Approach to Risk Management

In its approach to risk management, Japan Exchange Group and its subsidiaries (collectively referred to as JPX Group) recognize the importance of maintaining sound and stable business operations to fulfill JPX Group’s public role as a market operator and continue raising corporate value. JPX Group is working on risk management from this perspective.

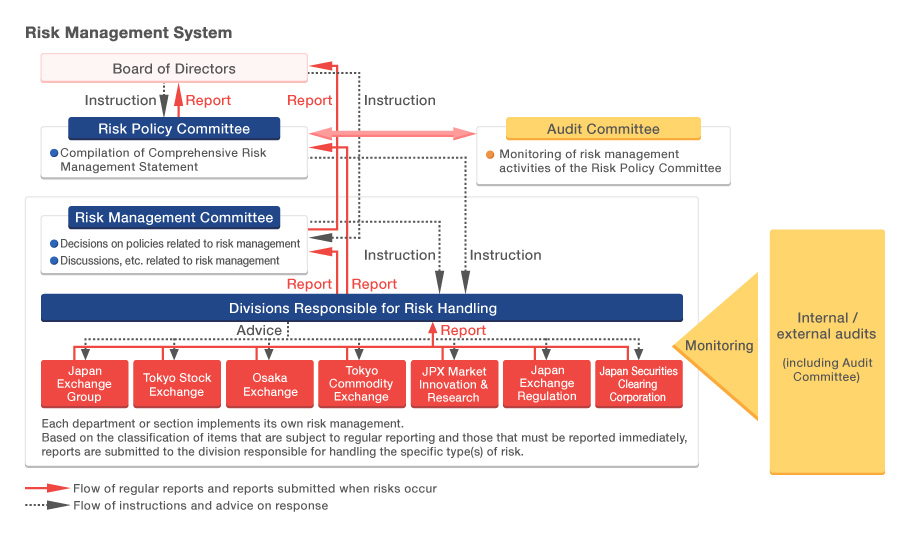

Risk Management Systems

JPX Group faces various risks in the course of its operations, including those associated with system failures, compensation in the event that a clearing participant defaults, and administration. To address these risks, JPX Group has established a Risk Policy Committee chaired by an outside director and a Risk Management Committee chaired by the CEO. These committees are responsible for identifying risks as well as developing and implementing measures to prevent such risks in accordance with the Group’s Risk Management Policy. JPX Group also has a system in place to ensure a swift and appropriate response when risks do or are likely to materialize.

Each fiscal year, the Risk Policy Committee identifies the significant risks that JPX Group should prioritize. Along with this, it formulates basic policies for addressing each significant risk. The results of this process are submitted to the Board of Directors as recommendations in the form of a Comprehensive Risk Management Statement.

Based on the above Comprehensive Risk Management Statement, JPX Group works to reduce the likelihood of the materialization of risks by taking action to prevent significant risks and other risks, and also works to enable flexible responses when they do materialize.

When a serious incident occurs, the Risk Management Committee gains an overall grasp of the situation and gives directions so that the matter can be resolved as quickly as possible. The system is set up so that all necessary information is reported to management promptly and without fail.

Risk Classification

| Types of Risk | Examples |

|---|---|

| Business strategy and business environment risk | Economic fluctuations, legal and regulatory matters, demographic changes, technological innovation, investor trends, public opinion, and failed business choices |

| Accidents and disaster risk | Major earthquakes, typhoons, tsunami, epidemics, terrorism, stoppage of social infrastructure, fires, and accidents |

| System risk | Inadequate hardware capacity and application errors |

| Legal risk | Violations of laws and regulations in the course of business, business partner's failure to perform on contracts, and the possibilities of having a relationship with anti‑social forces |

| Financial risk | Undermined reliability of financial reporting, lack of funds, and loss or damage to assets, including deposits |

| Human risk | Personnel shortage, industrial accidents, and occupational hazards |

| Information security risk | Information leakage, unauthorized access, and computer viruses |

| Operational risk | Mistakes in operational procedures and misjudgments |

| Risk of associated companies | Emergence of risk in group companies |

| Reputational risk | Decline in public reputation due to acts and statements by employees and/or third parties |

| Credit risk and liquidity risk arising from obligation assumption business | Emergence of losses or inability to settle due to default, etc. by clearing participants |

| Other risks | Risks other than those mentioned above |

Significant Risks

Each fiscal year, as group-wide risk management, we identify the significant risks for that year that could affect JPX Group*. We control the possibility of the materialization of these risks by implementing necessary preventive measures. We also implement measures to ensure that we are able to respond flexibly in the event that risks materialize.

- JPX Group approaches risk management on two levels. First, all group companies work to identify risks in the internal environment within JPX Group. Second, there is wide ranging discussion involving the management team about potential risk factors in the external environment, including geopolitical risk. Based on the results of these discussions, we then examine significant risks. Many risks are detected at this discussion stage, but we examine these risks in detail, and out of these we identify the risks that require the greatest attention as group-wide risks for each fiscal year, on the basis of the potential impact on JPX Group if the risk materializes and the frequency with which such risks are likely to arise. We then take preventive measures targeting specific significant risks.

Significant Risks

| Risk Event | Risk Scenarios |

| Risks that could impact JPX Group business continuity and business operations |

|

| Risks that could affect JPX Group business performance and financial position |

|