Expansion of Use of Clearing for Creation/Redemption of ETF

2025/11/27

Japan Securities Clearing Corporation launched the ETF Creation/Redemption clearing framework in January 2021 with the aim of improving convenience in the ETF Creation/Redemption process and enhancing its settlement efficiency. Since then, market participants in the ETF issuance market have utilized the said system for the Creation/Redemption for “In-kind type ETF,” where an ETF is issued in exchange for a basket of stocks and other securities.

By using the ETF Creation/Redemption clearing framework, settlements related to ETF Creation/Redemption and those related to the buying and selling of stocks and other securities in the market are netted. We expect that this netting will improve settlement efficiency of Authorized Participants, promote market makers to actively quote indications, which will contribute to improve liquidity in ETF market.

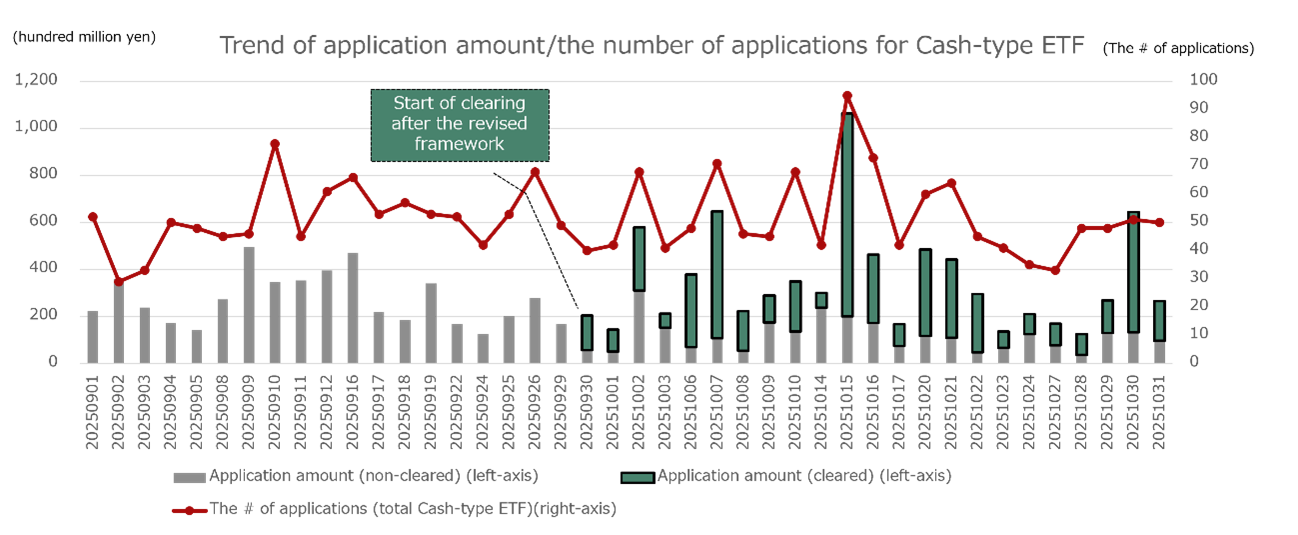

On the other hand, for “Cash-type ETF,” where an ETF is issued in exchange for cash, the clearing framework had not been used due to settlement cycle constraints. However, following the system enhancements implemented on September 29 of this year, the number of ETF eligible for clearing increased by 107*1 and the cleared value reached about 70% of total Cash-type ETF Creation/Redemption transactions (an average of approximately JPY 23 billion per day)*2, which demonstrates the expansion of use of clearing for ETF Creation/Redemption (please see the graph below for daily trends of cleared value for Cash-type ETF Creation/Redemption).

As our ongoing initiative, we will include “actively managed ETFs,” which do not track underlying indicators, in addition to the conventional “indicator-tracking ETFs,” as eligible for clearing to further expand the use of clearing for ETF Creation/Redemption, starting from December 8 (Mon.) of this year.

We expect a series of these initiatives will further improve liquidity in ETF market by smooth market-making.

*1 The number of issues as of the end of October 2025.

*2 Cleared value represents daily average in the period from September 29 to October 31, 2025. The ratio represents the ratio of cleared value to the total application amount on the ETF Creation/Redemption Platform (including new platform (“CredNex”) operated by Tokyo Stock Exchange).

| Expansion of Use of Clearing for Creation/Redemption of ETF |

|

Contact Points related to this Press Release

Japan Securities Clearing Corporation

Listed Products Clearing Service

TEL: +81-3-3665-1234 (Main Phone No.)