JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

December

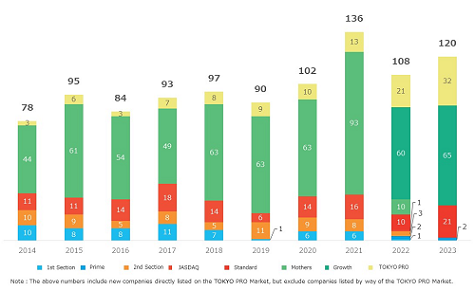

IPO Update for 2023

The demand for IPOs remains strong, with 120 new companies listing on Tokyo Stock Exchange (TSE) in 2023, the second highest number in 10 years.

The ratio of newly listed companies from regions outside Tokyo increased to approximately 40%, and the number of large-scale listings with initial market capitalizations exceeding JPY 100 billion was 6. This is a significant increase, with 3 cases more than the previous year.

The specified investor-oriented TOKYO PRO Market also reached a record number for the seventh consecutive year with 32 newly listed companies. The use of TSE markets is expanding.

TSE will continue making efforts to encourage and ensure the quality of IPOs through cooperation and collaboration with underwriters, audit firms, local financial institutions, and others involved in the IPO process, while actively promoting our listing activities across the country in 2024.

Dec. 4: JPX Joins Net Zero Financial Services Providers Alliance

Japan Exchange Group, Inc. (JPX) has joined the Net Zero Financial Services Providers Alliance (NZFSPA) to help achieve a decarbonized economy.

The NZFSPA is a global group of financial services providers committed to supporting the goal of global net zero greenhouse gas emissions by 2050 or sooner, in line with the ambition to limit the global temperature increase to 1.5°C above pre-industrial levels.

By joining the NZFSPA, JPX will further intensify its work toward the goal of net zero.

Dec. 8: Unveiling the JPX Prime 150 Index Logo

On July 3, 2023, JPX Market Innovation & Research, Inc. introduced the JPX Prime 150 Index, a new index that focuses on value creation, and recently unveiled its logo.

This index is composed of 150 stocks selected from among the top-ranked stocks listed on TSE Prime Market by market capitalization based on two measures of value creation: "return on capital" which is based on financial results, and "market valuation" which is based on future information and non-financial information.

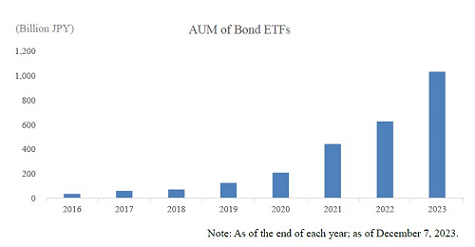

Dec. 12: AUM of Bond ETFs Surpasses JPY 1 Trillion

The assets under management (AUM) of bond exchange-traded funds (ETFs) that are listed on Tokyo Stock Exchange (TSE) and track Japanese and foreign bonds has surpassed JPY 1 trillion.

The number of bond ETFs on TSE has kept on growing thanks to the diversification of the bonds that they track and the listing of actively managed products. Currently, a total of 42 bond ETFs are listed.

By investing in bond ETFs on TSE, investors can reduce the hassle of buying and selling individual bonds and the costs associated with rebalancing. In addition, investors in Japan can use yen to invest in the ETFs, even ones that track foreign bonds. These characteristics make bond ETFs on TSE a very convenient form of investing. As of 2023, a wide range of investors are investing in bond ETFs on TSE. They primarily consist of Japanese financial institutions but also include other Japanese and foreign institutional investors as well as individual investors.

Dec. 13: Introduction of Letters Into Securities Codes

Due to the decrease in available securities codes for general companies (4-digit numbers from [1300] to [9999]), the Securities Identification Code Committee (SICC) has announced the incorporation of letters into securities codes to increase the number of available codes. The new policy will take effect starting January 1, 2024 as originally planned. However, codes set before January 2024 will not be changed and remain composed of numbers only.

Dec. 15: Initiatives to Invigorate the Securities Market in Preparation for the Start of New NISA

The new NISA (the Nippon Individual Savings Account) is scheduled to launch in January 2024 and is expected to realize a "virtuous cycle of growth and distribution" in which household investments support corporate growth, and the benefits of that growth are returned as household income.

Leading up to this, JPX Group has worked to improve the environment of the securities market to contribute to the realization of a "virtuous cycle of growth and distribution."

Specifically, JPX Group continues to promote the creation of a convenient investing environment for small investors, support initiatives to enhance the corporate value of listed companies, and improve households’ financial literacy. Furthermore, JPX Group has properly revised market usage fees paid by securities companies.

JPX Group views the launch of the new NISA as a once-in-a-lifetime opportunity to accelerate the flow of funds from savings to investments, and we are committed to supporting the new NISA more than ever.

Dec. 29: Ceremonies for the Last Trading Day of the Year

On December 29, Japan Exchange Group held its ceremonies for the last trading day of the year at its Tokyo and Osaka venues. To close the year, at the Tokyo venue, Kuriyama Hideki, Manager of Team Japan at the 2023 World Baseball Classic, was invited as a guest to carry out the bell-ringing ceremony and tejime (ceremonial rhythmic hand clapping), and at the Osaka venue, parties related to the market and members of the Kansai business community were invited to join in three cheers.