JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

August

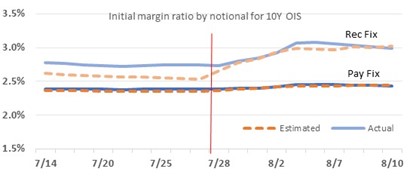

Jul. 18: Forward-looking Margin Simulation for JPY Interest Rate Products

On July 18, Japan Securities Clearing Corporation(JSCC), a CCP(Central Counterparty)under Japan Exchange Group, Inc. simulated the margin/collateral level of 10-year JGB futures, JPY interest rate swaps, and OTC JGB cleared by JSCC. The simulation assumes that large price fluctuations occur following the Monetary Policy Meeting on July 28. Amid growing market interests in Japan’s monetary policy, JSCC provided the results of these simulations to Clearing Participants ahead of the Monetary Policy Meeting, the outcome of which may lead to significant fluctuations in the JPY interest rates, causing the margin level to increase significantly as well.

JSCC will continue to proactively provide information so that the Clearing Participants can respond to various clearing and settlement-related operations under robust risk management practices.

Aug. 1: New SICC Page Regarding the Incorporation of Letters Into Security Codes

Due to the decrease in available security codes for listed companies (4-digit numbers from [1300] to [9999]), the Securities Identification Code Committee (SICC) has announced a new policy of incorporating letters into the codes and published a detailed outline of how each code is to be assigned. The new policy will take effect starting January 1, 2024.

To ensure the smooth implementation of this policy, the SICC has published a page on its website to increase awareness among market participants.

Aug. 7: Conclusion of Strategic Partnership (MOU) with and Minority Investment in Blue Ocean Technologies, LLC

On August 7 (JST), Tokyo Stock Exchange, Inc. (TSE) concluded a strategic partnership (MOU) with Blue Ocean Technologies, LLC (Blue Ocean), which operates a trading market for US stocks during daylight hours in Asia. The two companies hope to work together in developing a mutual market. TSE also agreed to make a 5% investment in Blue Ocean.

By doing so, TSE aims to strengthen its relationship with Blue Ocean and promote initiatives that further the expansion of the customer base for Japanese equities markets. Such initiatives include acquiring a deeper knowledge of US securities markets and possibly providing Blue Ocean customers the opportunity to trade Japanese equities.