JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

November

Nov. 6: New Margin Calculation Method (VaR Method) for Futures and Options

On November 6, 2023, Japan Securities Clearing Corporation (JSCC) changed its margin calculation method for futures and options from the “SPAN method” to the “VaR method.” Under the SPAN method, margins were calculated weekly by JSCC based on parameters determined for each product. Under the VaR method, however, in principle, margins are calculated daily based on historical data going back longer than five years for each issue, sale, and purchase. This is intended to enhance risk management and improve the original function of margins, which is to protect investors and financial instruments business operators, etc.

Nov. 13: Official Launch of JPX ESG Link

JPX Market Innovation & Research, Inc. (JPXI) released a beta version of a free website titled “JPX Listed Company and ESG Information WEB” in October 2022, which enabled investors and shareholders to search for and view ESG-related information disclosed by listed companies in one place. After confirming that listed companies, investors, and others were making use of this resource, JPXI announced the official launch of the site on November 13. The name of the service has now been changed to “JPX ESG Link,” and some slight adjustments have been made based on feedback received from users during the beta release period. For example, some screen specifications have been improved and the “Governance” category has been added to the search criteria.

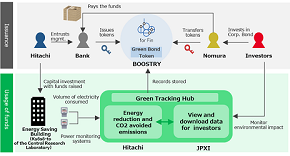

Nov. 16: Cooperation in the Issuance of Hitachi’s Digital Green Bond

Hitachi, Ltd. (Hitachi), JPX Market Innovation & Research, Inc. (JPXI), Nomura Securities Co., Ltd. (Nomura), and BOOSTRY Co., Ltd. (BOOSTRY) are cooperating toward the issuance of Hitachi’s “Digitally Tracked Green Bond” (digital green bond). The funds from the digital green bond Hitachi plans to issue will be allocated to energy-saving building projects. The aim of this digital green bond is to improve the transparency of data related to green investment and the efficacy of gathering that data. In addition to the Green Tracking Hub, which was jointly developed by Hitachi and JPXI and enables users to easily view the bond’s environmental effect, this digital green bond will use a corporate bond-type security token scheme with a blockchain platform provided by BOOSTRY. This is the second digital green bond to be issued in Japan, following the one issued by Japan Exchange Group, Inc.

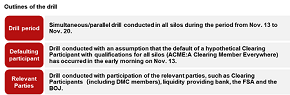

Nov. 20: Global Drill Simulating the Default of a Large-sized Financial Institution

Japan Securities Clearing Corporation (JSCC) conducted a fire drill to simulate the potential default of a large-sized financial institution (Global Fire Drill). The drill was conducted from November 13, 2023 to November 20, 2023, in alignment with major central counterparties abroad. The Financial Services Agency and the Bank of Japan, in addition to 52 financial institutions such as banks and securities firms, etc. took part in this effort.

This Global Fire Drill was the first coordinated simulation where key global CCPs conducted a simultaneous default settlement drill, which simulated for the default of a hypothetical global financial institution.

JSCC will continue to strive to maintain and enhance its default settlement framework, taking into consideration any findings and insights gained from this Global Fire Drill.