JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

January

Jan. 4: First Trading Day of 2023

Japan Exchange Group, Inc. (JPX) celebrated its 10th Anniversary in January 2023. Ceremonies to mark the first trading day of the New Year were held in Tokyo and Osaka.

In Tokyo, the Minister of State for Financial Services Shunichi Suzuki delivered his congratulatory remarks and rang the bell to pray for further development of the securities market.

In Osaka, attendees took part in a closing ceremony led by the shrine maidens of Imamiya Ebisu-jinja Shrine.

Both ceremonies can be viewed on JPX's official YouTube channel.

(Picture: Tokyo Site)

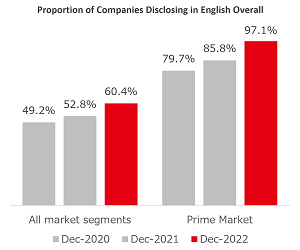

Jan. 17: Results of "Availability of English Disclosure Information by Listed Companies" Survey as of End of December 2022

Tokyo Stock Exchange, Inc. (TSE) has published the results for the survey as of the end of December 2022. TSE has been conducting surveys since 2019. This time, in order to reflect the disclosure situation more precisely, new survey questions have been added so that listed companies report the scope and the timing of English disclosure for all the documents included in the survey. The proportion of English disclosure by companies listed in the Prime Market which are expected to center their business on constructive dialogue with global investors reached 97.1%. This was based on the number of companies (up 11.3 percentage points from the end of the previous year), which shows how the transition to the new market segments has been a catalyst for progress in listed companies' work to disclose information in English. For further details, please see the website below.

Jan. 19: Japan Exchange Group, Inc. Signs MOU with Japan Electric Power Exchange

In order to achieve the shared goal of realizing fair and well-organized markets, Japan Electric Power Exchange (JEPX) and Japan Exchange Group, Inc. (JPX) have signed a memorandum of understanding (MOU) to work together and share information to improve the convenience and competitiveness of the Japanese electricity market. We will work hard to improve the efficiency of market operations and to provide more valuable services to participants in both markets through the cooperation between JEPX, which operates the spot market of electricity, and JPX group, which operates the futures market of electricity.

Jan. 20: Schedule for Setting up Systems at New Secondary Data Center

Japan Exchange Group, Inc. (JPX) has been constructing a new secondary data center (Kansai DC) in the Kansai region, which is a good distance from the Greater Tokyo Area, in order to prevent simultaneous disruption in the event of a large earthquake under the capital.

The construction of equities and derivatives trading systems that accept orders and execute trades and a clearing system that handles clearing after trades are executed have been completed as indicated in the schedule below.

This will enable us to continue cash equity and derivatives market operations and clearing operations if it becomes impossible to continue operations in the Greater Tokyo Area due to a wide-area disaster, such as a major earthquake under Tokyo, by switching the systems of JPX group companies to those at the Kansai data center based on our Business Continuity Plan (BCP).

To address natural disaster risks, JPX will remain committed to improving the stability of market operations.

Jan. 20: JPX Publishes "Survey of TCFD Disclosure in Japan (FY2022)"

On January 20, Japan Exchange Group, Inc. (JPX) published the "Survey of TCFD Disclosure in Japan (FY2022)." Following the first survey, published in November 2021, this second survey aims to shed light on the situation around Japanese companies' climate change-related information disclosure based on the TCFD Recommendations and provide listed companies with helpful reference information for preparing their own climate-related disclosure. This year's survey covers a bigger range of companies, namely the constituents of the JPX-Nikkei Index 400, in order to better reflect the current situation.

Jan. 25: Launch of "Processing Service for Stock Order Data" for Provision of Processed FLEX Full Data

Mitsubishi UFJ Trust Investment Technology Institute Co., Ltd. (MTEC) and JPX Market Innovation & Research, Inc. (JPXI) have launched the "Processing Service for Stock Order Data," which processes FLEX Full data* into a format that facilitates data analysis by JPXI. The Processing Service for Stock Order Data provides FLEX Full data processed by MTEC into information commonly used in market microstructure research, such as a bid-ask spread (the difference between the lowest sell order price and the highest buy order price) in a CSV format. This is expected to ease the burdens of and remove hurdles for users to analyze and utilize the data. *FLEX Full data is historical information of stock trading orders in the markets of Tokyo Stock Exchange, Inc.

Jan. 30: Financial Results for Q3 FY2022

Japan Exchange Group, Inc. has published its consolidated earnings report for Q3 2022.

Operating revenue was down JPY 0.05 billion (-0.1%) year-on-year to JPY 10.05 billion, mainly due to a decrease in revenues from listing services, despite an increase in cash equity trading, and derivatives trading volume exceeded those of the same period last year.

Operating expenses were up JPY 4.6 billion (+10.2%) year-on-year to JPY 50.2 billion, mainly due to an increase in depreciation and amortization in connection with systems replacements.

As a result, operating income decreased by JPY 4.2 billion (-7.5%) year-on-year to JPY 51.7 billion, and net income (attributable to owners of the parent company) decreased by JPY 2.8 billion (-7.5%) to JPY 35.1 billion.