JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

June

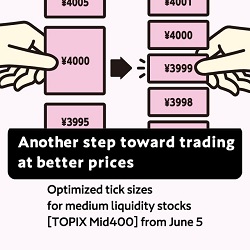

Jun. 5: Tick Sizes for Medium Liquidity Stocks (TOPIX Mid400)

Tokyo Stock Exchange, Inc. (TSE) applied tick sizes for medium liquidity stocks (TOPIX Mid400 constituents) in the auction market on June 5, 2023. Specifically, TSE carried out system changes in which tick sizes applied to TOPIX 100 constituents will also be applied to medium liquidity stocks (TOPIX Mid400 constituents). This has made it possible for various investors, particularly individual and long-term investors, to place orders at appropriate prices, and has created a trading environment in which the prices for buying and selling stocks are more appealing to investors than ever before. TSE remains committed to conducting various initiatives in order to contribute to improved convenience for investors.

Jun. 12: CONNEQTOR Begins Providing Direct Connection with NRI's Order Management System, SmartBridge Advance (SBA)

On June 12, Tokyo Stock Exchange, Inc. (TSE) began providing direct connection between CONNEQTOR, a RFQ (Request for Quote) platform, and SmartBridge Advance (SBA), a securities order and execution management system provided by Nomura Research Institute, Ltd.

With this new connection, order data entered into SBA by traders from asset management firms and others will be directly allocated to CONNEQTOR, enabling traders to execute trades quickly and reliably with market makers around the world on CONNEQTOR.

As a result, ETF trading costs will be reduced and the time required for trading will also be shortened, which is expected to contribute to better operational efficiency at asset management firms and elsewhere.

TSE remains committed to conducting various initiatives in order to trade “ETFs quicker and cheaper”.

Jun. 15: AUM of ESG-related ETFs and ETNs Exceeds JPY 400 billion

The AUM of ESG-related ETFs and ETNs listed on Tokyo Stock Exchange, Inc. (TSE) has exceeded JPY 400 billion due to the inflow of funds to the "iShares MSCI Japan Climate Change Action ETF" listed on June 8, 2023.

The listed ETFs cover a wide range of assets, including equities, REITs, and bonds, and investors can utilize these ETFs for ESG investments in various asset classes.

TSE will continue to enhance its lineup of ESG-related ETFs and ETNs and foster an environment in which investors can take advantage of such investments, aiming to support the realization of a sustainable society through ESG investment.

Jun. 16: 22nd Annual General Shareholders Meeting

On June 16, Japan Exchange Group, Inc. (JPX) held its 22nd Annual General Shareholders Meeting. During the meeting, JPX gave a report on the business status for FY2022 and future issues to be addressed, and held a Q&A session with the shareholders. The meeting concluded with approval of all resolutions and was streamed live for shareholders not in attendance. JPX strives to engage in constructive dialogue with shareholders through such opportunities as the shareholders meetings to ensure a long-term relationship of trust.

Jun. 6&29: Council of Experts Concerning the Revision of the Quarterly Disclosure System

Tokyo Stock Exchange, Inc. (TSE) announced the establishment of the Council of Experts Concerning the Revision of the Quarterly Disclosure System on June 6 and held the first meeting on June 29.

In the 2022 report from the Working Group on Corporate Disclosure of the Financial System Council, regarding quarterly disclosure from listed companies and from the perspective of reducing costs and improving the efficiency of disclosure practices, it was indicated that quarterly securities reports (for the first and third quarters) required by the Financial Instruments and Exchange Act should be abolished and integrated into the quarterly earnings reports required by the Tokyo Stock Exchange rules.

This council was established to discuss specific practical operations in line with indicated trends.

Taking into consideration the opinions of investors, listed companies, academic experts, and other market users, this council will hold discussions in order to realize better practical operations.

JPX Kitahama Festa 2023 (June-August)

Osaka Exchange, Inc. (OSE) will host the "JPX Kitahama Festa 2022", which marks the 9th installment of this annual event. This year, the festival will be mainly held offline for first time in four years. (Partly held online) In the first stage, "Wishes for Tanabata" will decorate bamboo branches set up in the atrium on the first (ground) floor of the OSE building. On July 7, the night of Tanabata, JPX will hold an observation tour of OSE both online and offline. In addition, as part of the "JPX Money Lab" initiative, JPX is planning to hold economics lectures, seminars, and panels for parents and children with a focus on financial literacy education. The event can be viewed on official JPX social media accounts.