Listed Company Compliance

Listed Company Compliance Operations

Being listed on a securities exchange means that a company's stock is quoted publicly and traded by the general public on the exchange market. Due to the nature of a listing, listed companies are required to be of a certain quality that allows investors to trade their stocks with confidence. Japan Exchange Regulation (JPX-R) constantly monitors the eligibility of listed companies based on ongoing listing requirements.

The Listed Company Compliance Department at JPX-R carries out the following:

- Examination related to timely disclosure

- Examination related to Code of Corporate Conduct

- Determination of measures against listed companies

- Delisting examination

Examination related to Timely Disclosure

For financial instruments markets to function properly, it is necessary to ensure investor confidence in their fairness and soundness. To this end, it is crucial that investors are provided with appropriate and timely information on securities and other issues to help with their investment decisions. There are two sets of rules which aim to ensure this: the statutory disclosure system based on the Financial Instruments and Exchange Act (securities reports, etc.) and the timely disclosure rules at financial instruments exchanges. The timely disclosure rules are prescribed by the rules of financial instruments exchanges so that listed companies provide material corporate information to investors, and ensure that disclosure is provided widely and in a timely manner, through the media or directly through TDnet (the Timely Disclosure Network).

For more information on the timely disclosure system, please see the below page.

The Listed Company Compliance Department examines whether disclosures of listed companies are in line with the rules, taking account into the following points:

Examination points related to timely disclosure

- Whether the timing of the disclosure is appropriate

- Whether disclosed information contains any false statements

- Whether disclosed information lacks any information deemed important for investment decisions

- Whether disclosed information gives rise to misunderstandings for investment decisions

- Whether disclosed information fall short of the disclosure requirements in any other way

- For an outline of the timely disclosure system, please refer to the website

Examination related to Code of Corporate Conduct

Listed companies are expected to remain conscious of their position as a part of the securities market and to conduct their business in an appropriate manner in the interests of investor protection. Considering their characteristics, TSE prescribes a Code of Corporate Conduct for listed companies in its listing rules. The code is composed primarily of two sections: "matters to be observed," which are matters to be complied with, and "matters desired to be observed," which are matters that companies are expected to work toward.

The Listed Company Compliance Department examines whether listed companies comply with the code.

Main matters specified in the Code of Corporate Conduct

(Matters to be observed)

- Matters to be observed for third-party allotments

- Prohibition of stock splits, gratis allotment of shares, gratis allotment of subscription warrants, reverse stock splits, or changes in the number of shares per share unit which are likely to disrupt the secondary market or infringe upon shareholder interests

- Obligation to secure independent director(s)/auditor(s)

- Prohibition of insider trading

(Matters desired to be observed)

- Efforts, etc. toward the shift to and maintenance of the desired investment unit level

- Respect for the principles of corporate governance for listed companies

- Securing an independent director on the board of directors

- Establishment of corporate system for prevention of insider trading

- For an outline of the Code of Corporate Conduct, please refer to the website

Measures against Listed Companies

In order to ensure compliance with the timely disclosure requirements, the Code of Corporate Conduct, and other TSE rules, the Listed Company Compliance Department conducts examinations regarding violations of these rules and deficiencies in the internal management systems of listed companies. Based on the examination, where necessary, JPX-R will determine measures against the company.

The measures are classified into two categories, penalties and improvement measures. Penalties, such as the listing agreement violation penalty (monetary fine) and public announcement measure, are imposed on a listed company which violated the rules.

Meanwhile, improvement measures are taken with the aim of urging improvements at the listed company. Depending on the severity of the deficiencies in the internal management system identified during the course of the examination, the company will be asked to submit an improvement report or designated as a security on special alert. If the company does not make improvements within the specified period (generally 1 year) after designation, it may be delisted.

List of Possible Measures

Delisting Examination

If a financial instrument that has lost its suitability as an investment instrument continues to be listed, it may cause unforeseen damage to investors and eventually undermine the credibility of the financial instruments market as a whole. In order to avoid such a situation, the Listed Company Compliance Department, in accordance with the Securities Listing Regulations, identifies financial instruments that are likely to have lost their suitability as investment instruments, examines whether they meet the delisting criteria, and makes delisting decisions for those that are found to meet the criteria.

For an overview of the delisting criteria, please refer to the following.

For example, if there is a possibility that a listed stock or other security is likely to fall under the delisting criteria, it is designated as Securities Under Supervision in order to make investors aware of this. During the period of designation as Securities Under Supervision, the Listed Company Compliance Department examines whether the delisting criteria are met.

If, as a result of the examination, the Listing Control Department finds that the security meets the delisting criteria, it will make a decision to delist the shares. In addition, in order to inform investors of this fact, the security will be designated as a "Security to Be Delisted" until the day before the delisting date.

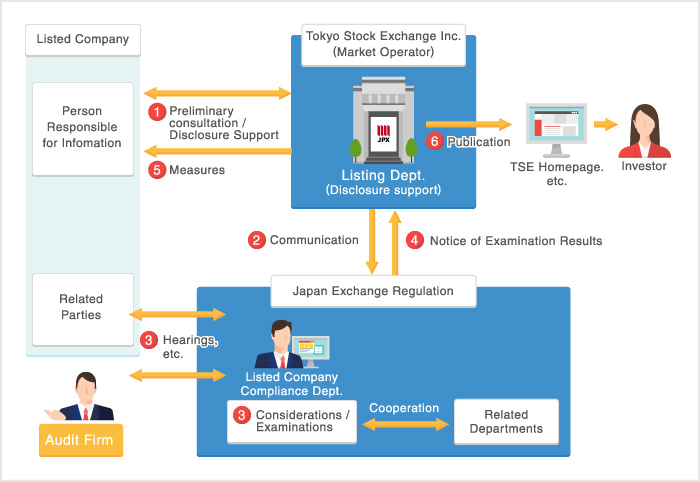

Listed Company Compliance Operations and Collaboration

While the Listed Company Compliance Department maintains close communications with the TSE Listing Department, it conducts examinations regarding disclosure, Code of Corporation Conduct, measures against listed companies, and delisting independently. In the course of the examination, the department requests the listed company, its audit firm and other related parties to provide documents or clarify a series of facts, where necessary.

Based on the examination, JPX-R determines whether the company should be delisted or to impose certain measures, giving comprehensive consideration of the severity of the case and its impact on investment decisions, as well as the background and cause of the violation.

The Listed Company Compliance Department conveys JPX-R's decision to the TSE Listing Department, and TSE implements the measure on the listed company and announces it publicly.

Preventative Compliance

The Listed Company Compliance Department pro-actively engages with listed companies to prevent unfair activities and identifies post-fact violations of TSE rules. Specific activities include the following.

・Providing advice on planned corporate action events in cooperation with the TSE Listing Department, and facilitating dialog with listed companies through individual visits.

・Disseminating information and promoting a deeper understanding of the rules by holding seminars for listed companies, publishing booklets on listing regulations and contributing articles interpreting such regulations to journals.

![]() Close

Close![]() Close

Close