JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

November

Nov. 4 / Nov. 17: Launch of J-Quants DataCube and Expansion of J-Quants Pro Dataset

On November 4, JPXI launched “J-Quants Datacube,” a “one-time purchase” market place for financial data. This service functions as a fundamental renewal of the JPX Data Cloud, offering a host of new features and an overall improved data-purchasing experience.

Additionally, on November 17, “Share Buyback Information Data” was added to J-Quants Pro. This new dataset offers comprehensive share buyback information for all listed domestic equities, as well as corresponding historical data. Furthermore, the Scheduled Earnings Announcement dataset has been enhanced with the addition of estimated times for earnings announcements according to JPX’s proprietary model, enabling more effective risk management and analysis.

For more details, please see the related pages.

Nov. 5: JPXI Enlists the Support of AWS to Improve its Data/Digital Businesses

With the support of Amazon Web Services (AWS), JPX Market Innovation & Research, Inc. (JPXI) is working to achieve the goal of turning Japan Exchange Group, Inc. (JPX) into a “global, comprehensive finance and information platform, which was set out in JPX’s Medium-Term Management Plan.

In light of this, JPXI has decided to migrate the Timely Disclosure Network (TDnet), which provides material corporate information, to AWS.

In doing so, JPXI aims to improve the system’s stability, resilience, and functionality. Furthermore, by leveraging AWS’s digital technologies, we have achieved the launch and enhancement of JPX’s integrated data services platform “J-LAKE,” and the securities data platform “JPxData Portal.” Going forward, JPXI will continue to strengthen its ties with AWS and strive to create new value.

Nov. 5: Notional Amount of Single Stock Options Trades in October 2025 Hits Post-Integration High for Second Consecutive Month

Osaka Exchange (OSE) is pleased to announce that the notional amount of trades in single stock options (SSOs) in October 2025 reached approximately JPY 96.8 billion, marking the highest level since the integration of the OSE and Tokyo Stock Exchange derivatives markets in 2014. With earnings announcements approaching for many companies, this significantly surpasses the previous high of JPY 68.5 billion set in September 2025, marking a record for the second consecutive month.

OSE will continue its efforts to improve efficiency in the SSO market in order to meet the needs to market stakeholders.

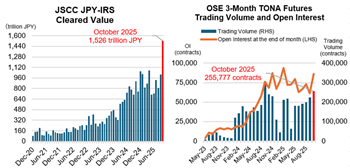

Nov. 7: Record High Clearing Volume for JPY Interest Rate Swaps and Second-Highest Trading Volume for 3-Month TONA Futures in October 2025

In October 2025, total clearing value of JPY interest rate swaps at Japan Securities Clearing Corporation (JSCC) reached approximately JPY 1,526 trillion, setting a new record high. Additionally, in September 2025, JSCC received a determination from the U.S. CFTC allowing U.S. customers access to JSCC’s interest rate swap clearing services. This is expected to drive further market expansion going forward.

In October 2025, total trading volume for 3-Month TONA Futures at Osaka Exchange reached approximately 250,000 contracts, marking the highest level in 2025 and the second highest since the market launched in May 2023. While foreign investors have previously dominated this market, a trend of increased trading by domestic financial institutions has emerged since 2025, leading to greater market activity. As the world’s most liquid TONA futures market, we will continue striving to further enhance liquidity.

Nov. 26: Japan–Southeast Asia Market Forum 2025

The Japan–Southeast Asia Market Forum, launched in 2022 and held annually in Singapore, marked its fourth instalment this year. This year’s forum welcomed a record turnout of approximately 500 participants (750 registered), including institutional investors, family offices, venture capital and private equity professionals, and members of the startup community.

Keynote sessions and panel discussions explored the future direction of Asia and Japan, as well as emerging business and investment opportunities. The event once again underscored the strong and growing interest in the Japanese market.

The high demand for integrated public–private information initiatives such as this forum remains clear, and we will continue to advance these efforts going forward.