OTC Japanese Government BondsShortening of JGB Settlement Cycle to T+1

As Shortening of JGB Settlement Cycle to T+1 launched on May 1, 2018 (Tue.), JSCC introduced Subsequent Collateral Allocation Repo. Explained below are the background of this project, framework and post-implementation overview. JSCC started to cover Inflation-Indexed JGBs as JGBs eligible for Clearing, along with the implementation of shortening of settlement cycle.

Background of the project

Shortening of JGB Settlement Cycle is the project developed along with the promotion of shortening of settlement cycle and expansion of use of clearing organizations in order to reduce settlement risk, under ”Development of Institutional Frameworks Pertaining to Financial and Capital Markets” (*1) by the Financial Services Agency, which was set after the financial crisis in 2008.

At ”Working Group on Shortening of JGB Settlement Cycle” of Japan Securities Dealers Association, 50 discussions for the project were held during the period from 2009 to May 2018 and Grand Design (*2) was announced in 2014. The points under discussion were as follows:

- For Shortening of GC Repo Transaction Settlement Cycle to T+0, which is needed for realization of Shortening of JGB Settlement Cycle to T+1, Subsequent Collateral Allocation Repos was introduced, where JSCC shall allocate Collaterals.

- Aiming to enhance market function, it was concluded that, in relation to Repos, Cash-secured Bond Lending Transactions(“gentan” transacton), which have been traded as major repo transactions in Japanese repo market, are desired to be migrated with Repo Transactions(“gensaki” transaction) which are traded as the global standard. Along with the revision of the template for “Master Agreement on the Transaction with Repurchase Agreement of the Bonds, etc.” (*3) by Japan Securities Dealers Association, Best Practice Guide was revised by Bond Repo Transactions Study Group (*4).

For more details, please access link to "Working Group on Shortening of JGB Settlement Cycle" by Japan Securities Dealers Association"(*2).

Introduction of Subsequent Collateral Allocation Repos at JSCC

JSCC announced the outline associated with the introduction of Subsequent Collateral Allocation Repos in November 2014, which was further revised in May 2015, June 2017 and January 2018, given further condition of discussion (*5).

JSCC revised the rules, such as "Japanese Government Bond Over-the-Counter Transaction Clearing Business Rules" on May 1, 2018.

Outlines of clearing status and framework after the implementation Clearing status

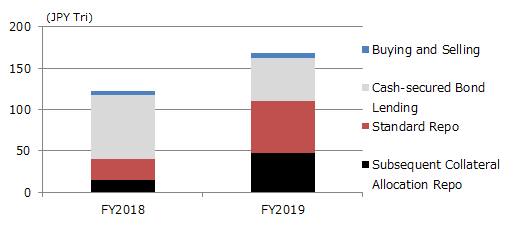

Cleared value for JGB OTC Transaction (daily average)was approximately 130 trillion in 2018 and approximately 170 trillion in 2019. Among them, cleared value for Subsequent Collateral Allocation Repo was approximately 20 trillion in 2018 and approximately 50 trillion in 2019. In line with facilitation of migration to gensaki type transactions, cleared value for such transactions has boosted, which accounted for approximately 70% of total repo transactions in 2019.

For the Settlement term for Buying and Selling and Standard Repo, T+1 settlement accounts for approximately 90% for total transactions.

Cleared Value (Daily average)

(Note)On a cleared value basis. For gensaki transactions and gentan transactions value is based on sum of Starting Transactions and Ending Transactions.

Subsequent Collateral Allocation Repos

JSCC, in relation to JGB OTC Clearing Business, introduced Subsequent Collateral Allocation Repos, transaction, contracting by basket (a group of multiple issues) without specifying collateral and allocating collateral from inventory of JGB by a delivering party just before the delivery for the Starting Transaction.

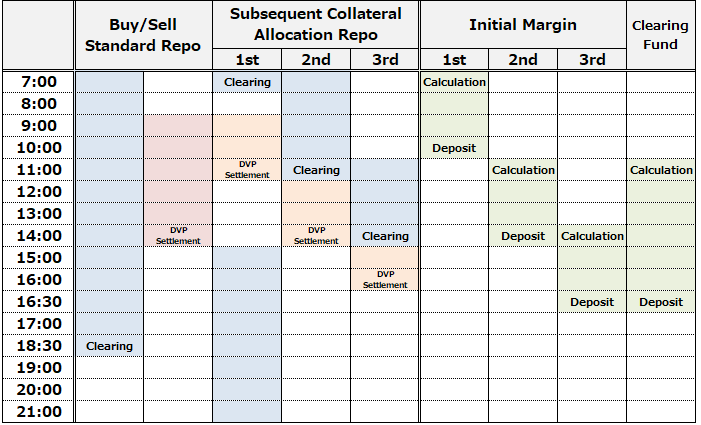

Cutoff time for clearing related to Subsequent Collateral Allocation Repos shall be set three (3) times a day. A delivering Participant related to Subsequent Collateral Allocation Repos shall notify JSCC of Issues to be Allocated and Allocable Quantities, for JGB, as Allocable Balance Notice. JSCC shall, for each time for clearing (three (3) times a day), allocate collaterals, according to Allocable Balance Notice so received.

Timeline

*Schedule summary chart after amendament of rules revision from December 2023

(Note)

・Clearing:Clearing cutoff time. -For Subsequent Collateral Allocation Repos, basket netting, collateral allocation, netting by issue are conducted.

・DVP settlement : The latest cutoff time is for receiving Participant (Cutoff time for delivering Participant arrives 30 minutes earlier than each latest cutoff time)

Baskets for Subsequent Collateral Allocation Repo

Subsequent Collateral Allocation Repo is required to be a transaction specifying either of the six (6) baskets set by JSCC.

Component Issues in each JGB Basket are as follows. Issues in each JGB Basket

| Basket Issue Short Name | Treasury Discount Bills |

Interest- bearing /Term to Maturity 10y or less |

Interest- bearing /Term to Maturity more than 10y |

Interest- bearing (Floating Rate) |

Inflation- Indexed |

Strips |

|---|---|---|---|---|---|---|

| JGBB-TDB | * | |||||

| JGBB-U10 | * | * | ||||

| JGBB-Fixed | * | * | * | |||

| JGBB-Large | * | * | * | * | ||

| JGBB-All | * | * | * | * | * | |

| JGBB-Strips | * |

*Strips; Principal-only Book-entry Transfer JGBs,Coupon-only Book-entry Transfer JGBs

Requested cooperation with our efforts

Even after the implementation of shortening of settlement cycle to T+1, JSCC's various efforts are essential to enhance the function of JGB market in Japan. JSCC appreciates each participant's continuous understanding and support.

*2 "Grand Design for Shortening of JGB Settlement Cycle to T+1 " (November 2014) (Japan Securities Dealers Association)

"Working Group on Shortening of JGB Settlement Cycle"(Japan Securities Dealers Association) (Japanese Only)

*3 “Master Agreement on the Transaction with Repurchase Agreement of the Bonds, etc.” (For reference) (Japan Securities Dealers Association) (Japanese Only)

*4 “Best Practice Guide (4th edition)”(Bond Repo Transactions Study Group) (Japanese Only)

*5 For the latest outlines, please refer to the web-site linked hereto