JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

April

Apr. 3: Release of API Distribution Service J-Quants API (Paid Version) for Retail Investors

JPX Market & Innovation, Inc. (JPXI) has been running the "J-Quants" project to provide an environment to promote the use of IT and data analysis in trading for individuals interested in data science. JPXI has been distributing historical stock prices and financial data through J-Quants API (beta) on a trial basis and received positive feedback from many users. Therefore, on April 3, 2023, JPXI officially released J-Quants API (paid version). The paid version of J-Quants API offers four plans, including a free plan. Users can use as much data as they would like on a monthly subscription.

Apr. 3: Tokyo Stock Exchange REIT Leveraged and Inverse Index Series to be Launched

In response to the diverse requirements for indices in the market, JPX Market Innovation & Research, Inc. (JPXI) is going to calculate and publish three indices; the "Tokyo Stock Exchange REIT Leveraged (2x) Index," the "Tokyo Stock Exchange REIT Inverse (-1x) Index," and the "Tokyo Stock Exchange REIT Double Inverse (-2x) Index".

The fluctuation of these three indices will be calculated by multiplying the fluctuation of the Tokyo Stock Exchange REIT index from the previous day by two, minus one, and minus two respectively.

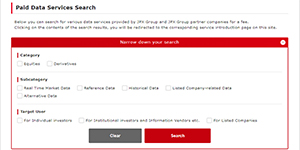

Apr. 11: Addition of Search Function for Paid Data Services

JPX Market Innovation & Research, Inc. (JPXI) has added a search function to the "JPX Data Catalog" page on the JPX website where various data services are provided by Tokyo Stock Exchange, Inc., Osaka Exchange, Inc., JPXI, and partner companies for a fee. Until now, the "JPX Data Catalog" has provided a list of paid and free data, but with the addition of this new function, users can now easily search for these paid data services by data service category or targeted user group.

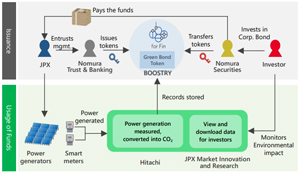

Apr. 27: "Study Panel on the Use of Digital Bonds in ESG Investing" Concluded Discussions and Published a Report

In order to explore the potential of digitally tracked green bonds, JPX Market Innovation & Research, Inc. (JPXI) partnered with Nomura Securities Co., Ltd. (Nomura) to form the "Study Panel on the Use of Digital Bonds in ESG Investing" on September 28, 2022 (organizer: JPXI; administration: Nomura). The panel brought together issuers and investors as well as securities firms, banks and trust banks, ESG rating agencies, system vendors, and public-sector organizations. The panel met seven times, and a report on the findings of its discussions was published.

Apr. 27: FY2022 Earnings Release

Japan Exchange Group, Inc. (JPX) has published its earnings release for FY2022.

Operating revenues decreased JPY 1.4 billion (-1.1%) year-on-year to JPY 133.9 billion, caused mainly by a decline in listing services revenues.

Operating expenses increased JPY 4.2 billion (+6.8%) year-on-year to JPY 67.5 billion, which are mainly system-related expenses.

As a result, operating income decreased JPY 5.2 billion (-7.1%) year-on-year to JPY 68.2 billion, and net income (attributable to owners of the parent company) decreased JPY 3.6 billion (-7.2%) year-on-year to JPY 46.3 billion.

In addition to the ordinary dividend, to commemorate the 10th anniversary of the establishment of JPX, a commemorative dividend of JPY 10 per share will be paid at the end of the fiscal year ending March 31, 2023 to express gratitude to shareholders for their support.