JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

April

Apr. 4: Ceremony Held for Transition to the New Market Structure

On April 4, the cash equity market of Tokyo Stock Exchange (TSE) transitioned into three new market segments: the Prime Market, Standard Market, and Growth Market. To celebrate this new beginning, JPX held a ceremony to invite investors and representatives from each new market segment. TSE aims to support the listed companies starting out on the new market segments in their efforts to improve their corporate value, while striving to make the cash equity market reliable and attractive for investors as a financial infrastructure which provides attractive investment targets.

Apr. 4: New Listing of LNG (Platts JKM) Futures and the Change of Listing Status of Electricity Futures

On April 4, Tokyo Commodity Exchange, Inc. (TOCOM) announced the listing of LNG (Platts JKM) Futures and the change of the listing status of Electricity Futures to permanent listing before the end of the three-year trial listing period. It will further promote/support the "Consolidated Energy Derivatives Exchange" in which one is able to trade electricity futures and power generation fuel futures in a one-stop trading environment. Consistent with national energy policies, TOCOM is continuing its efforts to contribute to the development of the Japanese economy as an industrial infrastructure which is responsible for hedging price fluctuation risks.

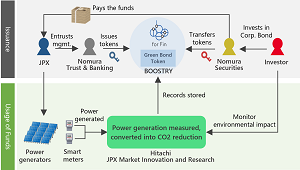

Apr. 15: Cooperation in the Issuance of Japan's First Wholesale Digitally Tracked Green Bond

Japan Exchange Group, Inc., Hitachi, Ltd., Nomura Securities Co., Ltd., and BOOSTRY Co., Ltd. have announced their cooperation in the issuance of Japan's first publicly-offered wholesale "Digitally Tracked Green Bond"* using a corporate bond-type security token scheme that utilizes blockchain provided by BOOSTRY.

Through this scheme, we aim to contribute to nationwide carbon neutrality by providing a highly convenient product that can be used by a variety of issuers and investors.

* Please refer to the press release "JPX Begins Research on "Digitally Tracked Green Bonds" Utilizing Security Tokens" published on February 14, 2022.

Apr. 15: Publication of Japan Exchange Group Green Bond Framework

On April 15, 2022, Japan Exchange Group, Inc. (JPX) published the Japan Exchange Group Green Bond Framework. This Framework has been created in line with the International Capital Market Association's Green Bond Principles 2021 and the Japanese Ministry of the Environment's Green Bond Guidelines 2020. It describes JPX's policies on a) use of proceeds, b) processes for evaluating and selecting projects, c) management of proceeds, and d) reporting, and has received a preliminary evaluation from Rating and Investment Information, Inc. (R&I).

Apr. 21: FTSE Russell and JPX launch new net zero climate indices: FTSE JPX Net Zero Japan Index Series

On April 21, JPX Market Innovation & Research, Inc. (JPXI), a wholly owned subsidiary of Japan Exchange Group (JPX), and FTSE Russell, a leading global index, data and analytics provider, announced the launch of the "FTSE JPX Net Zero Japan Index Series," which enables investors to reallocate capital based on the climate credentials and carbon performance of the constituent companies in the index. The new index series consists of two indices, "FTSE JPX Net Zero Japan 500 Index" and "FTSE JPX Net Zero Japan 200 Index." The base index of "FTSE JPX Net Zero Japan 500 Index" is a reference index that contains TOPIX 500 constituents. The base index of "FTSE JPX Net Zero Japan 200 Index" is the largest 200 stocks in terms of market value in the reference index. The new index series aims to achieve alignment with net zero emissions pathways by 2050.

Apr. 26: Announcement of Consolidated Financial Results for FY2021

JPX has released its consolidated financial results for FY2021.

Operating revenue was up JPY 2.0 billion (+1.6%) year on year to JPY 135.4 billion, due mainly to an increase in revenue from information services.

Operating expenses were up JPY 1.8 billion (+3.0%) year on year to JPY 63.2 billion, due mainly to an increase in system-related costs.

As a result, operating income decreased JPY 1.0 billion (-1.5%) to JPY 73.4 billion, with net income (attributed to owners of the parent company) down JPY 1.4 billion (-2.8%) to JPY 49.9 billion. Thus, revenue increased but profit decreased compared to the previous year.

This fiscal year, we achieved the profit target set out in the 3rd Medium-Term Management Plan for two consecutive terms. To express our appreciation for the support we received from our shareholders in implementing the key strategies in the 3rd Medium-Term Management Plan, JPX will pay a special dividend of JPY 15 per share for the fiscal year ended March 2022 in addition to the ordinary dividend.