JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

October

Oct. 11:Opening of the Carbon Credit Market and Start of Trading

Tokyo Stock Exchange (TSE) opened the Carbon Credit Market on October 11, 2023. To commemorate the opening of the Market, a ceremony was held on the same day, which was attended by Mr. Nishimura Yasutoshi, Minister of Economy, Trade, and Industry (METI), and other ministries and organizations involved in carbon credits.

The Carbon Credit Market began with 188 market participants, and had 206 participants as of October 18. A cumulative total of 10,127 t-CO2 was traded by October 27.

This fiscal year, TSE has again been selected by METI to sponsor the "Carbon Credit Market Stimulation Project" and will promote measures to activate transactions in the Carbon Credit Market in cooperation with METI.

Oct. 12:JSCC Joins Hyperledger Foundation

Japan Securities Clearing Corporation (JSCC) has officially joined Hyperledger Foundation, a non-profit organization dedicated to standardizing blockchain/distributed ledger technology (DLT) globally, and its higher-level organization, The Linux Foundation.

JSCC introduced in January 2023 its first blockchain production solution based on Hyperledger Besu, one of the open-source software (OSS) platforms hosted by Hyperledger Foundation, to facilitate the efficient delivery settlement of rubber futures.

Furthermore, we leveraged the use of several Hyperledger OSS tools and libraries across multiple Proof-of-Concept projects.

If we assume the widespread adoption of blockchain in future financial markets, the availability of stable standardized OSS will support global harmonization and contribute towards the building of a robust ecosystem. Accordingly, we aim to contribute to the development of OSS in the spirit of the Hyperledger Foundation mission.

Oct. 16:Launch of Free Trial for J-Quants for PRO (Tentative Name)

JPX Market Innovation & Research, Inc. (JPXI) commenced a free trial of "J-Quants for PRO" (tentative name) on October 16, an easy-to-use service that provides financial data related to the Japanese market to institutional users.

J-Quants for PRO is a service that delivers data through various user-friendly channels such as APIs and SFTP, with the goal of allowing users to discover new business opportunities and make effective, well-informed decisions.

During this free trial period, users will have the opportunity to explore these data sets and discover their value.

Oct. 19:Status of Proof of Concept Testing for HTML Disclosure of Earnings Reports

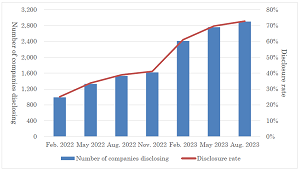

JPX Market Innovation & Research, Inc.(JPXI)announced the status of Proof of Concept (PoC) testing for HTML disclosure of earnings reports promoted by JPXI as of the end of August 2023. The number of listed companies that disclosed their earnings reports in HTML format on a quarterly basis has increased since the launch of PoC testing in December 2021. As of the end of August 2023, a cumulative total of over 2,800 listed companies (over 70% of listed companies) have voluntarily disclosed their earnings reports in HTML format. JPXI will continue to verify the effectiveness through PoC testing and consider a permanent response when it is complete.

Oct. 26:TSE to Publish a List of Companies That Have Disclosed Information Regarding “Action to Implement Management That is Conscious of Cost of Capital and Stock Price”

In March 2023, Tokyo Stock Exchange (TSE) requested all listed companies on the Prime and Standard Markets take “action to implement management that is conscious of capital and stock price.”

As expectations have been increasing among investors for companies to make further progress in their initiatives, TSE has decided to start publishing a list of companies that have disclosed information in compliance with the request to inform investors of which companies are taking action. This will also encourage companies to take a proactive effort.

The initial list will be compiled based on the status of corporate governance reports as of December 31, 2023, and will be published by January 15, 2024.

Oct. 26:Financial Results for Q2 FY2023

Japan Exchange Group, Inc.(JPX) has published its consolidated earnings report for Q2 FY2023.

Operating revenues were up JPY 6.8 billion (+10.4%) YoY to JPY 73.3 billion, mainly due to an increase in revenues from trading and clearing-related services inked to market conditions which cash equity trading value exceeded that of the same period last year.

Operating expenses were up JPY 1.1 billion (+3.3%) YoY to JPY 34.3 billion, mainly due to an increase in maintenance and operation costs associated with systems.

Furthermore, as a result of profits posted on the sale of owned assets, operating income increased by JPY 10.3 billion (+30.4%) YoY to JPY 44.4 billion, and net income (attributable to owners of the parent company) increased by JPY 8.2 billion (+35.5%) YoY to JPY 31.4 billion.