JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

June

May 31: Measures for Smooth Implementation of Roman Alphabet Characters in Securities Codes

In April 2009, to address a decrease in available specific name codes assigned to general companies (4-digit numbers from [1300] to [9999]), the Securities Identification Code Committee (SICC) announced a basic plan for the use of Roman alphabet characters in the specific name codes when the available codes run out and, in March 2010, its specific methods for implementation.

However, based on the recent decrease in remaining name codes, the SICC announced that Roman alphabet characters will be used from January 1, 2024 to facilitate the smooth implementation of the use of Roman alphabet characters in the securities codes, regardless of whether the available codes run out.

Japan Exchange Group companies use securities codes for a wide range of operations such as listing, trading, clearing settlement, and information distribution. Since the inclusion of Roman alphabet characters in securities codes affects a wide range of operations, we will focus on sharing information with related parties and promoting correspondence, and will conduct system tests with users who connect to the systems of each Japan Exchange Group company. We will continue to prepare for the smooth incorporation of Roman Alphabet characters.

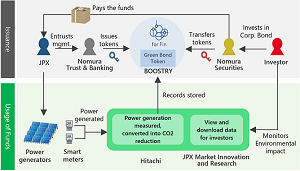

Jun. 1: Terms and Conditions as Determined by Japan Exchange Group for the Issuance of the Digitally Tracked Green Bonds, the First Digital Green Bonds in Japan

JPX has made its decision regarding the terms and conditions of issuing the 1st Unsecured Bonds (Digitally Tracked Green Bonds) which are the corporate bond-type security tokens that utilize a blockchain platform intended to increase the transparency of green investment data and convenience for parties concerned. Together with investors, JPX remains committed to making the Digitally Tracked Green Bonds more convenient going forward. JPX hopes many issuers and investors will be able to participate in this scheme with greater convenience.

Jun. 16: 21st Annual General Shareholders Meeting

On June 16, JPX held its 21st Annual General Shareholders Meeting. During the shareholders meeting, JPX reported on the FY2021 business status and future issues to be addressed, and held a Q&A session with the shareholders. The meeting concluded with approval of all resolutions. The meeting was streamed live for shareholders not in attendance. JPX strives to engage in constructive dialogue with shareholders through such opportunities as the shareholders meetings to ensure a long-term relationship of trust.

Jun. 17: Launch of Nikkei 225 micro Futures and Nikkei 225 mini Options

OSE has decided to introduce "Nikkei 225 micro Futures," with a contract unit one tenth of the Nikkei 225 mini, and to transform the current Nikkei 225 Weekly Options into "Nikkei 225 mini Options" by reducing the contract unit to one tenth of its current size and setting regular contract months in addition to the current weekly contract months.

The utilization of futures and options with smaller notional amounts than those in the past makes it easier to more precisely manage risk.

OSE is aiming to launch these contracts in the first quarter of FY2023.

JPX Kitahama Festa 2022 (June - August)

OSE hosted the "JPX Kitahama Festa 2022", which marked the 8th installment of this annual event. In the first stage, the "Wishes for Tanabata" were accepted through JPX's website and were written on tanzaku (strips of fancy, oblong paper), which decorated the bamboo branches in the atrium on the first (ground) floor of the OSE building. JPX also prepared tanzaku and pens in the atrium so visitors could write their wishes directly on tanzaku and hang them on the bamboo branches. On July 7, the night of Tanabata, JPX held an online observation tour of OSE. The event can be viewed on official JPX social media accounts. In addition, as part of the "JPX Money Laboratory" initiative, JPX is planning to hold panels, seminars, and economics lectures for parents and children focused on "financial literacy education from now on." This year, JPX is planning to hold seminars both online and offline.

Jun. 27: Launch of Real-time Calculation of Prime, Standard, and Growth Market Indices

On June 27, JPX Market Innovation & Research, Inc. (JPXI) changed the calculation frequency for the Tokyo Stock Exchange Prime Market Index, Tokyo Stock Exchange Standard Market Index and Tokyo Stock Exchange Growth Market Index to real-time calculation (every 15 seconds) instead of the current end-of day basis.

With respect to the market segment indices, which were launched in line with the transition to the new market segments on April 4, 2022, only closing prices have been calculated and disseminated daily, with the intention that they would be used as statistical indicators.

In this regard, we have received many requests from market participants and investors to be able to track the price movements of each market segment during trading hours.

Based on these requests, we have decided to change the calculation frequency of the market segment indices to a real-time basis from the current end-of-day basis in order to further enhance their functionality as statistical indicators, as well as reference indicators for investment decisions.