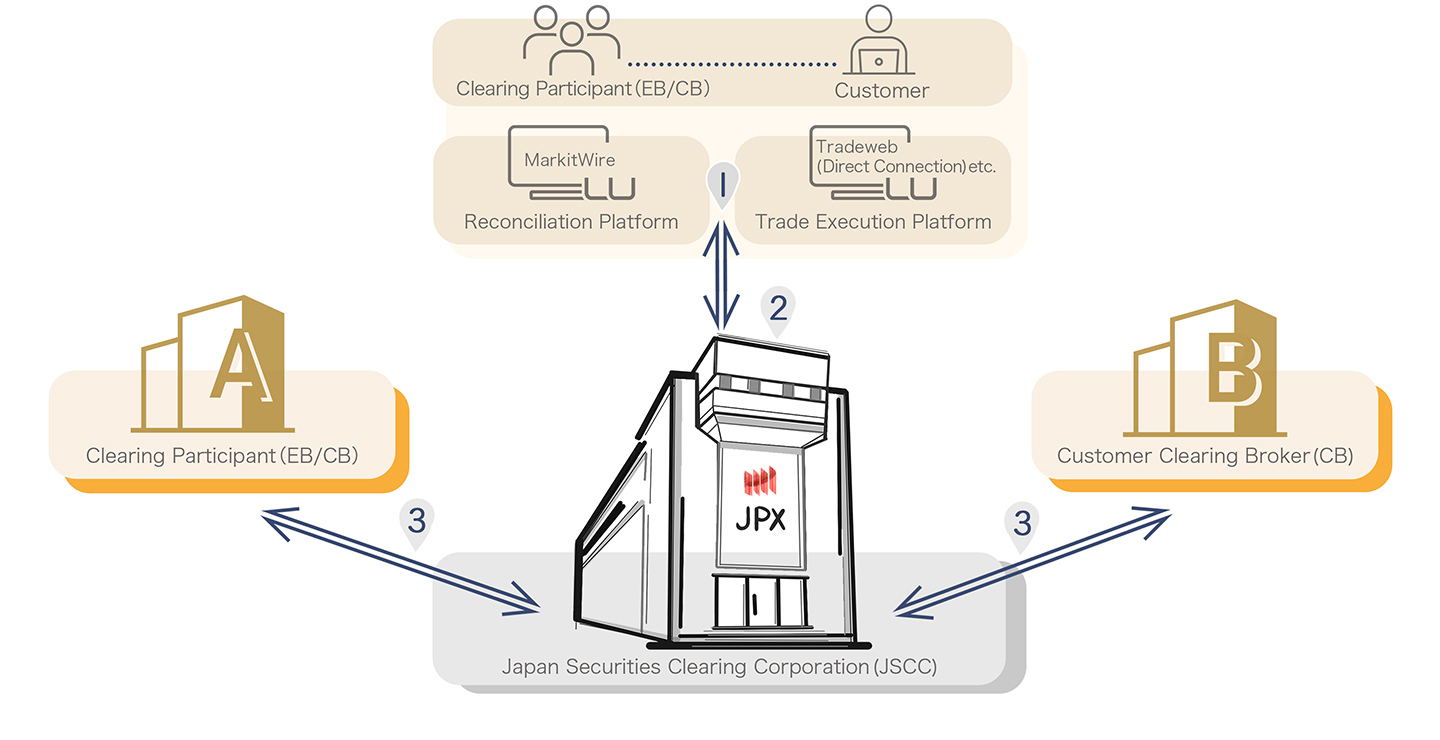

Illustration of Clearing Workflow

EB: Execution Broker which is a party to the original IRS transaction.

EB: Execution Broker which is a party to the original IRS transaction.

CB: Clearing Broker which acts as agent to offer clearing services for Customers.

- 1.

- Both parties to IRS reconcile the transaction and apply for clearing on an overseas reconciliation platform (MarkitWire) or Trading platform.

- 2.

- With respect to a transaction for which clearing is applied, JSCC checks requisite items, such as trade eligibility and sufficiency of collaterals.

・Transaction is cleared after confirming there is no problem on the part of the parties who applied for clearing.

- 3.

- JSCC distributes reports concerning clearing status, Margins and others related to IRS.