Equities and BondsClearing Fund

Clearing Fund for Cash Products

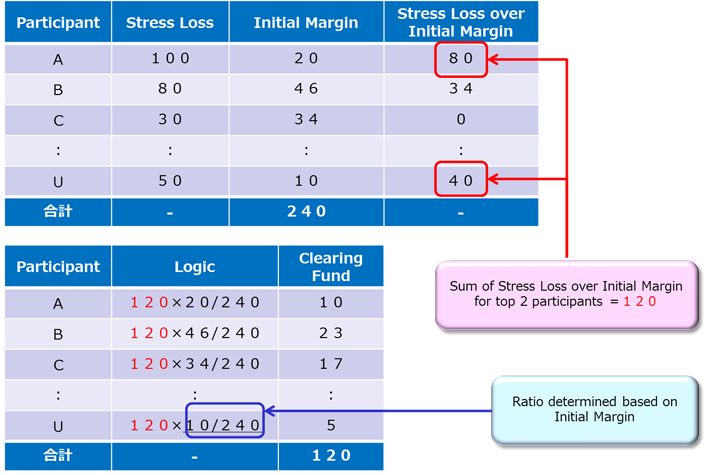

The portion of the amount of loss (risk equivalent under stressed conditions) that may arise under extreme but plausible market conditions (stressed condition) exceeding the amount of Initial Margin (excess risk amount) is calculated with respect to the positions of each Cash Products Clearing Participant. The required amount of Clearing Fund for Cash Products shall be the amount equivalent to the expected loss arising at the time of simultaneous default of two Cash Products Clearing Participants (including their Affiliated Companies(*1)) whose excess risk amounts are the largest and the second largest, prorated according to the Required Initial Margin Amount of each Cash Products Clearing Participant (if such amount is less than 10 million yen, then the minimum clearing fund requirement shall be 10 million yen).(*2)

The total excess risk amount to be used for the calculation of aggregate Clearing Fund requirements shall be the average of the sum total of daily excess risk amount for past 120 business days, and Required Initial Margin Amount to be used for the proration of Clearing Fund shall be the average of daily Required Initial Margin Amount for past 20 business days.

(*1) Any subsidiary or affiliate, or the parent company of such Clearing Participant, or any subsidiary or affiliate of the parent company.

(*2) The total required Clearing Fund for Cash Products amount contributed by all Clearing Participants was JPY 25.9 bil. (as of Jun. 30, 2025)

Illustration of Clearing Fund

Stress Scenarios to be Used for Calculation

The expected loss upon default of a Securities Clearing Participant under stressed conditions shall be obtained by an application of risk calculation methodologies in light of various issue compositions in cash equities, etc. Specifically, it will be calculated by using t-Copula model.