Credit Default SwapCDS Clearing

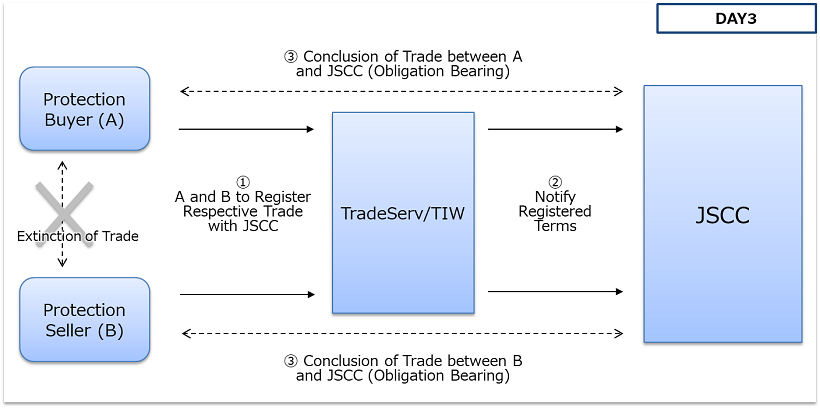

What is Assumption of Obligation (Obligation Bearing)?

- A clearing organization assumes obligations arising from a transaction from both long party and short party (paying party and receiving party), and, at the same time, acquires corresponding claims, and thereby becomes a party to the claims and obligations by standing in between long party and short party (paying party and receiving party).

- A party to the assumption of obligation (obligation bearing) is called “Clearing Participant” for whom JSCC has prescribed the requirements to qualify as a Clearing Participant. JSCC nets settlements between Clearing Participant and JSCC and has structured settlement guarantee scheme.

What is CDS?

CDS is the most basic and representative product of derivatives underlying asset of which is a credit risk associated with a default of a corporation (Credit Derivatives), which is mainly traded over-the-counter (OTC) between financial institutions.

- 1.

- A buyer of CDS purchases a protection against a default of a certain corporation (Reference Entity) by paying certain amount of contract fee (Fixed Rate) periodically (usually on a quarterly basis) during a certain contract period.

- 2.

- If a bankruptcy or other event (Credit Event) occurs with respect to the Reference Entity during the term of the transaction, the Protection Seller shall make certain payment, etc. to the Protection Buyer.

As such, the form of the transactions is similar to “guarantee” or “credit insurance,” and the indemnified party (“guaranteed person” under a guarantee) transfers credit risk underlying the transaction to the party providing the indemnity (“guarantor” under a guarantee).

① During Term of Transaction

② Example of Occurrence of Bankruptcy, etc. of Underlying Credit Risk (Credit Event)

Incidentally, CDS is to be concluded between a Protection Buyer and a Protection Seller, and a Reference Entity is literally an entity to be referred to. Therefore, unlike guarantee money related to its own obligation, there is no exchange of money involving a Reference Entity.

The above example is based on an assumption of the existence of claims and obligations between the Protection Buyer and the Reference Entity. However, the parties may enter into CDS without having claim or obligation.

Example of CDS Clearing

CDS contracts, which are traded over-the-counter, have tenors ranging from one year to 10 years in most cases (5 years is common). If the Protection Seller goes bankrupt during this period, the Protection Buyer will be unable to receive payment of the amount equal to the Notional in the event of a bankruptcy of the Reference Entity during the remaining term of the contract. Contrarily, if the Protection Buyer goes bankrupt during the contract term, the Protection Seller will be unable to receive Fixed Rate during the remaining term of the contract.

As such, in OTC transactions, the parties must bear credit risk not only of the reference entity, but also of transaction counterparties. Moreover, there will be separate operational procedure that needs to be processed for each of their counterparties which cause significant burden. Then, if one highly creditworthy organization bears obligations arising between the parties and acquires corresponding claims, and guarantees the settlement of the relevant transaction by becoming a party to the claims and obligations, each party may trade without having concern about the credit risk of original counterparties.

① During the term of transaction cleared by JSCC:

② Upon occurrence of Credit Event under transaction cleared by JSCC (Example)

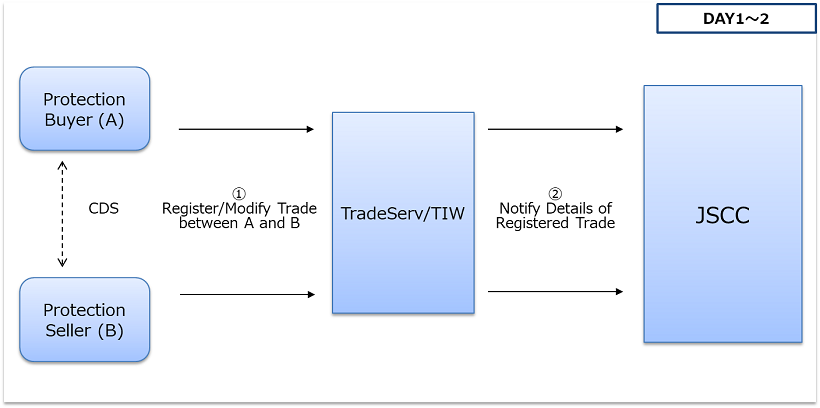

CDS Clearing Schedule

JSCC clears CDS once a week.

| Day1 (Tue) | Day2 (Wed) | Day3 (Thur) |

|---|---|---|

| Protection Seller and Protection Buyer register pre-cleared CDS to confirmation platform (TradeServ) and apply for Clearing. JSCC is subject to the notification of registration content via the TIW. |

Protection Seller and Protection Buyer modify registration entered on Day1 on TradeServ as necessary. | Protection Seller and Protection Buyer register cleared transactions with JSCC to be concluded on Day3 on TradeServ. JSCC will clear transactions for which clearing is applied at 16:00. |