Gold Rolling-Spot Futures

Suspension of Rolling-Spot Futures and Listing of New Products

Suspension of Rolling-Spot Futures

Cash-settled Rolling-Spot Futures for gold and platinum on Osaka Exchange (OSE) have recently been experiencing continuous large discrepancies between the market price and the theoretical spot price. In this regard, OSE already issued alerts on December 3, 2024 and February 18, 2025 respectively, advising investors that they should trade taking into account prices such as that of the lead contract of the standard futures contract, which is used to calculate the theoretical spot price.

However, without significant improvement in the discrepancy thereafter, appropriate price formation has been hindered, such as instances where the price reached the upper price limit calculated based on the theoretical spot price, preventing transactions from being executed. Additionally, there has been a decrease in liquidity, and consequently wider price fluctuations, which continues to create an undesirable situation from the perspective of investor protection.

In view of this situation, OSE has been holding discussions with market stakeholders and considering countermeasures. In order to ensure that a diverse range of investors can trade with confidence, we have determined that it is necessary to fundamentally change the nature of the existing Cash-settled Rolling-Spot Futures so that arbitrage trading with the standard physically delivered futures, which have the highest liquidity in OSE’s market, can function effectively. Consequently, we have decided to reform the existing Cash-settled Rolling-Spot Futures into a new product that has a last trading day.

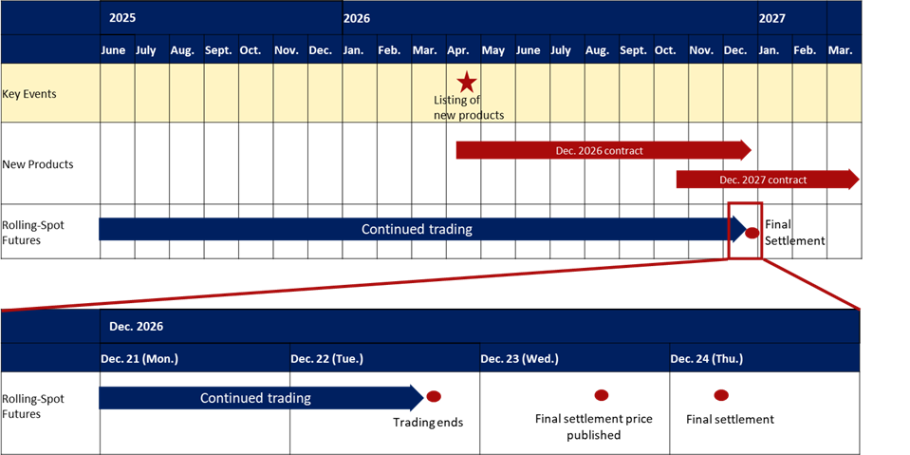

Specifically, effective on April 13, 2026 we will list new cash-settled futures contracts for gold and platinum whose underlying assets are the prices of Gold Standard Futures and Platinum Standard Futures, respectively (hereinafter collectively referred to as “new products”). These new products are designed to have a last trading day approximately one year after the first trading day. Meanwhile, trading of existing Cash-settled Rolling-Spot futures will be suspended with the last trading day set for December 22, 2026.

Positions in Cash-settled Rolling-Spot Futures that are still outstanding on the last trading day will not be transferred to the new products. Instead, they will be subject to final settlement using the theoretical spot price* to be determined on December 23, 2026 (hereinafter referred to as the “final settlement price”).

We kindly ask all investors to trade with the understanding that trading of the existing Cash-settled Rolling-Spot Futures will be suspended with the last trading day being December 22, 2026. We appreciate your attention to this matter.

- Please refer to Q11 below for the method of calculating the theoretical spot price.

Listing of New Products

New products for gold and platinum which have a last trading day are scheduled to be listed on April 13, 2026, replacing the existing Cash-settled Rolling-Spot Futures.

For more information on the new products, please refer to the following:

Implementation Schedule

The planned implementation schedule is as follows:

- Listing date of new products: April 13, 2026 (Mon.)

- Last trading day of existing Cash-settled Rolling-Spot Futures: December 22, 2026 (Tue.)

- Calculation date of final settlement price for existing Cash-settled Rolling-Spot Futures: December 23, 2026 (Wed.)

- Final settlement date for existing Cash-settled Rolling-Spot Futures: December 24, 2026 (Thu.)

- ・Positions still outstanding on the last trading day will be subject to final settlement using the final settlement price to be determined on the business day after the last trading day.

Frequently Asked Questions

Suspension of Cash-Settled Rolling-Spot Futures

- Q1. Why is trading of Cash-settled Rolling-Spot Futures being suspended?

-

A1.

Despite the fact that Cash-settled Rolling-Spot Futures are supposed to be linked to the price of gold bullion or platinum bullion, there has recently been a large discrepancy between the market price and the theoretical spot price calculated from the price of standard futures. This situation has persisted, making it difficult to effectively conduct arbitrage trading with the standard physically delivered futures. As a result, some arbitrage traders who provided liquidity have withdrawn from the market, and some Commodity Futures Business Operators have also refrained from accepting new orders, leading to a significant decrease in liquidity.

If the trading of Cash-settled Rolling-Spot Futures were to continue under these circumstances, there is a high likelihood that prices would become highly volatile, significantly impacting investors. Therefore, we have decided to suspend the trading of Cash-settled Rolling-Spot Futures as it is deemed undesirable to continue from the perspective of investor protection.

There are previous examples of trading suspensions within JPX Group, including rolling-spot futures on the Nikkei-TOCOM Commodity Index (suspended March 2012) in light of a risk of wider price fluctuations stemming from lower liquidity, and Exchange Foreign Exchange Margin Trading (commonly known as OSE-FX, suspended October 2014) due to a drop in liquidity.

- Q2. Why is it bad to have a discrepancy between the theoretical spot price and the market price? We believe the market price, which accounts for future price increases, is a more accurate reflection of the market than the theoretical spot price, as rolling-spot futures are a product that can be rolled over and held indefinitely.

-

A2.

Cash-settled Rolling-Spot Futures are not linked to the future prices of gold bullion or platinum bullion; rather, they are linked to the prices of gold bullion or platinum bullion on the current day.

We believe that the occurrence of a discrepancy between the market price and the theoretical spot price, which is specifically calculated to reflect the current day's prices of gold bullion or platinum bullion, is causing difficulties in achieving proper price formation for said underlier. If this situation is left unaddressed, it could lead to a purely supply-and-demand-driven market, where normal mechanisms fail, potentially causing high price volatility that negatively impacts investors.

- Q3. If the discrepancy between the theoretical spot price and the market price narrows, will you continue the trading of Cash-settled Rolling-Spot Futures?

- A3. Even if the discrepancy between the theoretical spot price and the market price temporarily narrows, we still believe there is a high likelihood that it will widen again due to the nature of Cash-settled Rolling-Spot Futures, which do not have a maturity and incur no holding costs for positions, leading to a tendency for them to be purchased even at overvalued prices. Therefore, even if the discrepancy temporarily narrows, it is difficult to consider continuation from an investor protection standpoint under circumstances where an expansion of the discrepancy is still foreseeable.

- Q4. I was not aware of the suspension of trading and I mistakenly made a trade, believing I could hold the contracts long-term. Could you accept my cancellation of this trade, given that it was based on a misunderstanding?

-

A4.

Unfortunately, we are unable to accommodate your request of cancellation.

We announced the suspension of Cash-settled Rolling-Spot Futures trading approximately one and a half years in advance of the scheduled suspension date, considering the impact of the suspension on investors. We kindly ask investors to decide within this period, using their own judgment, whether to conduct offsetting transactions for any unsettled positions based on market trends, or to let automatic settlement be applied to the final settlement at a final settlement price on the final settlement date (please refer to Q11 below).

- Q5. If positions in Cash-settled Rolling-Spot Futures are not settled by the last trading day, will they be transferred to the new products?

- A5. No, they will not be transferred to the new products. If positions in Cash-settled Rolling-Spot Futures are not offset by the last trading day, they will be automatically settled at the final settlement price as above.

- Q6. I currently hold positions in Cash-settled Rolling-Spot Futures. What should I do before the trading suspension?

- A6. For the positions you currently hold, we kindly request that you decide based on your own judgment, within the period of approximately one and a half years before the trading suspension, whether to conduct offsetting transactions for any unsettled positions or to let automatic settlement be applied to the final settlement at a final settlement price on the final settlement date (please refer to Q11).

- Q7. What happens if positions in Cash-settled Rolling-Spot Futures are not settled by the last trading day?

-

A7.

Positions in Cash-settled Rolling-Spot Futures that are not settled by the last trading day will be automatically settled at the final settlement price, which will be the theoretical spot price calculated on December 23, 2026 (Wed.).

Since the theoretical spot price is currently used as the daily settlement price for Cash-settled Rolling-Spot Futures, we will apply the same practice to minimize the impact on investors.

- Q8. Until when can new trades in Cash-settled Rolling-Spot Futures be conducted?

- A8. Under the OSE rules, new trades in Cash-settled Rolling-Spot Futures can be conducted until the last trading day, December 22, 2026. However, please note that your brokerage firm may have additional restrictions, so we recommend contacting them for specific details.

- Q9. What is the difference between trading suspension and delisting?

- A9. In terms of the inability to conduct trades, both are the same. We have opted for a trading suspension to minimize the impact on brokerage firms’ systems.

- Q10. It seems that the discrepancy between the theoretical spot price and the market price for platinum is smaller than that for gold. Why are you suspending trading for platinum as well?

- A10. Although the current discrepancy is relatively small, there have been instances in the past where significant discrepancies occurred, and there is potential for the discrepancy to widen in the future. Therefore, from an investor protection standpoint, we believe it is not advisable to continue trading.

- Q11. How do you calculate the theoretical spot price?

-

A11.

The theoretical spot price is calculated as below using the prices of the second and sixth contracts of standard futures.

Theoretical Spot Price Calculation Formula

r 2 = [ log ( F 6 / F2)]/ t 2-6

S = F 2 / e r2 t0-2- The meaning of each symbol in the above formula is as follows.

S : Theoretical spot price

r 2 : Forward rate calculated using the settlement prices of the second contract and the sixth contract of physically delivered futures

F 2 : Settlement price of the second contract of physically delivered futures

F 6 : Settlement price of the sixth contract of physically delivered futures

t 2-6 : No. of days between the last trading day of the second contract and the sixth contract of physically delivered futures divided by 360

e : Base of a natural logarithm

t 0-2 : No. of days between a trading day and the last trading day of the second contract of physically delivered futures divided by 360

- The theoretical cash price of cash-settled rolling spot futures is the theoretical cash price that is calculated from the settlement price of the second contract of physically delivered futures, according to the number of days remaining until the last trading day of the second contract of physically delivered futures and the forward rate (meaning the interest rate for notional borrowing/lending in the OSE market; the same shall apply hereinafter) which is calculated based on the settlement price of the second contract and sixth contract of the physically delivered futures which are the underlying products of said cash-settled rolling spot futures.

- Forward rates shall be rounded to the eighth decimal place.

- The theoretical cash price of cash-settled rolling spot futures shall be rounded to the nearest JPY 1.

To estimate the theoretical spot price, please use this Excel spreadsheet.

Theoretical Spot Price Estimation Sheet (Japanese only)

New Products

- Q1. When will the new products be listed?

- A1. The new products are scheduled to be listed on April 13, 2026.

- Q2. The new products are said to be reforming the current Cash-settled Rolling-Spot Futures. What are their characteristics?

- A2. The new products are designed to facilitate smooth arbitrage trading by having the price of standard futures as their underlier. The new products will have a single contract month per year, specifically a December contract that reaches maturity in December. Additionally, another December contract maturing in the following year will be available for trading from late October of each year. This means that from late October to late December each year, there will be two December contracts (one maturing in the current year and another maturing in the next year), allowing for the rollover from the current year's December contract to the next year's December contract during this period.

- Q3. Will the new products to be listed experience discrepancies similar to those seen in Cash-settled Rolling-Spot Futures?

- A3. It is not possible. The new products are linked to the price of standard futures and will be finally settled after maturity using the final settlement price, which is the opening price of the day session of the last trading day of the December contract of standard futures. This approach prevents discrepancies between the theoretical spot price and the market price.

- Q4. Why is the contract unit set at 100 grams? Did you consider using ounces or 10 grams instead?

- A4. We decided to maintain the same contract unit as the current Cash-settled Rolling-Spot Futures, based on feedback that gram-based units are easier to understand and that 10 grams would be too small.

- Q5. What is the expected margin requirement per contract for the new products?

- A5. The margin requirement per contract for the new products is expected to be at a level similar to that of Gold Mini Futures or Platinum Mini Futures.

- The meaning of each symbol in the above formula is as follows.