JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

September

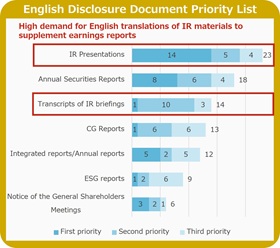

Sep. 2: Results of Survey of Overseas Investors on English Disclosure by Japanese Companies

Tokyo Stock Exchange conducted a survey on English-language disclosures targeting overseas institutional investors and other related parties, and has compiled the results (the third such survey, following those published in 2021 and 2023).

According to the survey, 88% of respondents answered that English disclosure by listed companies in Japan has "improved" or "somewhat improved." This result indicates that many investors assess recent progress positively, particularly in light of the mandatory English disclosure requirement for the Prime Market implemented in April 2025.

Beyond earnings reports and timely disclosure materials, which have seen increased translation into English due to the mandate, most respondents indicated that priority should be given to translating IR presentation materials. There was also demand for English translations of transcripts of the presentations.

Additionally, many respondents requested the promotion of English-language disclosure for small and mid-cap stocks, as well as the full translation of documents, not just summaries or partial translations.

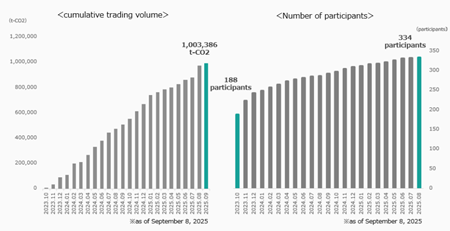

Sep. 8: Carbon Credit Market's Cumulative Trading Volume Reaches One Million t-CO2

On October 11, 2023, Tokyo Stock Exchange, Inc. launched the Carbon Credit Market, where cumulative trading volume reached one million t-CO2 on September 8, 2025 with a cumulative total of 1,003,386 t-CO2 (daily average of 2,153 t-CO2). Transactions have been made on 363 out of 466 days (78%), providing continuous trading opportunities and consistent price disclosure.

Additionally, the number of participants in the Carbon Credit Market has steadily increased, with 334 participants registered as of September 8, 2025.

JPX Group will continue to contribute to the realization of carbon neutrality in Japan with the cooperation of all market participants.

Sep. 10: Fundamental Data for Stock Indices to Be Offered on Snowflake

Starting on October 14, 2025, JPX Market Innovation & Research, Inc. (JPXI) will begin offering fundamental data for indices such as TOPIX through the market-leading data cloud platform by Snowflake Inc., (hereinafter referred to as “Snowflake”). This will supplement the conventional web and data feed services (FTP and SFTP) it currently uses to provide index data.

Snowflake enables access to historical data for specified periods as well as future-dated information, and users can search and obtain data based on their own chosen search criteria.

Sep. 12: AUM of the ETFs on TSE Exceeded JPY 100 Trillion

We are pleased to announce that the assets under management (AUM) of the exchange-traded funds (ETFs) listed on Tokyo Stock Exchange (TSE) has exceeded JPY 100 trillion.

TSE’s ETF market has continued to grow in both AUM and the number of listings since the first ETF was listed in Japan in 1995.

In order to further develop its ETF market, TSE will continue to enhance the market’s lineup and promote the provision of an infrastructure that investors can utilize effectively.

Sep. 16: Enabled JPY Interest Rate Swap Clearing Service for U.S. Customers

On September 12, 2025, Japan Securities Clearing Corporation (JSCC) received a regulatory authorization from the U.S. Commodity Futures Trading Commission (CFTC), the U.S. regulator, allowing JSCC, under certain conditions, to expand the clearing services of JPY interest rate swap (JPY-IRS) to customers which fall under the CFTC’s definition of U.S. person.

With this determination, U.S. customers can now access the clearing venue with the deepest liquidity for JPY-IRS.

Sep. 22: New Infrastructure Supporting the Evolution of the ETF Market – Launch of ETF Creation and Redemption Platform “CredNex”

Tokyo Stock Exchange, Inc. (TSE) will launch “CredNex,” a new platform supporting ETF (exchange-traded fund) creation and redemption operations, on September 29, 2025.

CredNex will overhaul the current ETF creation and redemption platform provided by Japan Securities Clearing Corporation (JSCC), enabling automation and acceleration of ETF creation and redemption operations.

This is expected to further enhance the stability and liquidity of the ETF market.

TSE positions CredNex as core infrastructure supporting the ETF market. We will continue to enhance its functionality and ensure flexible cooperation, thereby contributing to the sustainable growth of the ETF market and the development of its ecosystem.

Sep. 25: Selection of the 2025 "TSE Asia Startup Hub" Supported Companies

On September 25, 2025, Tokyo Stock Exchange (TSE) selected 20 companies as the 2025 TSE Asia Startup Hub supported companies (including seven new companies and 13 reselected companies).

Together with its partners, TSE will continue to provide support tailored to the needs of these 20 companies, including assistance with business development and fundraising in Japan, as well as IPO preparation.

Note:

The “TSE Asia Startup Hub” is an initiative supporting IPOs on TSE by establishing an ecosystem that fosters the growth of Asian startups with ties to Japan.