Our Business

Overview

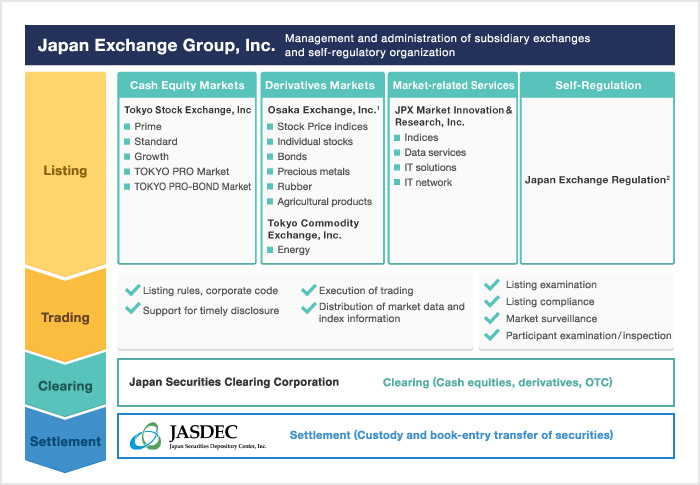

Japan Exchange Group, Inc. (JPX) was established via the business combination between Tokyo Stock Exchange Group and Osaka Securities Exchange on January 1, 2013.

JPX operates financial instruments exchange markets to provide market users with reliable venues for trading listed securities and derivatives instruments. In addition to providing market infrastructure and market data, JPX also provides clearing and settlement services through a central counterparty and conducts trading oversight to maintain the integrity of the markets. In the course of working together as an exchange group to offer a comprehensive range of services, we continue to make every effort to ensure reliable markets and create greater convenience for all market users.

On October 1, 2019, JPX expanded its business into commodity derivatives trading by acquiring Tokyo Commodity Exchange, Inc.

- Osaka Securities Exchange was renamed Osaka Exchange on March 24, 2014.

- Tokyo Stock Exchange Regulation was renamed Japan Exchange Regulation on April 1, 2014.

- ・Japan Securities Depository Center, Inc. is a JPX affiliate.

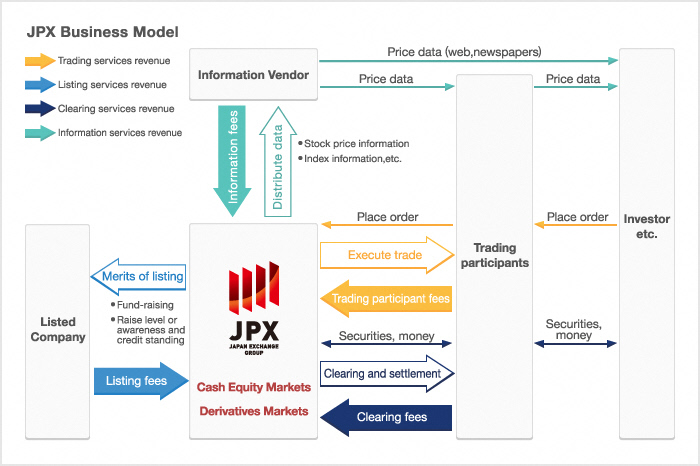

Business Model

JPX provides a fair, secure, and reliable market infrastructure, and in return receives fees from securities firms, issuers, information vendors, and other market users. Our main revenue streams are trading services revenue, clearing services revenue, listing services revenue, and information services revenue. In terms of cost and revenue factors, market expansion and growth boost income while expenses remain relatively stable and unaffected by changes in market condition.

Tokyo Stock Exchange

Tokyo Stock Exchange, Inc. (TSE) is a licensed financial instruments exchange under the Financial Instruments and Exchange Act of Japan, which is engaged in the provision of market facilities for trading of securities, publication of stock prices and quotations, ensuring fair trading of securities and other financial instruments, and other matters related to the operation of exchange financial instruments markets.

About Cash Markets

We operate and maintain Prime, Standard and Growth to be central to TSE markets.

TSE has established its position as Japan’s central market, and is ranked the third in the world* and the first in Asia* by market capitalization.

In an effort to accommodate varied needs of investors, we are promoting to diversify our product lineups such as ETFs and ETNs, which will allow investors to take advantage of more diversified asset allocation at smaller costs.

We serve as a one-stop market and offer a wide variety of ETFs and ETNs linked to Japanese and foreign stock price indices, commodity indices such as precious metal and agricultural products, REIT indices, and leveraged and inverse indicators calculated by multiplying the daily fluctuation rate of the underlying indicators.

We consider it extremely important and essential to ensure a stable system operation to maintain stability and reliability in market by keeping a trading platform smoothly.

To accommodate varied needs of users in response to diversified and sophisticated trading methods due to advancements in financial information technology and listing of new financial instruments etc. in an appropriate and flexible manner, it is necessary to develop and improve the system infrastructure.

We operate the cash market trading system “arrowhead” which combines low latency, high reliability and scalability. With the best latency level in order processing and data distribution as well as the synchronized 3-node data protection system to restore trading information such as orders, executions, and order books, “arrowhead” positions itself as one of the best trading system of the world.

- The market capitalization is as of end of June, 2020.

Osaka Exchange

Osaka Exchange, Inc. (OSE) is a licensed financial instruments exchange under the Financial Instruments and Exchange Act of Japan, which is engaged in the provision of market facilities for trading of financial derivatives, publication of prices and quotations, ensuring fair trading and other financial instruments, and other matters related to the operation of exchange financial instruments markets.

Tokyo Commodity Exchange

Tokyo Commodity Exchange, Inc. (TOCOM) is a licensed commodity exchange under the Commodity Derivatives Act of Japan, which is engaged in the provision of market facilities for trading of commodity derivatives, physical commodities and commodity index futures.

About Derivatives Markets

As part of the Comprehensive Exchange, the OSE derivatives market allows investors to trade financial derivatives products, such as those based on stock price indices, and commodity derivatives products, such as those based on precious metals, all on one platform.

Stock price index derivatives are available on both domestic and global indices, and products such as Nikkei 225 futures, Nikkei 225 mini, Nikkei 225 options and TOPIX futures are the leading derivatives products in Japan.

For JGB futures, high liquidity in 10-year contracts means that their price movements are used as indicators of Japanese long-term interest rates. In addition, as well as the gold market being the most liquid in East Asia and the platinum market the most liquid in the world, prices on the rubber market are used as the global benchmark.

The TOCOM derivatives market allows investors to trade energy derivatives, such as oil futures and electricity futures. TOCOM's Dubai crude oil prices are widely used by market participants as a benchmark for the price of Asia-bound oil from the Middle East.

- ・For the latest updates on OSE markets, please refer to the following link:

Stable system operations are essential to achieve smooth trading and maintain a stable and reliable market. The IT infrastructure, including the trading system, requires constant development to meet the needs of market users by appropriately and flexibly responding to diversified and sophisticated trading methods brought about by advancements in financial information technology and the listing of new products. As such, we adopted “J-GATE”, a derivatives trading system that boasts capabilities of the highest global standards. By advancing the full utilization of the system’s capabilities, we are able to provide highly reliable and convenient markets for investors.

JPX Market Innovation & Research, Inc.

JPX Market Innovation & Research, Inc. (JPXI) has been newly established as a non-exchange subsidiary with the aim of pursuing the creation of market services that contribute to better functionality and efficiency across the board. Without being constrained by the traditional "exchange" framework, JPXI will foster a new company culture while aiming for flexible and mobile business development through M&As and leveraging highly skilled human resources, and will advance the diversification of businesses and sophistication of services by strengthening digital and network-related businesses that utilize data and technology.

Japan Exchange Regulation

Japan Exchange Regulation (JPX-R) is an independent self-regulatory body dedicated to maintaining integrity in the Japanese securities markets. Established under Japan Exchange Group (JPX), JPX-R specializes in self-regulatory operations such as listing examination, listed company compliance, market surveillance, and inspections and examinations of trading participants (broker-dealers qualified to access directly the trading platforms of Tokyo Stock Exchange or Osaka Exchange).

Japan Securities Clearing Corporation

In January 2003, Japan Securities Clearing Corporation (JSCC) was licensed in Japan as the first clearing organization to conduct a “Securities Obligation Assumption Service” (now called “Financial Instrument Obligation Assumption Service”) and started clearing services for transactions executed on Japanese stock exchanges. The birth of JSCC enabled the integration of clearing processes that used to be performed separately by individual stock exchanges, dramatically improving the efficiency and serviceability of the post-trade process in securities markets. Since its start, JSCC has steadily expanded the scope of its services, and now, in addition to listed products, JSCC provides clearing services for OTC derivatives (CDS and Interest Rate Swaps) and OTC Japanese Government Bond transactions as the Financial Instruments Clearing Organization.

In July 2020, JSCC merged with Japan Commodity Clearing House Co., Ltd. (JCCH), and now also provides clearing services as a commodity clearing organization, for transactions made on commodity markets run by TOCOM and the Osaka Dojima Commodity Exchange.

For more information, please refer to the following link: