OTC Japanese Government BondsAssumption of Obligation

OTC JGB Transaction

The secondary market for JGB in Japan is divided between securities exchanges and the OTC market, and the vast majority of trading activity occurs in the OTC market.

Trading of JGB is primarily categorized into three types: cash bond transactions, Gensaki (i.e. buying/selling with a resale/repurchase agreement), and Cash-secured Bond Lending Transactions. Out of these, Gensaki and Cash-secured Bond Lending Transactions correspond to so-called "repurchase transactions," and such transactions are used both for short-term financing using JGB as collateral, and as regular securities transactions. Gensaki consists of two types of transactions, Standard Repo Transactions, which specify an individual issue for subject of transaction and Subsequent Collateral Allocation Repo Transactions, which specify a basket (a group of multiple issues) for subject of transaction.

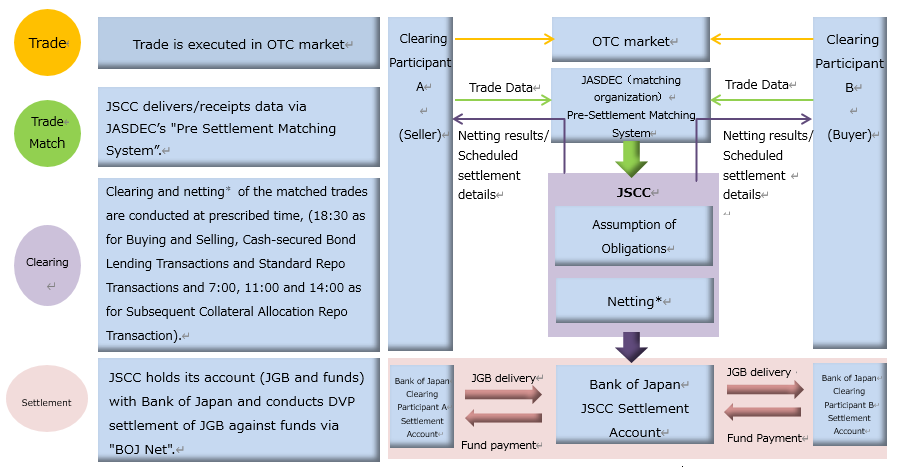

Outline of the Clearing Operations for OTC JGB Transactions (Obligation Assumption, Netting, Guaranteed Fulfillment of Settlement, DVP Settlement)

When an obligation (delivery of securities or payment) is assumed by a clearing organization for a counterparty, the clearing organization simultaneously acquires its corresponding claim (claim to receive securities or to receive payment), wherein the clearing organization and the counterparty of the original contract mutually become the settlement counterparties.

JSCC assumes obligations arising from transactions sent for clearing by counterparties which hold qualification as Clearing Participants. Eligibility requirements to be a Clearing Participant are set by JSCC. While assuming obligations, JSCC tries to reduce settlement risk through the process of netting. Also, JSCC guarantees settlement even in the case of a counterparty's default, thereby alleviating counterparty credit risk for Clearing Participants.

By conducting DVP settlement※ through the Bank of Japan Financial Network System (BOJ-NET) for JGB transactions between JSCC and Clearing Participants, JSCC is able to eliminate the principal risk associated with such transactions.

※Settlement between JSCC and its Clearing Participants is conducted via DVP (Delivery Versus Payment) settlement. DVP settlement links the delivery of securities and the payment of funds, that is, securities can be delivered on the condition that the corresponding payment is completed, while payment can be received on the condition that the corresponding securities are delivered. Consequently, should defaults occur, the counterparty will not be left with non-receipt of securities or funds.

Procedures from trade to settlement

* As for Subsequent Collateral Allocation Repo Transactions, after netting is conducted by Basket and Collateral is allocated, netting by Individual Issue will be conducted.

Collateral Allocation for Subsequent Collateral Allocation Repo Transactions

JSCC, whenever it assumes obligations related to Subsequent Collateral Allocation Repo Transactions, for each clearing participant and for each basket, calculates the balance of selling price and buying price and replace the position (claims and obligations) between the relevant Clearing Participant with such net amount. This calculation of net amount and replacement of the positon are referred to as "Basket Netting".

Further, for the result of Basket Netting, JSCC determines the individual issue and quantity to be settled based on the information notified from the delivering clearing participant on the individual issue and quantity which can be delivered by such delivering clearing participant. This determination of the individual issue and quantity is referred to as "Collateral Allocation".