On May 21, 2007, OSE introduced Give-Up System to improve the convenience of futures and options transactions by reducing margin requirements and office expenses for settlement-related operations.

Give-Up System

What is a Give-Up System?

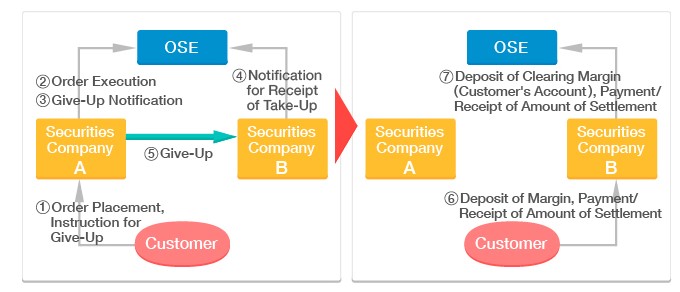

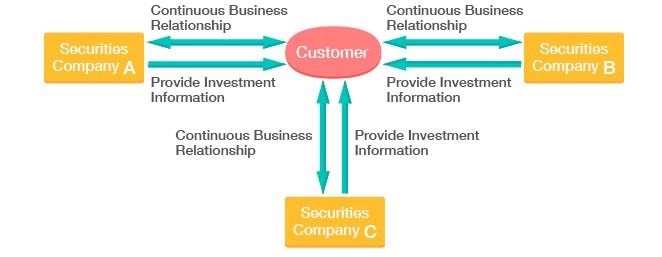

A Give-Up System enables a customer to entrust order-execution to a Transaction Participant and to entrust its settlement-related operations (payment/receipt of the difference at the time of settlement for futures trading, payment/receipt of options premium and margins, etc.) to other Transaction Participants.

Chart1

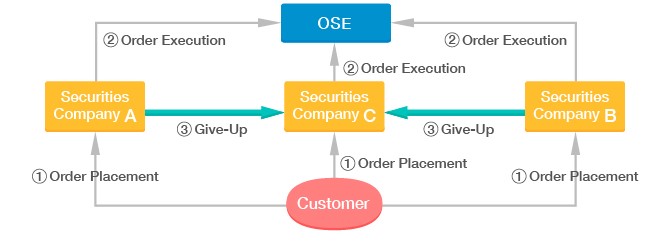

Advantages of a Give-Up System

Cost Reduction/ Efficient Risk Management

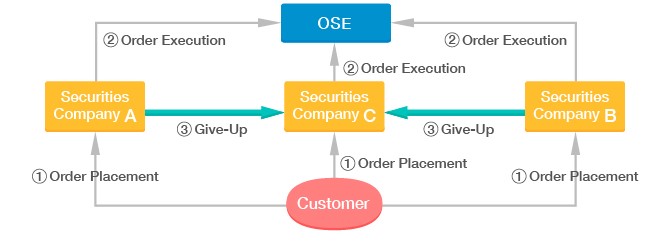

A customer can consolidate transactions that the customer conducted with Securities Company A, Securities Company B and Securities Company C, into Securities Company C. It enables not only a reduction in margin requirements and office expenses, but also more efficient risk management.

Chart2

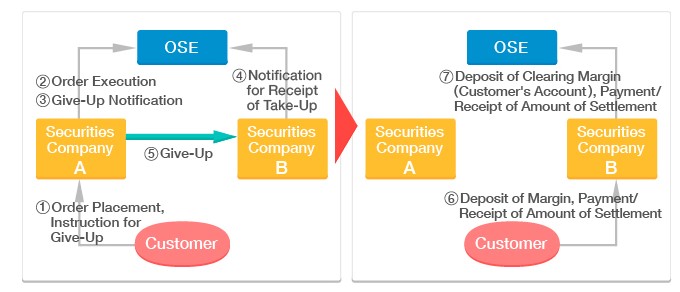

Execution under the Best Condition

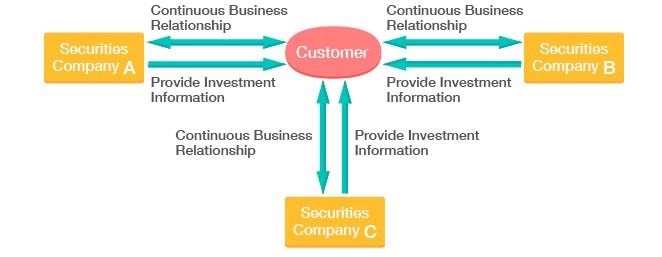

A Give-Up System can meet demands of many investors who want to use several Transaction Participants for placing orders and to choose the Transaction Participant who offers the best condition for execution.

In addition, under the Give-Up System, a customer, while additionally having benefits from the above-mentioned advantages, can obtain useful information from several Transaction Participants as before by continuing business relationship with those Transaction Participants.

Chart3

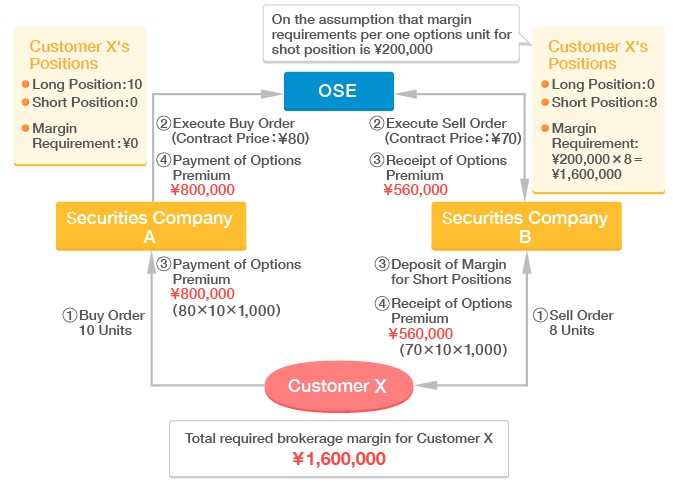

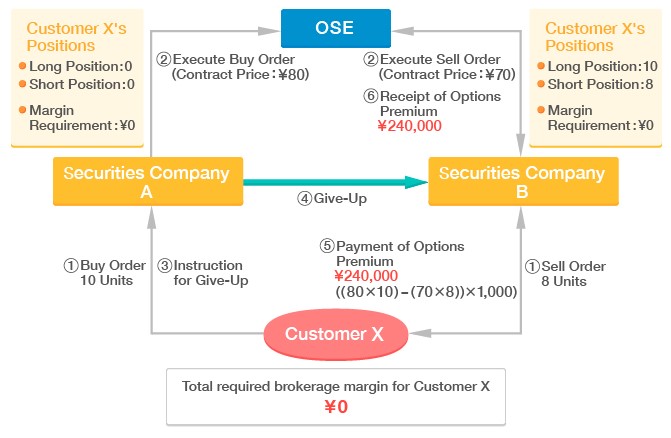

[ Example ]

How much margin requirement can be reduced under the Give-Up System?

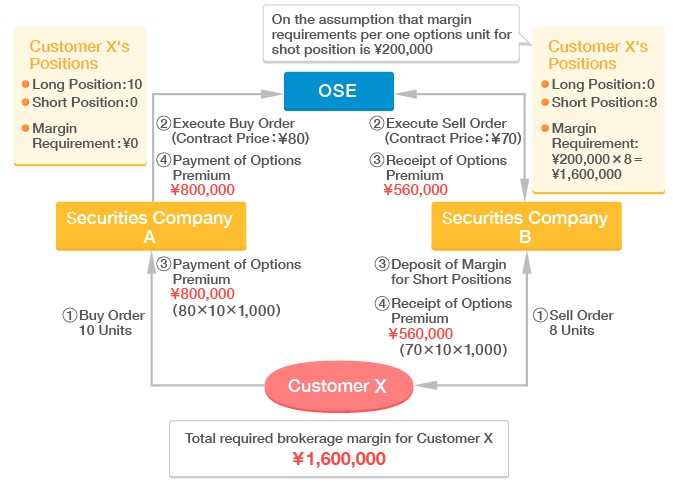

Customer X buys an issue of Nikkei 225 Options for 10 units at ¥80 at Securities Company A, and sells the same issue for 8 units at ¥70 at Securities Company B (on the assumption that margin requirements per one options unit for short position is ¥200,000).

Without the Give-Up System, Customer X pays ¥800,000 as options premium to Securities Company A, receives ¥560,000 as options premium from Securities Company B, and simultaneously deposits ¥1,600,000 as margin.

Chart4 : Without Give-Up System

Under the Give-Up System

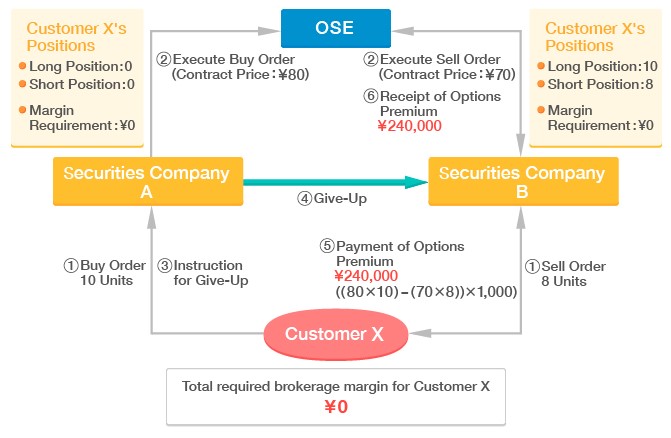

However, under the Give-Up System, when Customer X gives-up the transactions conducted at Securities Company A to Securities Company B, no payment and receipt of money occurs between Customer X and Securities Company A. In addition, the options premium and positions are offset between transactions conducted at Securities Company A and those conducted at Securities Company B. As a result Customer X pays ¥240,000 as the amount of difference between the purchase price and selling price of the options premium (no additional margin is necessary because there are more long positions after the positions netting).

Chart5 : Under the Give-Up System

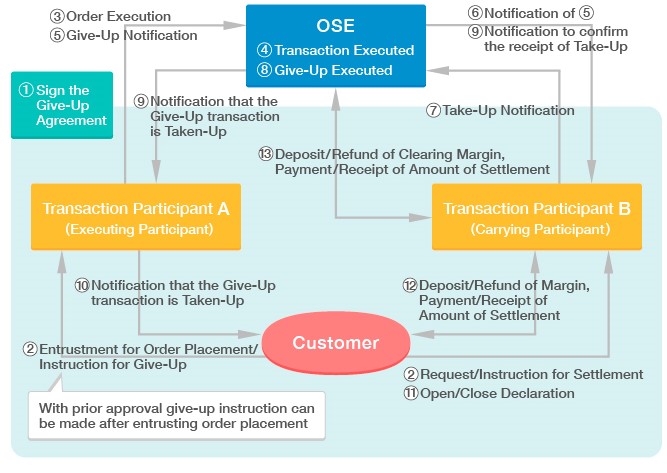

Operational Flow for Give-Up

Chart6

(note)

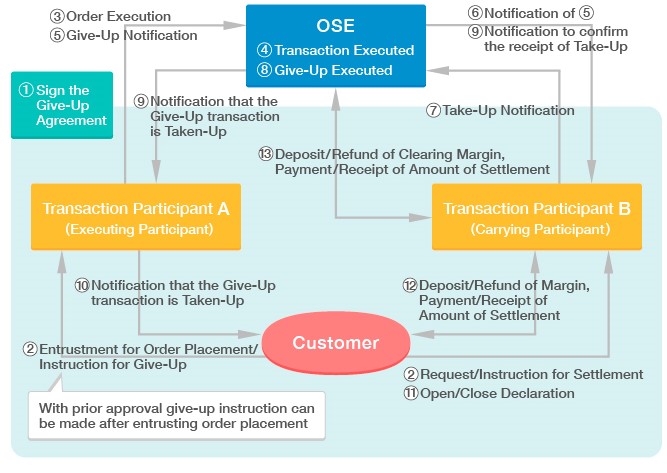

- ・This outline is based on the situation where the customer entrusts order placement to Transaction Participant A and settlement to Transaction Participant B.

- Sign the Give-Up Agreement (Flow ① in Chart6)

A customer, a Transaction Participant to whom the customer entrusts order placement (hereinafter referred to as “Executing Participant”) and a Transaction Participant to whom the customer entrusts Give-Up (hereinafter referred to as “Designated Carrying Participant”) are required to conclude in advance the Give-Up agreement which prescribes the amount of charges, etc.

- Instruction by Customer for Give-Up (Flow ② in Chart6)

When the customer instructs Give-Up, he/she is required to notify the Executing Participant his/her intention of Give-Up and the name of Designated Carrying Participant on each occasion in principle. However, in case there is a prior approval between an Executing Participant and a Carrying Participant, the Give-Up instruction may be given after the order entrustment.

- Give-Up Notification to OSE by Executing Participant (Flow ⑤ in Chart6)

- Take-Up Notification to OSE by Designated Carrying Participant (Flow ⑦ in Chart6)

- Execution of Give-Up (Flow ⑧ in Chart6)

When OSE receives a Notification from the Designated Carrying Participant that he/she accepts Take-Up, OSE executes such Give-Up.

- Notification of Give-Up execution to Customer (Flow ⑩ in Chart6)

When the Give-Up is executed, the Executing Participant or the Carrying Participant promptly notifies the customer to that effect.

- Open/Close declaration by Customer (Flow ⑪ in Chart6)

The customer notifies the Designated Carrying Participant whether the Give-Up transactions are an opening purchase or sale, or a closing purchase or sale.

- Deposit and Refund of Margin, Payment and Receipt of Amount of Settlement (Flow ⑫ in Chart6)

The customer deposits/receives refund of margin and pays/receives the amount of settlement with/from/to the Designated Carrying Participant

Notice

- Signing of Give-Up Agreement

An Executing Participant, a customer and a Carrying Participant are required to conclude a Give-Up Agreement in advance which prescribes ways to pay/receive the Give-Up charges among the parties and handling of cases when Give-Up fails to be executed.

“INTERNATIONAL UNIFORM BROKERAGE EXECUTION SERVICE (“GIVE-UP”) AGREEMENT” prepared by Futures Industry Association (FIA) is available. Please click the link below to download the FIA form.

http://www.futuresindustry.org/giveup-agreements2.asp

- Deadline for Give-Up Instruction by Customer

Give-Up instruction by the customer to the Executing Participant is in principle necessary on each occasion. In case the customer obtains prior approval from the Executing Participant and the Carrying Participant, the customer may give his/her instruction for Give-Up by the time designated by the Executing Participant.

- Deadline for Open/Close Declaration related to Give-Up.

The customer may notify the Carrying Participant whether it is an opening purchase or sale, or a closing purchase or sale, by the time designated by the Carrying Participant.

![]() Close

Close![]() Close

Close